Key Insights

The Asia-Pacific Epoxy Adhesive Market is poised for substantial growth, driven by robust demand across diverse end-user industries and rapid technological advancements. The market is estimated to reach USD 8.67 billion in 2025, demonstrating a strong trajectory. This expansion is fueled by an impressive Compound Annual Growth Rate (CAGR) of 13.94% from 2019 to 2033. Key growth drivers include the burgeoning automotive sector's increasing adoption of lightweight materials for enhanced fuel efficiency, the expansive aerospace industry's reliance on high-performance adhesives for structural integrity and weight reduction, and the booming construction sector, particularly in developing economies, which utilizes epoxy adhesives for their durability and bonding strength in infrastructure projects and building applications. Furthermore, the packaging industry's shift towards sustainable and high-barrier packaging solutions, along with the healthcare sector's demand for biocompatible and sterile adhesives, are significant contributors to market expansion. The woodworking and joinery segment also presents a notable area of growth, leveraging epoxy adhesives for superior bonding and finish.

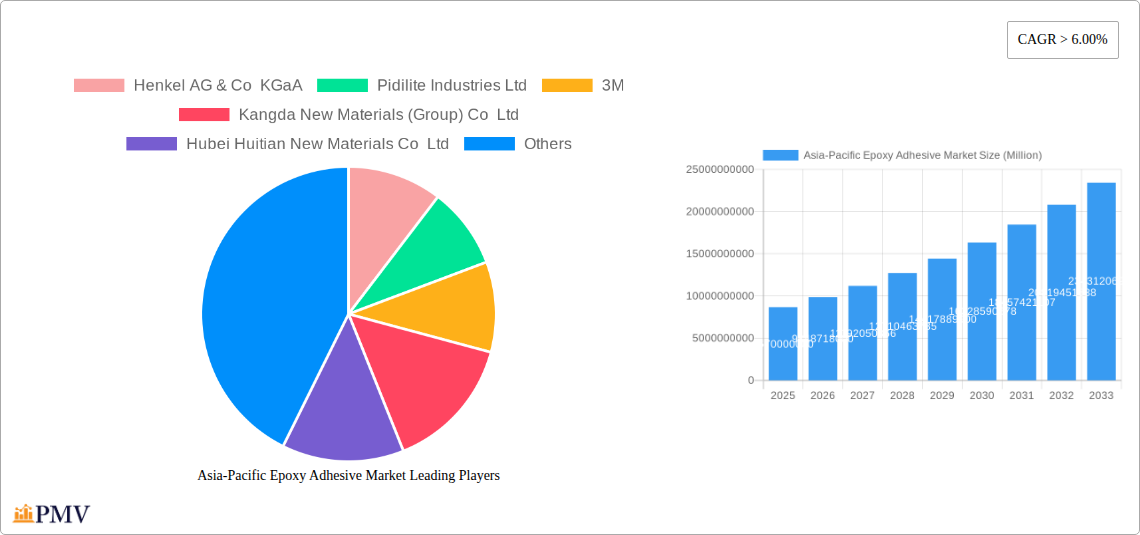

Asia-Pacific Epoxy Adhesive Market Market Size (In Billion)

The market's dynamism is further shaped by technological evolution and emerging trends. The shift towards more environmentally friendly and safer adhesive formulations is evident, with an increasing preference for UV-cured and water-borne adhesives over traditional solvent-borne options, aligning with stringent environmental regulations and growing consumer awareness. Reactive adhesive technologies continue to dominate due to their superior performance characteristics, catering to demanding applications. While the market enjoys strong growth drivers, certain restraints, such as the volatile raw material prices for epoxy resins and hardeners, and the need for specialized application equipment, could temper the pace of expansion. Nonetheless, the immense potential within the Asia-Pacific region, encompassing major economies like China, Japan, South Korea, and India, is expected to propel the market forward. Major players like Henkel AG & Co KGaA, Pidilite Industries Ltd, 3M, and H B Fuller Company are actively investing in R&D and expanding their presence to capture this burgeoning market. The forecast period of 2025-2033 is anticipated to witness sustained innovation and market penetration, solidifying the significance of epoxy adhesives in the region's industrial landscape.

Asia-Pacific Epoxy Adhesive Market Company Market Share

Asia-Pacific Epoxy Adhesive Market: Comprehensive Market Analysis & Forecast 2019-2033

This in-depth report provides a meticulous analysis of the Asia-Pacific epoxy adhesive market, a dynamic and rapidly expanding sector driven by robust industrial growth and technological advancements. Covering the study period from 2019 to 2033, with a base year of 2025, this research offers crucial insights into market size, trends, competitive landscape, and future outlook. The Asia-Pacific epoxy adhesive market size is projected to reach XX billion USD by 2033, exhibiting a significant CAGR of XX% during the forecast period (2025-2033). This report delves into various epoxy adhesive applications, market segmentation by end-user industry, and technology types, offering a holistic view for stakeholders.

Asia-Pacific Epoxy Adhesive Market Market Structure & Competitive Dynamics

The Asia-Pacific epoxy adhesive market exhibits a moderately concentrated structure, characterized by the presence of a few large multinational corporations and a significant number of regional and local players. Innovation ecosystems are thriving, fueled by constant R&D investments in developing high-performance, eco-friendly, and specialized epoxy adhesive formulations. Regulatory frameworks across different APAC nations, while evolving, are increasingly focusing on environmental compliance and product safety standards, influencing product development and market entry strategies. Product substitutes, such as polyurethane adhesives and cyanoacrylates, present a competitive challenge, yet the superior strength, durability, and chemical resistance of epoxy adhesives maintain their market dominance in critical applications. End-user trends, including the growing demand for lightweight materials in automotive and aerospace, coupled with the booming construction sector, significantly shape market dynamics. Mergers and acquisitions (M&A) activities are also observed as key players seek to expand their geographical reach, product portfolios, and technological capabilities. For instance, strategic partnerships and acquisitions often involve significant deal values, estimated to be in the hundreds of millions of USD, aiming to consolidate market share and enhance competitive advantages.

- Market Concentration: Moderate, with key players holding substantial market share.

- Innovation Ecosystems: Strong focus on R&D for advanced and sustainable solutions.

- Regulatory Frameworks: Increasingly stringent environmental and safety standards.

- Product Substitutes: Competition from alternative adhesive technologies.

- End-User Trends: Driven by automotive lightweighting, construction boom, and electronics manufacturing.

- M&A Activities: Strategic consolidation and expansion through acquisitions and partnerships.

Asia-Pacific Epoxy Adhesive Market Industry Trends & Insights

The Asia-Pacific epoxy adhesive market is poised for substantial growth, driven by a confluence of macroeconomic and industry-specific factors. The accelerating industrialization and urbanization across nations like China, India, and Southeast Asian countries are significant market growth drivers, directly impacting demand from the building and construction, automotive, and packaging sectors. Technological disruptions, such as the development of advanced curing technologies (e.g., UV-cured adhesives) and the formulation of bio-based epoxy adhesives, are reshaping product offerings and market penetration. Consumer preferences are shifting towards more durable, sustainable, and high-performance adhesive solutions, compelling manufacturers to innovate. Competitive dynamics are intensifying, with companies focusing on product differentiation, cost optimization, and strategic market expansion. The automotive industry's increasing adoption of epoxy adhesives for structural bonding and lightweighting initiatives is a key trend, contributing to an estimated market penetration of over XX% in this segment. Similarly, the burgeoning infrastructure projects and residential construction boom in the region are fueling demand for epoxy adhesives in construction. The electronics manufacturing sector's continuous growth also presents significant opportunities, with epoxy adhesives being crucial for component assembly and protection. The CAGR for the Asia-Pacific epoxy adhesive market is projected to be XX% during the forecast period, signifying robust expansion. The market is also witnessing a trend towards specialization, with manufacturers developing tailor-made epoxy solutions for specific end-user needs, such as high-temperature resistance for aerospace applications or rapid curing for packaging.

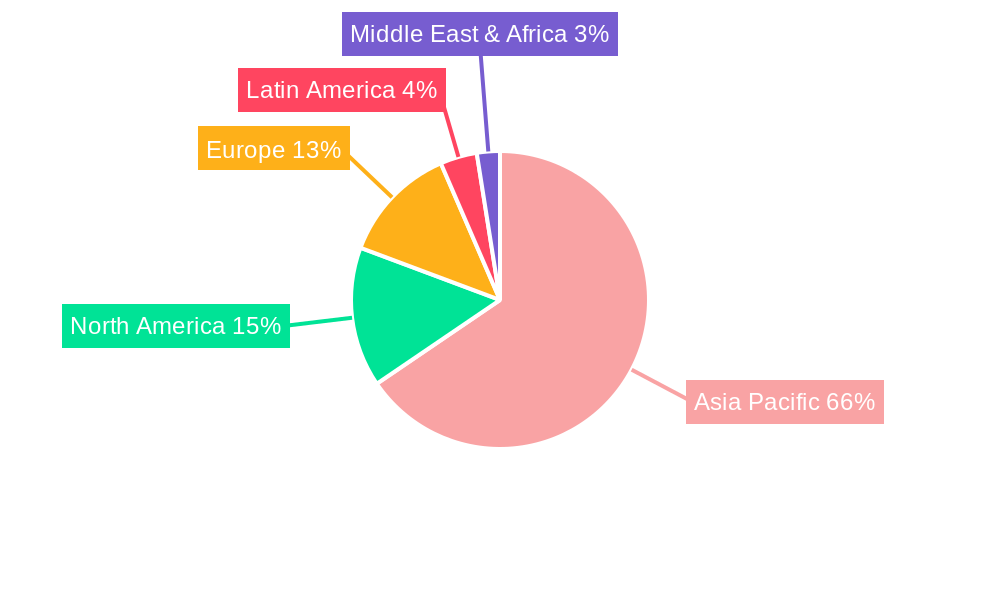

Dominant Markets & Segments in Asia-Pacific Epoxy Adhesive Market

The Asia-Pacific epoxy adhesive market is characterized by the dominance of specific regions and segments, driven by economic policies, infrastructure development, and industrial output.

Leading Region:

- Asia-Pacific itself is the focal point of this market. Within this vast region, China stands out as the most dominant country, accounting for a significant portion of the market share. This dominance is fueled by its colossal manufacturing base across various industries, substantial infrastructure investments, and rapid technological adoption.

Dominant End-User Industries:

- Building and Construction: This sector is a primary driver of the epoxy adhesive market. The rapid urbanization, extensive infrastructure projects (roads, bridges, buildings), and growing real estate development across the APAC region significantly boost demand for epoxy adhesives used in flooring, tiling, structural bonding, and concrete repair. Government initiatives promoting sustainable construction and durable infrastructure further amplify this segment's growth.

- Automotive: The increasing production of vehicles in APAC, coupled with the industry's shift towards lightweighting and structural integrity, makes the automotive sector a major consumer of epoxy adhesives. These adhesives are used for bonding various components, including body panels, chassis, and interior parts, contributing to improved fuel efficiency and safety. Policies supporting electric vehicle manufacturing also indirectly boost demand.

- Packaging: While often considered a lower-value segment, the sheer volume of goods produced and consumed in APAC makes the packaging industry a substantial market. Epoxy adhesives are used in flexible packaging, rigid containers, and specialty packaging applications requiring high bond strength and chemical resistance. The e-commerce boom further accentuates this demand.

- Aerospace: Although a smaller segment by volume, the aerospace industry’s demand for high-performance, lightweight, and durable materials makes it a critical and high-value segment for epoxy adhesives. The growing aerospace manufacturing capabilities in countries like China and India are contributing to increased adoption for aircraft component assembly and repair.

Dominant Technology Types:

- Reactive Adhesives: This category, encompassing two-component epoxy systems, holds a dominant position due to their exceptional mechanical strength, chemical resistance, and versatility in bonding a wide range of substrates. Their ability to cure at room temperature or with mild heat makes them suitable for numerous industrial applications.

- UV Cured Adhesives: With their rapid curing times under UV light, these adhesives are gaining traction in industries requiring high throughput and precision, such as electronics assembly and medical device manufacturing. Their energy efficiency and low VOC emissions also contribute to their growing popularity.

Key drivers for the dominance of these segments include:

- Economic Policies: Government incentives for manufacturing, infrastructure development, and foreign direct investment.

- Infrastructure Development: Massive investments in transportation networks, urban development, and renewable energy projects.

- Industrial Output: High production volumes in key sectors like automotive, electronics, and construction.

- Technological Advancements: Adoption of advanced manufacturing processes and material science innovations.

- Consumer Demand: Growing middle class with increased purchasing power, driving demand for packaged goods and durable products.

Asia-Pacific Epoxy Adhesive Market Product Innovations

The Asia-Pacific epoxy adhesive market is witnessing a surge in product innovations aimed at enhancing performance, sustainability, and application efficiency. Manufacturers are developing advanced formulations with superior thermal resistance, chemical stability, and mechanical strength to meet the evolving demands of high-tech industries like aerospace and automotive. A significant trend is the development of low-VOC and solvent-free epoxy adhesives, aligning with growing environmental regulations and consumer preferences for eco-friendly products. Innovations in UV-cured epoxy adhesives offer faster curing times and improved energy efficiency, crucial for high-volume manufacturing. Furthermore, the development of bio-based epoxy adhesives, derived from renewable resources, is gaining traction, presenting a sustainable alternative to traditional petroleum-based products. These product developments are crucial for maintaining competitive advantages and tapping into new market segments.

Report Segmentation & Scope

This comprehensive report segments the Asia-Pacific epoxy adhesive market based on critical parameters to provide granular insights. The segmentation covers:

End-User Industry:

- Aerospace: High-performance adhesives for aircraft assembly and repair.

- Automotive: Structural bonding and lightweighting solutions.

- Building and Construction: Adhesives for flooring, tiling, concrete repair, and structural applications.

- Footwear and Leather: Adhesives for durable and flexible bonding.

- Healthcare: Medical-grade adhesives for device assembly and wound care.

- Packaging: Adhesives for flexible and rigid packaging solutions.

- Woodworking and Joinery: Adhesives for furniture manufacturing and joinery.

- Other End-user Industries: Including electronics, marine, and general industrial applications.

Technology:

- Reactive: Two-component epoxy systems offering high strength and durability.

- Solvent-borne: Traditional formulations with solvent carriers, though declining due to environmental concerns.

- UV Cured Adhesives: Fast-curing solutions for high-throughput manufacturing.

- Water-borne: Eco-friendly formulations with water as the carrier.

Each segment's market size, growth projections, and competitive dynamics are meticulously analyzed.

Key Drivers of Asia-Pacific Epoxy Adhesive Market Growth

Several key factors are propelling the growth of the Asia-Pacific epoxy adhesive market. The robust expansion of the automotive industry, driven by increasing vehicle production and the adoption of lightweighting strategies, is a major contributor. Similarly, the booming building and construction sector, fueled by urbanization and infrastructure development across the region, creates significant demand for durable and high-performance adhesives. Technological advancements, particularly in formulating eco-friendly and high-strength epoxy adhesive solutions, are opening up new application areas and enhancing market competitiveness. Furthermore, growing investments in the aerospace and electronics manufacturing sectors, demanding specialized and reliable bonding solutions, are also significant growth accelerators.

- Automotive Industry Expansion: Increased vehicle production and lightweighting initiatives.

- Building and Construction Boom: Urbanization and infrastructure development.

- Technological Advancements: Development of eco-friendly and high-performance formulations.

- Aerospace and Electronics Manufacturing Growth: Demand for specialized and reliable bonding.

Challenges in the Asia-Pacific Epoxy Adhesive Market Sector

Despite the strong growth trajectory, the Asia-Pacific epoxy adhesive market faces several challenges that could impede its full potential. Fluctuating raw material prices, particularly for key components like bisphenol A and epichlorohydrin, can impact profit margins and pricing strategies. The increasing stringency of environmental regulations across various APAC countries, while driving innovation in sustainable adhesives, also presents compliance challenges and potential cost increases for manufacturers. Competition from substitute adhesive technologies, such as polyurethanes and silicones, remains a constant pressure, requiring continuous product differentiation and performance improvements. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can also affect production and delivery timelines. Furthermore, the need for specialized application equipment and skilled labor for certain epoxy adhesive applications can act as a barrier to market entry for smaller players.

- Raw Material Price Volatility: Impact on production costs and pricing.

- Stringent Environmental Regulations: Compliance costs and adaptation requirements.

- Competition from Substitutes: Pressure from alternative adhesive technologies.

- Supply Chain Disruptions: Logistical challenges and production delays.

- Technical Expertise Requirements: Need for specialized equipment and skilled labor.

Leading Players in the Asia-Pacific Epoxy Adhesive Market Market

The Asia-Pacific epoxy adhesive market features a mix of global leaders and strong regional players. These companies are at the forefront of innovation, production, and market reach.

- Henkel AG & Co KGaA

- Pidilite Industries Ltd

- 3M

- Kangda New Materials (Group) Co Ltd

- Hubei Huitian New Materials Co Ltd

- NANPAO RESINS CHEMICAL GROUP

- Arkema Group

- Huntsman International LLC

- H B Fuller Company

- Sika AG

Key Developments in Asia-Pacific Epoxy Adhesive Market Sector

The Asia-Pacific epoxy adhesive market has witnessed strategic developments aimed at expanding production capacities, enhancing technological offerings, and strengthening market presence.

- December 2021: Sika planned to establish a new technology center and manufacturing factory for high-quality adhesives and sealants in Pune, India. The company primarily manufactures products for the transportation and construction industries through its three new production lines, signaling a significant investment in the Indian market.

- July 2021: H.B. Fuller announced a strategic agreement with Covestro to offer sustainable adhesives in the market. This collaboration aims to leverage Covestro's expertise in material science to introduce more environmentally friendly adhesive solutions.

- June 2021: H.B. Fuller signed a distribution agreement with Jubilant Agri and Consumer Products to promote its adhesive solutions in the Indian woodworking segment. This partnership is expected to expand H.B. Fuller's reach and product availability within the growing Indian woodworking industry.

Strategic Asia-Pacific Epoxy Adhesive Market Market Outlook

The Asia-Pacific epoxy adhesive market is on a robust growth trajectory, with significant strategic opportunities for stakeholders. The increasing demand for high-performance materials in sectors like automotive, aerospace, and electronics, coupled with the ongoing infrastructure development, will continue to be key growth accelerators. Strategic partnerships, mergers, and acquisitions are expected to shape the market landscape, as companies seek to consolidate their positions and expand their technological capabilities. A strong focus on developing sustainable and eco-friendly epoxy adhesive solutions will be critical for long-term success, aligning with global environmental trends and regulatory pressures. The penetration of advanced technologies like UV-cured and bio-based epoxy adhesives will further drive market expansion and unlock new application frontiers, ensuring a dynamic and promising future for the Asia-Pacific epoxy adhesive industry.

Asia-Pacific Epoxy Adhesive Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Footwear and Leather

- 1.5. Healthcare

- 1.6. Packaging

- 1.7. Woodworking and Joinery

- 1.8. Other End-user Industries

-

2. Technology

- 2.1. Reactive

- 2.2. Solvent-borne

- 2.3. UV Cured Adhesives

- 2.4. Water-borne

Asia-Pacific Epoxy Adhesive Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Epoxy Adhesive Market Regional Market Share

Geographic Coverage of Asia-Pacific Epoxy Adhesive Market

Asia-Pacific Epoxy Adhesive Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from the Packaging Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Pandemic on Global Economy

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Epoxy Adhesive Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Footwear and Leather

- 5.1.5. Healthcare

- 5.1.6. Packaging

- 5.1.7. Woodworking and Joinery

- 5.1.8. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Reactive

- 5.2.2. Solvent-borne

- 5.2.3. UV Cured Adhesives

- 5.2.4. Water-borne

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Henkel AG & Co KGaA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pidilite Industries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3M

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kangda New Materials (Group) Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hubei Huitian New Materials Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NANPAO RESINS CHEMICAL GROUP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Arkema Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Huntsman International LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 H B Fuller Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sika A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Asia-Pacific Epoxy Adhesive Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Epoxy Adhesive Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Epoxy Adhesive Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 2: Asia-Pacific Epoxy Adhesive Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: Asia-Pacific Epoxy Adhesive Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Epoxy Adhesive Market Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 5: Asia-Pacific Epoxy Adhesive Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 6: Asia-Pacific Epoxy Adhesive Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Epoxy Adhesive Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Epoxy Adhesive Market?

The projected CAGR is approximately 13.94%.

2. Which companies are prominent players in the Asia-Pacific Epoxy Adhesive Market?

Key companies in the market include Henkel AG & Co KGaA, Pidilite Industries Ltd, 3M, Kangda New Materials (Group) Co Ltd, Hubei Huitian New Materials Co Ltd, NANPAO RESINS CHEMICAL GROUP, Arkema Group, Huntsman International LLC, H B Fuller Company, Sika A.

3. What are the main segments of the Asia-Pacific Epoxy Adhesive Market?

The market segments include End User Industry, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from the Packaging Industry; Other Drivers.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Pandemic on Global Economy.

8. Can you provide examples of recent developments in the market?

December 2021: Sika planned to establish a new technology center and manufacturing factory for high-quality adhesives and sealants in Pune, India. The company primarily manufactures products for the transportation and construction industries through its three new production lines.July 2021: H.B. Fuller announced a strategic agreement with Covestro to offer sustainable adhesives in the market.June 2021: H.B. Fuller signed a distribution agreement with Jubilant Agri and Consumer Products to promote its adhesive solutions in the Indian woodworking segment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Epoxy Adhesive Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Epoxy Adhesive Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Epoxy Adhesive Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Epoxy Adhesive Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence