Key Insights

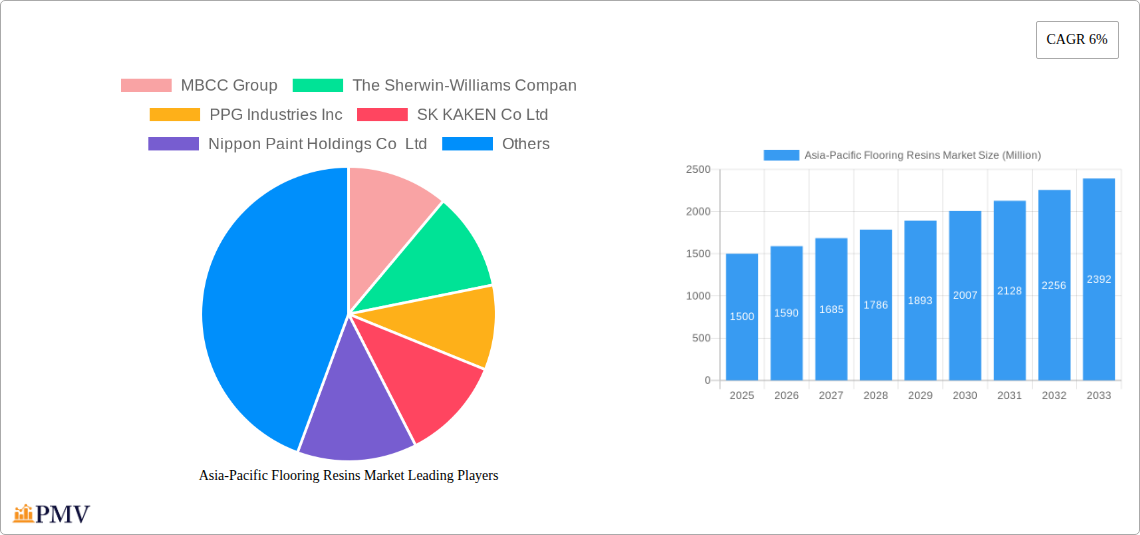

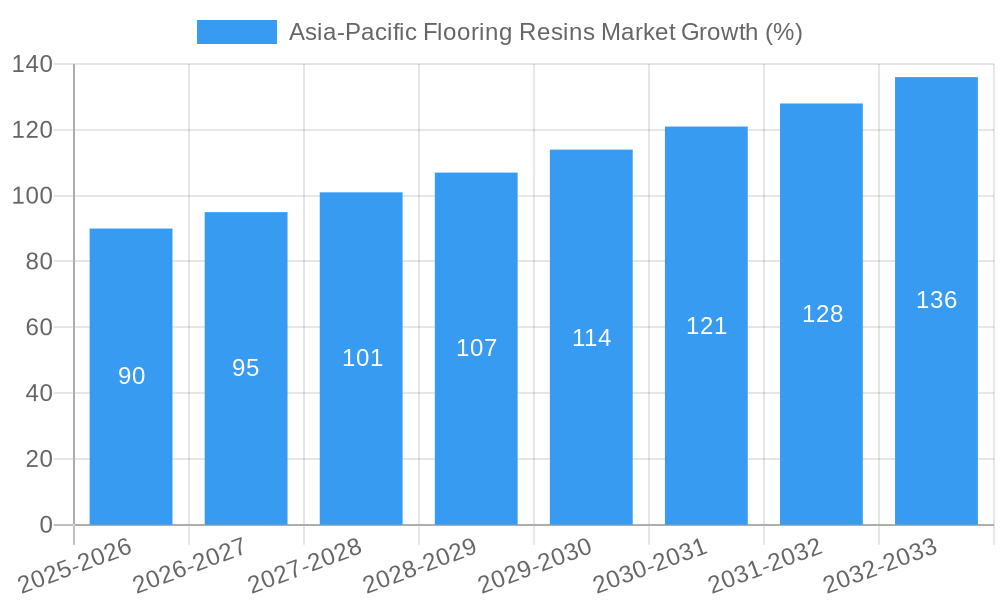

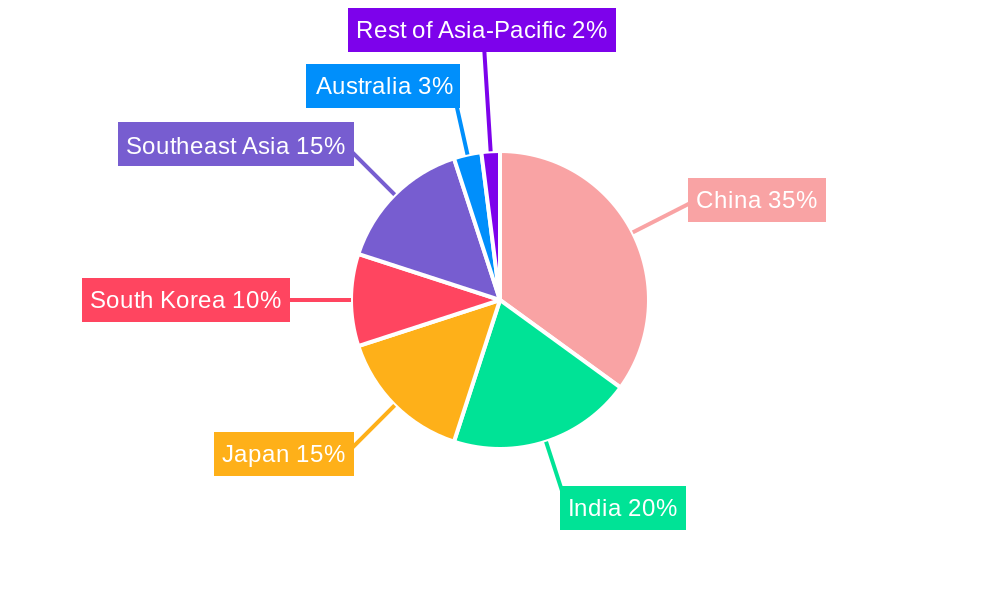

The Asia-Pacific flooring resins market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6% from 2025 to 2033. This expansion is fueled by several key factors. The region's burgeoning construction industry, particularly in rapidly developing economies like China and India, is a significant driver. Increased infrastructure development projects, including commercial buildings, industrial facilities, and residential complexes, are creating substantial demand for high-performance flooring solutions. Furthermore, the rising preference for aesthetically pleasing and durable flooring options in both residential and commercial settings is boosting the adoption of advanced resin technologies, such as epoxy and polyurethane, known for their exceptional strength, longevity, and visual appeal. The growing awareness of hygiene and easy maintenance in public spaces further fuels demand. While fluctuating raw material prices and potential supply chain disruptions pose some challenges, the overall market outlook remains positive. Segmentation analysis reveals strong growth within the commercial and industrial end-use sectors, primarily due to the increasing adoption of epoxy and polyaspartic resins for their chemical resistance and ease of cleaning. Key players like MBCC Group, Sherwin-Williams, and PPG Industries are actively investing in research and development to introduce innovative resin formulations, catering to the diverse needs of the market. The dominance of China and India within the Asia-Pacific region underscores the significant opportunities for market expansion in the coming years.

The continued urbanization across Asia-Pacific coupled with government initiatives promoting sustainable construction practices will further contribute to market growth. While acrylic resins maintain a significant market share due to their cost-effectiveness, the demand for high-performance alternatives like polyaspartic and polyurethane resins is rapidly increasing due to their superior properties. This trend reflects a shift toward specialized flooring solutions catering to specific performance requirements, particularly in industrial environments. The competitive landscape is characterized by both established international players and regional manufacturers, leading to innovation and price competition. Further segmentation by resin type (acrylic, epoxy, polyaspartic, polyurethane, other) and end-use sector (commercial, industrial, infrastructure, residential) allows for a nuanced understanding of market dynamics and growth prospects within specific niches. The consistent growth projection for the forecast period suggests a sustained period of expansion for the Asia-Pacific flooring resins market.

Asia-Pacific Flooring Resins Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific flooring resins market, offering valuable insights into market dynamics, competitive landscape, and future growth prospects. The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report segments the market by sub-product (Acrylic, Epoxy, Polyaspartic, Polyurethane, Other Resin Types) and end-use sector (Commercial, Industrial and Institutional, Infrastructure, Residential), offering granular data and analysis for informed decision-making. The market size is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key players like MBCC Group, The Sherwin-Williams Company, PPG Industries Inc., and others are profiled, highlighting their strategies and market positions.

Asia-Pacific Flooring Resins Market Market Structure & Competitive Dynamics

The Asia-Pacific flooring resins market exhibits a moderately concentrated structure, with a few major players holding significant market share. The market is characterized by a dynamic innovation ecosystem, driven by ongoing research and development in resin technology and application techniques. Regulatory frameworks concerning environmental sustainability and building codes significantly influence market dynamics. Product substitutes, such as traditional flooring materials like tiles and wood, pose competitive pressure. End-user trends, particularly towards sustainable and aesthetically pleasing flooring solutions, are shaping market demand. Mergers and acquisitions (M&A) are frequent, as evidenced by recent activities like Sika’s acquisition of MBCC Group's flooring resins business in May 2023, impacting market concentration and competitive dynamics. This deal, valued at xx Million, significantly altered the market landscape. Other M&A activities are estimated to have contributed to xx Million in deal value during the historical period.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Innovation: Focus on high-performance, sustainable, and aesthetically appealing resins.

- Regulatory Landscape: Stringent environmental regulations are driving the adoption of eco-friendly resins.

- Substitutes: Traditional flooring materials (tiles, wood) compete with resinous flooring.

- End-User Trends: Growing demand for durable, low-maintenance, and visually appealing flooring solutions.

Asia-Pacific Flooring Resins Market Industry Trends & Insights

The Asia-Pacific flooring resins market is experiencing robust growth, propelled by several factors. Rapid urbanization and infrastructure development across the region are key drivers, increasing demand for flooring solutions in both residential and commercial sectors. Technological advancements, such as the development of high-performance, self-leveling resins and UV-cured coatings, are enhancing product features and expanding application possibilities. Consumer preferences are shifting towards sustainable and environmentally friendly options, driving innovation in bio-based resins. Competitive dynamics are intense, with leading players investing heavily in R&D, capacity expansion, and strategic acquisitions to maintain market share. The market exhibits a strong growth trajectory, with a projected CAGR of xx% during the forecast period. Market penetration of resinous flooring solutions is steadily increasing, particularly in high-growth economies like India and China. This trend is attributed to the growing demand for aesthetically appealing and durable flooring solutions in commercial settings, including retail spaces and industrial warehouses. The market is influenced by various factors like changing consumer preferences and technological advancements, but the primary growth factor remains the ongoing infrastructural development in the region.

Dominant Markets & Segments in Asia-Pacific Flooring Resins Market

China and India dominate the Asia-Pacific flooring resins market, driven by rapid economic growth, expanding construction activities, and increasing investments in infrastructure projects. The Epoxy segment holds the largest market share among sub-products due to its excellent durability, chemical resistance, and cost-effectiveness. The Commercial, Industrial, and Institutional end-use sector is the major contributor to market revenue, fuelled by the growing demand for hygienic and durable flooring in various settings.

- Key Drivers for China & India:

- Rapid urbanization and infrastructure development.

- Rising disposable incomes and increased construction spending.

- Government initiatives promoting sustainable construction practices.

- Epoxy Segment Dominance:

- Superior durability and chemical resistance.

- Cost-effectiveness compared to other resin types.

- Wide range of applications across various sectors.

- Commercial, Industrial, and Institutional Sector Leadership:

- High demand for hygienic and durable flooring solutions.

- Growing preference for resinous flooring in hospitals, factories, and commercial buildings.

Asia-Pacific Flooring Resins Market Product Innovations

Recent innovations in flooring resins focus on enhanced performance characteristics, improved aesthetics, and sustainability. Manufacturers are developing self-leveling, high-strength resins with UV-resistance and anti-microbial properties. Bio-based resins made from renewable resources are gaining traction, aligning with the growing demand for eco-friendly building materials. These advancements cater to the growing need for durable, aesthetically pleasing, and sustainable flooring solutions in various sectors. The focus on ease of application and improved durability continues to shape the market.

Report Segmentation & Scope

This report segments the Asia-Pacific flooring resins market based on sub-product type and end-use sector. The sub-product segment includes Acrylic, Epoxy, Polyaspartic, Polyurethane, and Other Resin Types, each exhibiting unique properties and applications, resulting in varying market sizes and growth projections. Similarly, the end-use sector segmentation comprises Commercial, Industrial and Institutional, Infrastructure, and Residential sectors, each with its specific growth dynamics and market size. Each segment's competitive landscape is analyzed, identifying key players and their market strategies. Growth projections for each segment are provided based on market trends and forecast analysis.

Key Drivers of Asia-Pacific Flooring Resins Market Growth

The Asia-Pacific flooring resins market's growth is driven by several factors. Rapid urbanization and infrastructure development across the region create substantial demand for new construction and renovation projects, significantly boosting resin flooring adoption. The rising disposable incomes in many Asian countries, coupled with increased awareness of hygiene and aesthetics, fuel the demand for high-quality flooring solutions. Government initiatives promoting sustainable and green building practices encourage the use of eco-friendly resin flooring options. Technological advancements in resin formulations continue to improve product properties and expand application possibilities.

Challenges in the Asia-Pacific Flooring Resins Market Sector

Several factors challenge the Asia-Pacific flooring resins market. Fluctuations in raw material prices impact production costs and profitability. Stringent environmental regulations can increase compliance costs for manufacturers. Competition from traditional flooring materials and emerging substitutes limits market penetration. Supply chain disruptions can affect production and delivery schedules. These challenges create uncertainty for market players and shape their strategic responses.

Leading Players in the Asia-Pacific Flooring Resins Market Market

- MBCC Group

- The Sherwin-Williams Company

- PPG Industries Inc

- SK KAKEN Co Ltd

- Nippon Paint Holdings Co Ltd

- Akzo Nobel N V

- Allnex GMBH

- Sika AG

- Kansai Paint Co Ltd

- KCC Corporation

Key Developments in Asia-Pacific Flooring Resins Market Sector

- May 2023: Sika acquired MBCC Group's flooring resins business, expanding its market share and product portfolio.

- May 2023: The Sherwin-Williams Company launched SofTop Comfort flooring solutions, enhancing its seamless resinous flooring offerings.

- July 2022: The Sherwin-Williams Company acquired Dur-A-Flex Inc., strengthening its position in the resinous flooring market.

Strategic Asia-Pacific Flooring Resins Market Market Outlook

The Asia-Pacific flooring resins market holds significant future potential, driven by continued urbanization, infrastructure development, and rising consumer demand for high-quality flooring solutions. Strategic opportunities exist for manufacturers who can offer innovative, sustainable, and cost-effective products. Focus on technological advancements, strong distribution networks, and strategic partnerships will be crucial for success in this dynamic and growing market. Companies that effectively address sustainability concerns and cater to evolving consumer preferences are poised for significant growth in the coming years.

Asia-Pacific Flooring Resins Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

- 2.1. Acrylic

- 2.2. Epoxy

- 2.3. Polyaspartic

- 2.4. Polyurethane

- 2.5. Other Resin Types

Asia-Pacific Flooring Resins Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Flooring Resins Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Flooring Resins Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Acrylic

- 5.2.2. Epoxy

- 5.2.3. Polyaspartic

- 5.2.4. Polyurethane

- 5.2.5. Other Resin Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. China Asia-Pacific Flooring Resins Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Flooring Resins Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Flooring Resins Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Flooring Resins Market Analysis, Insights and Forecast, 2019-2031

- 10. Southeast Asia Asia-Pacific Flooring Resins Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Flooring Resins Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Flooring Resins Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 MBCC Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 The Sherwin-Williams Compan

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PPG Industries Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SK KAKEN Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nippon Paint Holdings Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Akzo Nobel N V

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Allnex GMBH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Sika AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Kansai Paint Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 KCC Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 MBCC Group

List of Figures

- Figure 1: Asia-Pacific Flooring Resins Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Flooring Resins Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Flooring Resins Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Flooring Resins Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Flooring Resins Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 4: Asia-Pacific Flooring Resins Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 5: Asia-Pacific Flooring Resins Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 6: Asia-Pacific Flooring Resins Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 7: Asia-Pacific Flooring Resins Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Flooring Resins Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Flooring Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Flooring Resins Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Southeast Asia Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Southeast Asia Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Flooring Resins Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 26: Asia-Pacific Flooring Resins Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 27: Asia-Pacific Flooring Resins Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 28: Asia-Pacific Flooring Resins Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 29: Asia-Pacific Flooring Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Flooring Resins Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: China Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Japan Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: South Korea Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Korea Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: India Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Australia Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: New Zealand Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: New Zealand Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Indonesia Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Indonesia Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Malaysia Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Malaysia Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Singapore Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Singapore Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Thailand Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Thailand Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Vietnam Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Vietnam Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: Philippines Asia-Pacific Flooring Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Philippines Asia-Pacific Flooring Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Flooring Resins Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Asia-Pacific Flooring Resins Market?

Key companies in the market include MBCC Group, The Sherwin-Williams Compan, PPG Industries Inc, SK KAKEN Co Ltd, Nippon Paint Holdings Co Ltd, Akzo Nobel N V, Allnex GMBH, Sika AG, Kansai Paint Co Ltd, KCC Corporation.

3. What are the main segments of the Asia-Pacific Flooring Resins Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.May 2023: The Sherwin-Williams Company introduced SofTop Comfort flooring solutions, an addition to its seamless resinous flooring portfolio that provides comfort, excellent aesthetics, and sustainability.July 2022: The Sherwin-Williams Company acquired Dur-A-Flex Inc. to provide more value and a higher level of service as the go-to partner in resinous flooring.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Flooring Resins Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Flooring Resins Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Flooring Resins Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Flooring Resins Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence