Key Insights

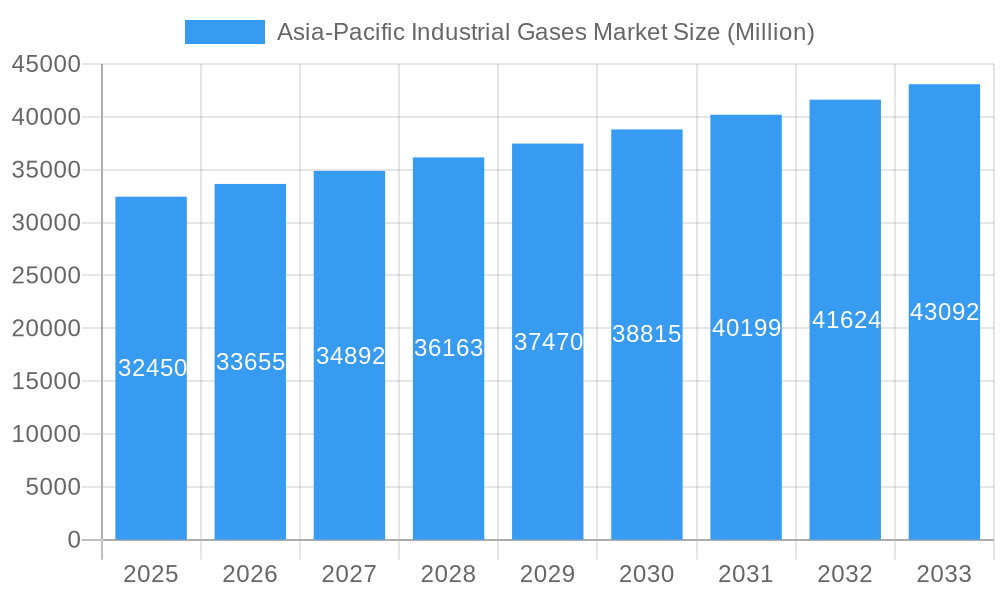

The Asia-Pacific Industrial Gases Market is poised for significant expansion, with a current market size of USD 32,450 million and projected to grow at a robust CAGR exceeding 3.00% over the forecast period from 2025 to 2033. This growth is underpinned by several dynamic drivers, including the escalating demand from the chemical processing and refining sectors, which rely heavily on industrial gases for various synthesis and purification processes. The burgeoning electronics industry, particularly in regions like China and South Korea, is another key contributor, utilizing gases like nitrogen and oxygen in semiconductor manufacturing and other high-tech applications. Furthermore, the increasing adoption of industrial gases in the food and beverage sector for packaging, preservation, and processing, alongside their critical role in oil and gas extraction and metal fabrication, are propelling market growth. The medical and pharmaceutical industries also represent a steady demand source, with gases like oxygen and nitrous oxide being essential for patient care and drug production.

Asia-Pacific Industrial Gases Market Market Size (In Billion)

The market's trajectory is further influenced by emerging trends such as the growing emphasis on sustainable gas production methods, including green hydrogen initiatives, and the increasing deployment of on-site gas generation solutions to reduce logistics costs and enhance supply chain reliability. However, the market faces certain restraints, including the volatile pricing of raw materials and energy, which can impact production costs. Stringent environmental regulations related to gas emissions and handling also present challenges, requiring significant investment in compliance and technological advancements. Geographically, China is expected to remain a dominant force, driven by its extensive manufacturing base and rapid industrialization. Other key markets include India, Japan, South Korea, and the ASEAN countries, each presenting unique growth opportunities and challenges. The competitive landscape features major players like Linde PLC, Air Products and Chemicals Inc., and Air Liquide, who are actively investing in expanding their production capacities and geographical reach to cater to the evolving needs of this dynamic market.

Asia-Pacific Industrial Gases Market Company Market Share

This in-depth report provides a detailed examination of the Asia-Pacific Industrial Gases Market, offering critical insights and actionable intelligence for stakeholders. With a study period spanning from 2019 to 2033, including a base year of 2025, an estimated year of 2025, and a forecast period from 2025 to 2033, this analysis delves into historical trends (2019-2024) to project future market trajectories. The report covers a wide array of industrial gases, including Nitrogen, Oxygen, Carbon dioxide, Hydrogen, Helium, Argon, Ammonia, Methane, Propane, Butane, and Other Product Types (Fluorine and Nitrous oxide), and analyzes their application across diverse end-user industries such as Chemical Processing and Refining, Electronics, Food and Beverage, Oil and Gas, Metal Manufacturing and Fabrication, Medical and Pharmaceutical, Automotive and Transportation, Energy and Power, and Other En. Key geographies covered include China, India, Japan, South Korea, ASEAN Countries, and Rest of Asia-Pacific.

The Asia-Pacific Industrial Gases Market is experiencing robust growth driven by rapid industrialization, expanding manufacturing sectors, and increasing demand from the healthcare and electronics industries. This report offers an unparalleled view of market dynamics, competitive landscapes, technological advancements, and emerging opportunities.

Asia-Pacific Industrial Gases Market Market Structure & Competitive Dynamics

The Asia-Pacific Industrial Gases Market is characterized by a moderately consolidated structure, with a few dominant global players holding significant market share, alongside a growing number of regional and specialized suppliers. The market concentration is influenced by the high capital expenditure required for the production and distribution infrastructure of industrial gases, particularly for large-scale atmospheric and process gases. Innovation ecosystems are thriving, driven by advancements in gas production technologies, purification methods, and on-site generation solutions. Regulatory frameworks, particularly concerning environmental standards and safety protocols for handling hazardous gases, play a crucial role in shaping market entry and operational strategies. Product substitutes are limited for many core industrial gases like oxygen and nitrogen, given their unique chemical properties. However, the advent of advanced on-site generation technologies can be seen as a form of substitution for traditional bulk supply for certain applications. End-user trends are heavily influenced by sector-specific demands, with the electronics industry’s need for ultra-high purity gases and the medical sector’s reliance on medical-grade gases being prime examples. Mergers and acquisitions (M&A) activities are strategic tools employed by leading players to expand their geographical reach, enhance their product portfolios, and gain a competitive edge. For instance, M&A deal values are often substantial, reflecting the strategic importance of acquiring market share and technological capabilities. Market share among the top players is a key indicator of competitive strength, with companies like Linde PLC, Air Products and Chemicals Inc., and Air Liquide consistently leading.

Asia-Pacific Industrial Gases Market Industry Trends & Insights

The Asia-Pacific Industrial Gases Market is poised for significant expansion, driven by a confluence of powerful growth drivers, disruptive technological advancements, evolving consumer preferences, and dynamic competitive forces. The overarching trend is the increasing industrialization and urbanization across the region, particularly in emerging economies like China and India, which are translating into escalating demand for a wide spectrum of industrial gases. This growth is further amplified by the burgeoning electronics sector, necessitating high-purity gases for semiconductor manufacturing and advanced display production, with countries like South Korea and Taiwan at the forefront. The renewable energy transition is another significant catalyst, with the escalating demand for Hydrogen as a clean fuel for transportation and industrial processes, propelling substantial investment in production and infrastructure. Similarly, the expanding healthcare sector, bolstered by an aging population and increased access to medical facilities, is fueling the demand for medical-grade gases such as Oxygen and Nitrous oxide.

Technological disruptions are reshaping the market landscape. On-site gas generation technologies, such as Pressure Swing Adsorption (PSA) and membrane separation, are gaining traction, offering cost-effective and convenient solutions for end-users, reducing reliance on traditional bulk supply. The development of more energy-efficient production methods and advanced gas purification techniques is also a key focus for innovation. Consumer preferences are shifting towards sustainability and localized supply chains. This is leading to an increased interest in green gases, particularly green Hydrogen produced via electrolysis powered by renewable energy, and a preference for suppliers who can demonstrate environmental responsibility. The competitive dynamics are intense, with established global players continuously investing in capacity expansion, strategic partnerships, and technological R&D to maintain their market leadership. Regional players are also emerging, leveraging their local market understanding and agility to capture niche segments. The projected Compound Annual Growth Rate (CAGR) for the industrial gases market in Asia-Pacific is robust, reflecting the region's strong economic fundamentals and growing industrial output. Market penetration for various gases varies significantly by end-use industry and geography, with atmospheric gases like Nitrogen and Oxygen having widespread adoption, while specialized gases like Helium and Fluorine find applications in more niche, high-value sectors. The sustained focus on economic development, coupled with an increasing emphasis on environmental sustainability and technological innovation, positions the Asia-Pacific Industrial Gases Market for a period of sustained and dynamic growth throughout the forecast period.

Dominant Markets & Segments in Asia-Pacific Industrial Gases Market

The Asia-Pacific Industrial Gases Market exhibits distinct dominance across various segments, driven by unique economic, industrial, and demographic factors.

Dominant Geography:

- China stands out as the largest and most dominant market within the Asia-Pacific region. This is primarily attributed to its colossal manufacturing base, extensive industrial infrastructure, and rapid economic development. China's significant investments in sectors like chemical processing, electronics, and automotive manufacturing directly translate into substantial demand for a broad range of industrial gases.

- Key Drivers: Government initiatives supporting industrial growth, massive domestic consumption, and strategic advancements in high-tech manufacturing sectors.

- India is emerging as a rapidly growing market, fueled by its expanding manufacturing capabilities, increasing healthcare expenditure, and burgeoning automotive sector. The country's demographic dividend and supportive economic policies are further accelerating its growth trajectory.

- Key Drivers: Favorable government policies promoting 'Make in India', rising disposable incomes, and substantial investments in infrastructure development.

- ASEAN Countries collectively represent a significant and growing market, characterized by diverse industrial landscapes, ranging from electronics manufacturing in Singapore and Malaysia to automotive production in Thailand and industrial processing in Indonesia.

- Key Drivers: Growing export-oriented manufacturing hubs, increasing foreign direct investment, and regional economic integration initiatives.

- Japan and South Korea, while mature markets, continue to be significant consumers, particularly in advanced electronics and high-precision manufacturing, driving demand for specialized and high-purity gases.

Dominant Product Type:

- Nitrogen is the most widely consumed industrial gas across Asia-Pacific. Its inert properties make it indispensable in various applications, including food and beverage packaging, metal processing, chemical inerting, and electronics manufacturing. The sheer breadth of its applications ensures consistent and high demand.

- Key Drivers: Pervasive use in inerting, freezing, and blanketing applications across numerous industries; cost-effectiveness in bulk supply.

- Oxygen ranks as the second-largest segment, primarily driven by its critical role in metal fabrication, chemical production, and the rapidly expanding healthcare sector for medical applications.

- Key Drivers: Essential for combustion in metal cutting and welding; vital for medical respiration and therapeutic applications; key reactant in various chemical processes.

- Carbon Dioxide finds significant application in the food and beverage industry for carbonation and preservation, as well as in welding and fire suppression. Growing environmental concerns are also spurring interest in captured CO2 for enhanced oil recovery.

- Key Drivers: Widespread use in the beverage industry; emerging applications in enhanced oil recovery and industrial cleaning.

- Hydrogen is experiencing the most significant growth potential, propelled by the global shift towards clean energy. Its use as a fuel for transportation (fuel cell vehicles) and in industrial decarbonization processes is creating substantial new demand.

- Key Drivers: Increasing adoption in fuel cell technology, industrial decarbonization initiatives, and its role in the production of ammonia and methanol.

Dominant End-user Industry:

- Chemical Processing and Refining is the largest end-user industry, consistently demanding high volumes of Nitrogen, Oxygen, and Hydrogen for various synthesis, inerting, and purification processes.

- Key Drivers: Large-scale production of chemicals, petrochemicals, and fertilizers; need for process efficiency and safety.

- Metal Manufacturing and Fabrication is another major consumer, relying heavily on Oxygen for cutting and welding, and Argon for welding applications.

- Key Drivers: Robust manufacturing sectors in the region, requiring gases for welding, cutting, and heat treatment processes.

- Electronics is a high-growth segment, demanding ultra-high purity gases like Nitrogen, Argon, and Helium, as well as specialized gases for semiconductor fabrication, display manufacturing, and printed circuit board production.

- Key Drivers: Rapid expansion of semiconductor manufacturing, display panel production, and the increasing complexity of electronic devices.

- Medical and Pharmaceutical is a critical and growing segment, with consistent demand for medical-grade Oxygen, Nitrous Oxide, and specialty gases for diagnostics and research.

- Key Drivers: Aging populations, increasing healthcare access, and advancements in medical research and treatment.

The interplay of these dominant geographies, product types, and end-user industries shapes the overall market landscape and presents distinct opportunities for growth and investment within the Asia-Pacific Industrial Gases Market.

Asia-Pacific Industrial Gases Market Product Innovations

Product innovations in the Asia-Pacific Industrial Gases Market are primarily focused on enhancing efficiency, purity, and sustainability. Advancements in cryogenic distillation and membrane separation technologies are leading to more energy-efficient production of atmospheric gases like Nitrogen and Oxygen. The development of on-site generation solutions is a key trend, offering tailored supply for specific customer needs and reducing transportation costs. In the realm of specialty gases, there's a continuous drive for higher purity levels, crucial for the stringent demands of the electronics and semiconductor industries. Furthermore, the growing emphasis on decarbonization is fueling innovation in Hydrogen production, with a focus on green hydrogen technologies utilizing renewable energy sources, and advancements in carbon capture and utilization (CCU) for Carbon Dioxide. These innovations not only offer competitive advantages but also align with the market's increasing focus on environmental responsibility and cost optimization.

Report Segmentation & Scope

This report segments the Asia-Pacific Industrial Gases Market comprehensively across key dimensions. The Product Type segmentation includes Nitrogen, Oxygen, Carbon dioxide, Hydrogen, Helium, Argon, Ammonia, Methane, Propane, Butane, and Other Product Types (Fluorine and Nitrous oxide), each analyzed for its market size and growth projections. The End-user Industry segmentation covers Chemical Processing and Refining, Electronics, Food and Beverage, Oil and Gas, Metal Manufacturing and Fabrication, Medical and Pharmaceutical, Automotive and Transportation, Energy and Power, and Other En, detailing their specific demand drivers and market penetration. Geographically, the market is segmented into China, India, Japan, South Korea, ASEAN Countries, and Rest of Asia-Pacific, providing regional market sizes, growth rates, and competitive dynamics. The scope includes historical data from 2019-2024 and forecasts up to 2033, offering a complete market overview.

Key Drivers of Asia-Pacific Industrial Gases Market Growth

The Asia-Pacific Industrial Gases Market is propelled by several interconnected growth drivers. The sustained industrial expansion and manufacturing output across countries like China and India are primary contributors, increasing the demand for fundamental gases like Nitrogen and Oxygen. The booming electronics sector's need for high-purity specialty gases is a significant accelerator. Furthermore, the healthcare industry's steady growth fuels demand for medical-grade gases. The global push for decarbonization and clean energy is a substantial driver for Hydrogen, with increasing investments in fuel cell technology and industrial applications. Favorable government policies promoting industrial development, R&D in gas production technologies, and strategic investments in infrastructure further bolster market growth.

Challenges in the Asia-Pacific Industrial Gases Market Sector

Despite robust growth, the Asia-Pacific Industrial Gases Market faces several challenges. The high capital investment required for setting up production facilities and distribution networks can be a barrier to entry for new players. Stringent environmental regulations and safety protocols, while necessary, can increase operational costs and complexity. Supply chain disruptions, exacerbated by geographical vastness and logistical challenges in certain regions, can impact delivery efficiency and cost. Intense competition among established global players and emerging regional entities can lead to price pressures and necessitate continuous innovation. Fluctuations in raw material prices and energy costs can also affect profitability.

Leading Players in the Asia-Pacific Industrial Gases Market Market

- Linde PLC

- Ellenbarrie Industrial Gases

- Air Products and Chemicals Inc.

- Bhuruka Gases Limited

- BASF SE

- Iwatani Corporation

- PT Samator Indo Gas Tbk

- Asia Technical Gas Co Pte Ltd

- Air Liquide

- Nippon Sanso Holdings Corporation

- Yingde Gas

- Messer SE & Co KGaA

Key Developments in Asia-Pacific Industrial Gases Market Sector

- December 2022: Yingde Gases announced the completion of the purchase of a 100% share in Shanghai Nanhua Industrial Gas Company Ltd. This strategic acquisition significantly boosted Yingde Gases' impact in the industrial packaged gas and medical oxygen segments, marking a crucial step in their packaged-gas strategy and entry into this market.

- July 2022: Yingde Gases Group announced a collaboration agreement with China Hydrogen. This partnership involves joint investment and the establishment of green hydrogen and green ammonia facilities in Ordos, Inner Mongolia, representing Yingde Gases' inaugural green ammonia project and a significant move towards sustainable energy solutions.

Strategic Asia-Pacific Industrial Gases Market Market Outlook

The strategic outlook for the Asia-Pacific Industrial Gases Market is exceptionally promising, driven by accelerating demand from rapidly industrializing nations and the global transition towards cleaner energy. Key growth accelerators include the increasing adoption of Hydrogen in mobility and industrial decarbonization, coupled with the sustained expansion of the electronics and medical sectors. Innovations in on-site generation and advanced purification techniques will continue to enhance operational efficiencies for end-users. Strategic opportunities lie in expanding production capacities in high-growth regions, focusing on specialty gas offerings for advanced manufacturing, and developing sustainable gas solutions, particularly green Hydrogen and Ammonia. Market players that can effectively navigate regulatory landscapes, invest in cutting-edge technology, and forge strong partnerships will be best positioned for long-term success.

Asia-Pacific Industrial Gases Market Segmentation

-

1. Product Type

- 1.1. Nitrogen

- 1.2. Oxygen

- 1.3. Carbon dioxide

- 1.4. Hydrogen

- 1.5. Helium

- 1.6. Argon

- 1.7. Ammonia

- 1.8. Methane

- 1.9. Propane

- 1.10. Butane

- 1.11. Other Product Types (Fluorine and Nitrous oxide)

-

2. End-user Industry

- 2.1. Chemical Processing and Refining

- 2.2. Electronics

- 2.3. Food and Beverage

- 2.4. Oil and Gas

- 2.5. Metal Manufacturing and Fabrication

- 2.6. Medical and Pharmaceutical

- 2.7. Automotive and Transportation

- 2.8. Energy and Power

- 2.9. Other En

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Industrial Gases Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Industrial Gases Market Regional Market Share

Geographic Coverage of Asia-Pacific Industrial Gases Market

Asia-Pacific Industrial Gases Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Frozen and Stored Food; Growing Need for Alternate Energy Sources; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Environmental Regulations and Safety Issues; Other Restraints

- 3.4. Market Trends

- 3.4.1. Chemical Processing and Refining to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Nitrogen

- 5.1.2. Oxygen

- 5.1.3. Carbon dioxide

- 5.1.4. Hydrogen

- 5.1.5. Helium

- 5.1.6. Argon

- 5.1.7. Ammonia

- 5.1.8. Methane

- 5.1.9. Propane

- 5.1.10. Butane

- 5.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Chemical Processing and Refining

- 5.2.2. Electronics

- 5.2.3. Food and Beverage

- 5.2.4. Oil and Gas

- 5.2.5. Metal Manufacturing and Fabrication

- 5.2.6. Medical and Pharmaceutical

- 5.2.7. Automotive and Transportation

- 5.2.8. Energy and Power

- 5.2.9. Other En

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Nitrogen

- 6.1.2. Oxygen

- 6.1.3. Carbon dioxide

- 6.1.4. Hydrogen

- 6.1.5. Helium

- 6.1.6. Argon

- 6.1.7. Ammonia

- 6.1.8. Methane

- 6.1.9. Propane

- 6.1.10. Butane

- 6.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Chemical Processing and Refining

- 6.2.2. Electronics

- 6.2.3. Food and Beverage

- 6.2.4. Oil and Gas

- 6.2.5. Metal Manufacturing and Fabrication

- 6.2.6. Medical and Pharmaceutical

- 6.2.7. Automotive and Transportation

- 6.2.8. Energy and Power

- 6.2.9. Other En

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Nitrogen

- 7.1.2. Oxygen

- 7.1.3. Carbon dioxide

- 7.1.4. Hydrogen

- 7.1.5. Helium

- 7.1.6. Argon

- 7.1.7. Ammonia

- 7.1.8. Methane

- 7.1.9. Propane

- 7.1.10. Butane

- 7.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Chemical Processing and Refining

- 7.2.2. Electronics

- 7.2.3. Food and Beverage

- 7.2.4. Oil and Gas

- 7.2.5. Metal Manufacturing and Fabrication

- 7.2.6. Medical and Pharmaceutical

- 7.2.7. Automotive and Transportation

- 7.2.8. Energy and Power

- 7.2.9. Other En

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Nitrogen

- 8.1.2. Oxygen

- 8.1.3. Carbon dioxide

- 8.1.4. Hydrogen

- 8.1.5. Helium

- 8.1.6. Argon

- 8.1.7. Ammonia

- 8.1.8. Methane

- 8.1.9. Propane

- 8.1.10. Butane

- 8.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Chemical Processing and Refining

- 8.2.2. Electronics

- 8.2.3. Food and Beverage

- 8.2.4. Oil and Gas

- 8.2.5. Metal Manufacturing and Fabrication

- 8.2.6. Medical and Pharmaceutical

- 8.2.7. Automotive and Transportation

- 8.2.8. Energy and Power

- 8.2.9. Other En

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Korea Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Nitrogen

- 9.1.2. Oxygen

- 9.1.3. Carbon dioxide

- 9.1.4. Hydrogen

- 9.1.5. Helium

- 9.1.6. Argon

- 9.1.7. Ammonia

- 9.1.8. Methane

- 9.1.9. Propane

- 9.1.10. Butane

- 9.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Chemical Processing and Refining

- 9.2.2. Electronics

- 9.2.3. Food and Beverage

- 9.2.4. Oil and Gas

- 9.2.5. Metal Manufacturing and Fabrication

- 9.2.6. Medical and Pharmaceutical

- 9.2.7. Automotive and Transportation

- 9.2.8. Energy and Power

- 9.2.9. Other En

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. ASEAN Countries Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Nitrogen

- 10.1.2. Oxygen

- 10.1.3. Carbon dioxide

- 10.1.4. Hydrogen

- 10.1.5. Helium

- 10.1.6. Argon

- 10.1.7. Ammonia

- 10.1.8. Methane

- 10.1.9. Propane

- 10.1.10. Butane

- 10.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Chemical Processing and Refining

- 10.2.2. Electronics

- 10.2.3. Food and Beverage

- 10.2.4. Oil and Gas

- 10.2.5. Metal Manufacturing and Fabrication

- 10.2.6. Medical and Pharmaceutical

- 10.2.7. Automotive and Transportation

- 10.2.8. Energy and Power

- 10.2.9. Other En

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Asia Pacific Asia-Pacific Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Nitrogen

- 11.1.2. Oxygen

- 11.1.3. Carbon dioxide

- 11.1.4. Hydrogen

- 11.1.5. Helium

- 11.1.6. Argon

- 11.1.7. Ammonia

- 11.1.8. Methane

- 11.1.9. Propane

- 11.1.10. Butane

- 11.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Chemical Processing and Refining

- 11.2.2. Electronics

- 11.2.3. Food and Beverage

- 11.2.4. Oil and Gas

- 11.2.5. Metal Manufacturing and Fabrication

- 11.2.6. Medical and Pharmaceutical

- 11.2.7. Automotive and Transportation

- 11.2.8. Energy and Power

- 11.2.9. Other En

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Linde PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Ellenbarrie industrial Gases

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Air Products and Chemicals Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bhuruka Gases Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 BASF SE

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Iwatani Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 PT Samator Indo Gas Tbk

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Asia Technical Gas Co Pte Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Air Liquide

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Nippon Sanso Holdings Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Yingde Gas*List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Messer SE & Co KGaA

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Linde PLC

List of Figures

- Figure 1: Asia-Pacific Industrial Gases Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Industrial Gases Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 13: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 19: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 21: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 29: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 35: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 36: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 37: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 43: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 44: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 45: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 51: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 52: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 53: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 55: Asia-Pacific Industrial Gases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Asia-Pacific Industrial Gases Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Industrial Gases Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Asia-Pacific Industrial Gases Market?

Key companies in the market include Linde PLC, Ellenbarrie industrial Gases, Air Products and Chemicals Inc, Bhuruka Gases Limited, BASF SE, Iwatani Corporation, PT Samator Indo Gas Tbk, Asia Technical Gas Co Pte Ltd, Air Liquide, Nippon Sanso Holdings Corporation, Yingde Gas*List Not Exhaustive, Messer SE & Co KGaA.

3. What are the main segments of the Asia-Pacific Industrial Gases Market?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 32450 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Frozen and Stored Food; Growing Need for Alternate Energy Sources; Other Drivers.

6. What are the notable trends driving market growth?

Chemical Processing and Refining to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Regulations and Safety Issues; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Yingde Gases announced the completion of the purchase of a 100% share in Shanghai Nanhua Industrial Gas Company Ltd. Yingde Gases' first packaged gas purchase boosted the group's impact in industrial packaged gas and medical oxygen. The purchase is a step forward in the organization's strategic packaged-gas strategy, indicating the group's entry into the market of packaged gas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Industrial Gases Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Industrial Gases Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Industrial Gases Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Industrial Gases Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence