Key Insights

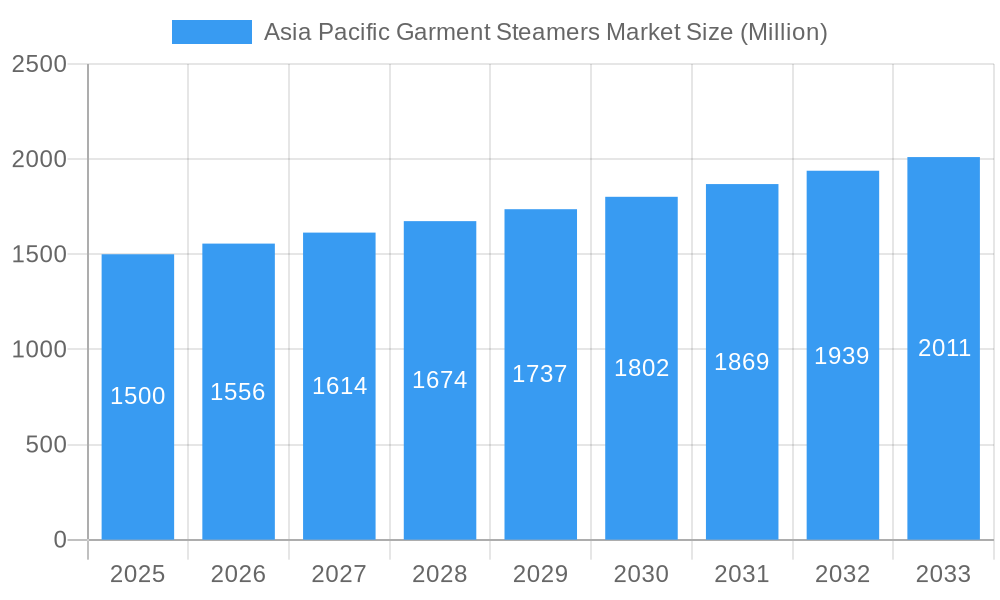

The Asia Pacific garment steamers market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by a CAGR of 3.78% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes across major economies like China, India, and South Korea are empowering consumers to invest in convenient and efficient home appliances like garment steamers. The increasing preference for wrinkle-free and presentable clothing, particularly in urban centers with a strong focus on professional attire, further boosts market demand. The growing popularity of online shopping, coupled with the ease of using garment steamers for quick touch-ups, is also significantly contributing to market growth. Furthermore, the market is witnessing innovation in product design and functionality, with the introduction of more compact and versatile models, catering to diverse consumer needs. While the market faces restraints from the availability of affordable alternatives like ironing, its sustained growth trajectory is expected to continue, driven by the aforementioned factors. The segment breakdown shows strong demand across various product types (handheld, upright, tank types), distribution channels (online and specialty stores prove increasingly important), and countries within the Asia Pacific region. China, India, and Japan are expected to be key contributors to this market's overall expansion during the forecast period.

Asia Pacific Garment Steamers Market Market Size (In Billion)

The diverse range of players, including Groupe SEB SA, Philips, Haier, and Conair, indicates a competitive landscape. However, the market's relatively high growth potential provides opportunities for both established players and emerging brands to thrive. The strategic focus will be on expanding product lines, enhancing distribution networks, and leveraging digital marketing strategies to reach the ever-growing base of digitally-savvy consumers. Product differentiation, incorporating features like advanced steam technology and ease of use, will be crucial for securing a competitive edge. While the precise market size for each segment remains unavailable, logical inferences based on industry trends suggest a greater market share for handheld steamers (due to their affordability and convenience), online distribution channels (due to e-commerce growth), and China (due to its large consumer base and rapid economic development).

Asia Pacific Garment Steamers Market Company Market Share

Asia Pacific Garment Steamers Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific Garment Steamers Market, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscapes, segment performance, and future growth prospects. With a focus on key players like Groupe SEB SA, Pursteam, Philips, Haier Group Corporation, Conair Corporation, Reliable Corporation, Salav, Maryant, and Jiffy Steamer Company, this report is essential for businesses seeking to understand and capitalize on opportunities within this burgeoning market. The Base Year is 2025, and the Estimated Year is 2025, with a Forecast Period spanning 2025-2033 and a Historical Period covering 2019-2024.

Asia Pacific Garment Steamers Market Structure & Competitive Dynamics

The Asia Pacific garment steamer market exhibits a moderately concentrated structure, with a few key players holding significant market share. The market's competitive landscape is characterized by intense rivalry, driven by factors such as product innovation, pricing strategies, and brand reputation. Innovation ecosystems are dynamic, with continuous advancements in steam technology, design, and functionality. Regulatory frameworks vary across countries in the region, impacting product safety and labeling requirements. Product substitutes, primarily traditional irons, continue to exist, but garment steamers are gaining traction due to their convenience and effectiveness. End-user trends indicate a growing preference for portable and versatile steamers, particularly among younger demographics and busy professionals. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with deal values averaging approximately xx Million USD. Market share data reveals that the top five players collectively account for approximately xx% of the market. Specific M&A deals, including their values, were not widely publicized for this industry; therefore no further information is available to report.

Asia Pacific Garment Steamers Market Industry Trends & Insights

The Asia Pacific garment steamers market is experiencing robust growth, fueled by a confluence of factors. The burgeoning middle class across rapidly developing economies like India and China, coupled with rising disposable incomes, is significantly driving increased consumer spending on home appliances, including garment steamers. This trend reflects a growing emphasis on personal style and appearance, particularly among younger demographics. While precise figures are commercially sensitive, the market demonstrated a strong Compound Annual Growth Rate (CAGR) during the historical period (2019-2024), and analysts project continued robust growth during the forecast period (2025-2033). This growth is further propelled by technological innovations. Faster heating times, enhanced steam output, and more compact, ergonomically designed models are significantly increasing the appeal of garment steamers. Consumer preferences are increasingly gravitating towards cordless and handheld models for their convenience and portability. Despite considerable growth, the market penetration of garment steamers remains lower than that of traditional irons, representing a substantial untapped market opportunity. E-commerce platforms are playing a crucial role in expanding market accessibility and driving sales, contributing to the overall market dynamism.

Dominant Markets & Segments in Asia Pacific Garment Steamers Market

- Leading Region: China dominates the Asia Pacific garment steamers market due to its vast population, strong economic growth, and rising consumer demand for convenient and effective apparel care solutions.

- Leading Country: China's dominance extends to the national level. Its large and expanding middle class has greatly increased the demand for home appliances.

- Leading Product Type: Handheld garment steamers are the most popular segment, favored for their portability and ease of use.

- Leading Tank Type: Removable tank steamers are gaining traction due to their ease of refilling and increased convenience.

- Leading Distribution Channel: Online channels are witnessing rapid growth, offering convenience and wide reach to consumers.

- Key Drivers:

- China's robust economic growth and expanding middle class.

- Increasing disposable incomes across the region.

- Growing awareness of the benefits of garment steaming over traditional ironing.

- Rise in e-commerce and online retail channels.

- Government policies promoting consumer spending.

The dominance of these segments stems from the convergence of several factors such as consumer preferences, technological advancements, and distribution infrastructure. The high population density and strong economic growth in China fuel this dominance.

Asia Pacific Garment Steamers Market Product Innovations

Recent innovations in the Asia Pacific garment steamers market are heavily focused on enhancing user experience through improved convenience, portability, and functionality. Manufacturers are actively responding to consumer demand by incorporating features such as significantly faster heating times, larger water tank capacities for extended use, and more powerful, consistent steam output. A key technological trend involves the integration of smart features, including app-based controls, automated settings, and potentially even AI-driven fabric recognition for optimized steaming cycles. Design innovations are also prominent, with a focus on space-saving designs and multi-functional appliances that can serve multiple household needs. This proactive approach to addressing evolving consumer needs and leveraging technological advancements is paramount for maintaining competitiveness in this dynamic and rapidly evolving market landscape.

Report Segmentation & Scope

This report segments the Asia Pacific garment steamers market across several key parameters:

Product Type: Handheld, Upright. Handheld steamers are projected to maintain a significant market share due to their portability and ease of use; however, the upright segment is expected to experience steady growth driven by its higher steam output and capability to steam larger garments.

Tank Type: Fixed, Removable. The removable tank segment is anticipated to demonstrate a faster growth rate than fixed tank models, owing to the increased convenience in refilling.

Distribution Channel: Multi-brand stores, Specialty stores, Online, Other distribution channels. The online channel is poised for significant growth due to its accessibility and convenience; however, traditional retail channels such as multi-brand and specialty stores will continue to play a crucial role.

Country: Australia, China, India, Japan, South Korea, Rest of Asia Pacific. China is expected to maintain its position as the largest market; however, other countries in the region are projected to show strong growth potential driven by increasing disposable incomes and changing consumer preferences. Each segment is analyzed based on its growth trajectory, market size, and competitive landscape.

Key Drivers of Asia Pacific Garment Steamers Market Growth

The robust growth of the Asia Pacific garment steamers market is driven by a synergistic interplay of several key factors. The significant rise in disposable incomes across the region is a primary driver, leading to increased spending on convenience-enhancing household appliances. The expansion of the middle class, especially within developing economies such as India and China, represents a substantial and growing consumer base eager to adopt time-saving and efficient technologies like garment steamers. Technological advancements, such as improved heating elements resulting in faster heating times and more efficient steam generation, contribute significantly to market expansion. Finally, the proliferation and increasing influence of online retail channels have significantly broadened market access and fueled sales growth, further solidifying the upward trajectory of the Asia Pacific garment steamers market.

Challenges in the Asia Pacific Garment Steamers Market Sector

The Asia Pacific garment steamers market faces several challenges. Competition from established players and new entrants puts pressure on pricing and profit margins. Supply chain disruptions, particularly those arising from geopolitical events, can impact product availability and cost. Varying regulatory requirements across different countries also present hurdles for manufacturers. Additionally, consumer preference shifts and the emergence of innovative alternatives pose ongoing challenges for market participants. These challenges necessitate strategic adaptation and resilience for players to succeed.

Leading Players in the Asia Pacific Garment Steamers Market

- Groupe SEB SA

- Pursteam

- Philips

- Haier Group Corporation

- Conair Corporation

- Reliable Corporation

- Salav

- Maryant

- Jiffy Steamer Company

Key Developments in Asia Pacific Garment Steamers Market Sector

- August 2023: Haier launched a new space-saving garment steamer with a foldable design, integrated wheels, and a multi-functional handle that doubles as a clothes hanger. This innovation addresses consumer demand for compact and versatile appliances.

- October 2022: Panasonic introduced a new garment steamer with a 30-second heat-up time and a 9-minute continuous steam function. This emphasizes convenience and efficiency, attracting users who prioritize time-saving solutions.

Strategic Asia Pacific Garment Steamers Market Outlook

The Asia Pacific garment steamers market presents significant growth potential. Continued economic expansion, rising disposable incomes, and evolving consumer preferences will drive demand. Strategic opportunities exist for companies that innovate to offer increasingly convenient, efficient, and technologically advanced products. Expanding into emerging markets within the region and leveraging online distribution channels are also key strategies for success. Focusing on sustainability and eco-friendly designs can also provide a competitive edge. The overall market outlook is positive, signifying a promising future for players who can effectively address evolving consumer needs.

Asia Pacific Garment Steamers Market Segmentation

-

1. Product Type

- 1.1. Handheld

- 1.2. Upright

-

2. Tank Type

- 2.1. Fixed

- 2.2. Removable

-

3. Distribution Channel

- 3.1. Multi brands store

- 3.2. Specialty Store

- 3.3. Online

- 3.4. Other Distribution Channel

Asia Pacific Garment Steamers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Garment Steamers Market Regional Market Share

Geographic Coverage of Asia Pacific Garment Steamers Market

Asia Pacific Garment Steamers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Gentle and Safe on Fabrics

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. Rising Sales Through Online Channels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Garment Steamers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Handheld

- 5.1.2. Upright

- 5.2. Market Analysis, Insights and Forecast - by Tank Type

- 5.2.1. Fixed

- 5.2.2. Removable

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi brands store

- 5.3.2. Specialty Store

- 5.3.3. Online

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Groupe SEB SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pursteam

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philips

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haier Group Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Conair Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Reliable Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pursteam

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Salav

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Maryant

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jiffy Steamer Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Groupe SEB SA

List of Figures

- Figure 1: Asia Pacific Garment Steamers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Garment Steamers Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Tank Type 2020 & 2033

- Table 4: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 5: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Tank Type 2020 & 2033

- Table 12: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 13: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: China Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: China Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Garment Steamers Market?

The projected CAGR is approximately 11.98%.

2. Which companies are prominent players in the Asia Pacific Garment Steamers Market?

Key companies in the market include Groupe SEB SA, Pursteam, Philips, Haier Group Corporation, Conair Corporation, Reliable Corporation, Pursteam, Salav, Maryant, Jiffy Steamer Company.

3. What are the main segments of the Asia Pacific Garment Steamers Market?

The market segments include Product Type, Tank Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Gentle and Safe on Fabrics.

6. What are the notable trends driving market growth?

Rising Sales Through Online Channels.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

August 2023: Haier launched a new garment steamer that focuses on saving space. The whole appliance can be folded into a small box. Wheels are equipped with a box to help move them. The handle on the top helps users twist or pull the steamer. The handle can also be used as a clothes hanger and has two width options for different clothes. There are additional hangers for clothes and a steam nozzle at the bottom of the ironing board for user convenience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Garment Steamers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Garment Steamers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Garment Steamers Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Garment Steamers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence