Key Insights

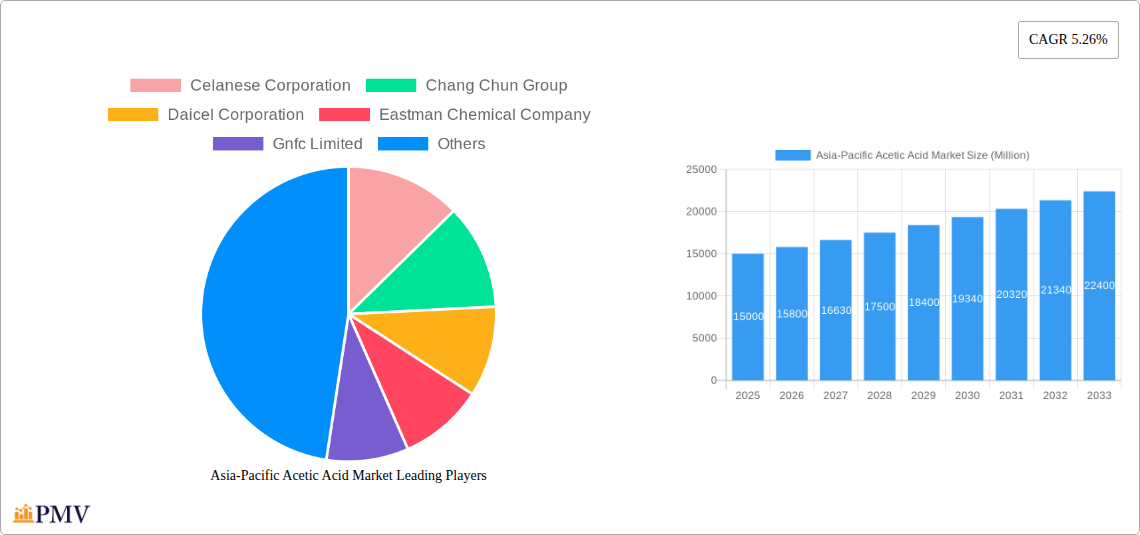

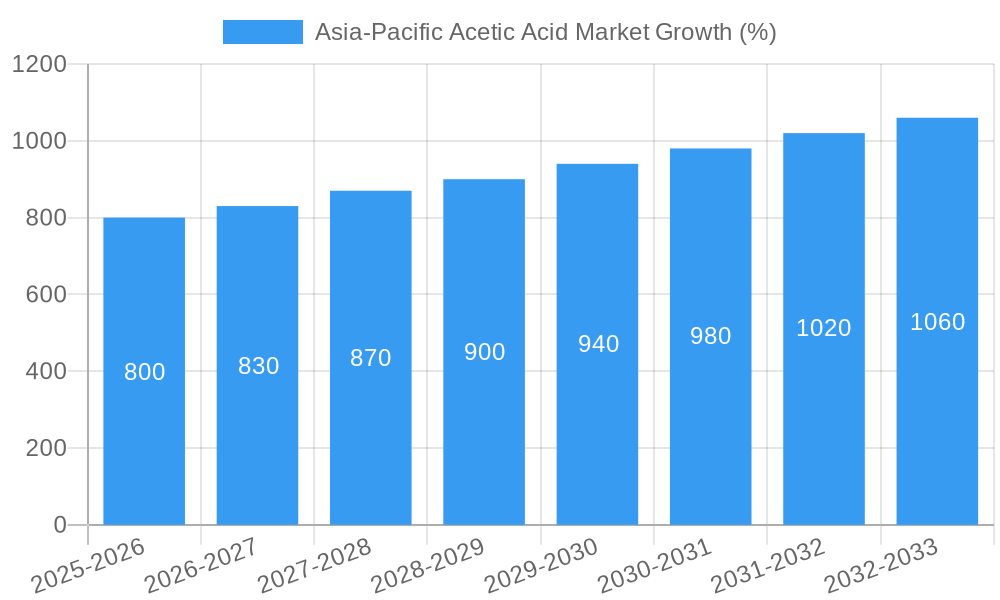

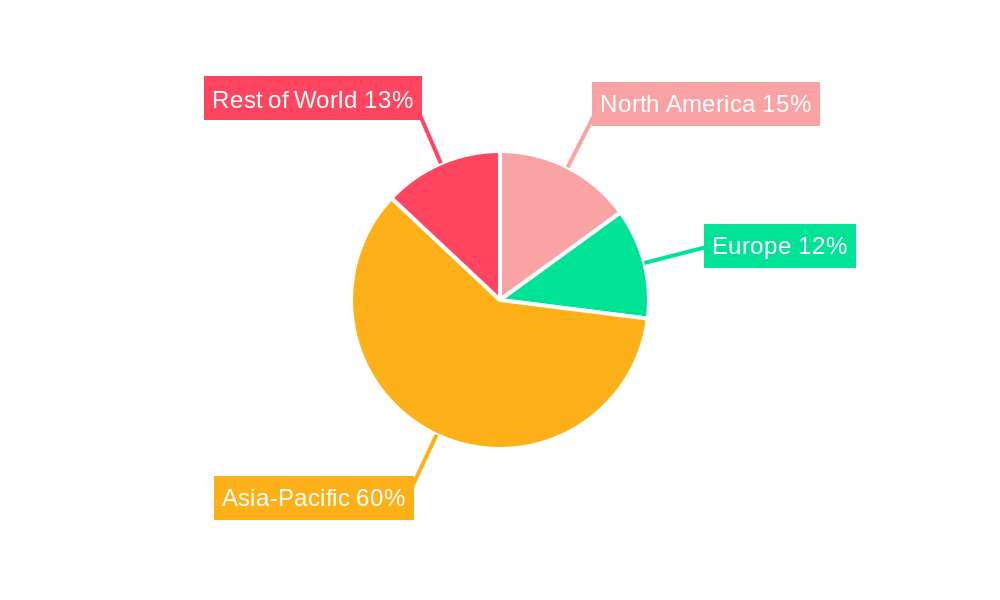

The Asia-Pacific acetic acid market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by the burgeoning demand from key downstream sectors. The region's significant manufacturing base, particularly in China, India, and Southeast Asia, fuels this expansion. The rising consumption of acetic acid in the production of vinyl acetate monomer (VAM), used extensively in adhesives, paints, and coatings, is a primary growth driver. Furthermore, increasing demand from the textile industry for acetic acid as a dyeing and finishing agent, coupled with its use in the food and pharmaceuticals sectors, contributes significantly to market expansion. A CAGR of 5.26% from 2025 to 2033 indicates substantial market potential. However, fluctuating crude oil prices, a key raw material for acetic acid production, present a significant challenge. Stringent environmental regulations and the potential for increased competition from bio-based acetic acid production also pose restraints on market growth. The market is segmented by application (VAM, PTA, solvents, others), and production method (conventional, bio-based). Major players like Celanese Corporation, Eastman Chemical Company, and SABIC are actively shaping market dynamics through capacity expansions, technological advancements, and strategic partnerships.

The competitive landscape is characterized by the presence of both global giants and regional players. The established players are leveraging their extensive production networks and technological capabilities to maintain their market share. The emergence of bio-based acetic acid production methods presents both an opportunity and a challenge. While offering a more sustainable alternative, its higher production cost and limited availability currently constrain its widespread adoption. Nevertheless, the increasing focus on environmental sustainability is likely to drive future investments in bio-based production, potentially reshaping the market dynamics in the coming years. Future market growth will depend on factors like economic growth in the region, government policies supporting chemical manufacturing, and advancements in sustainable acetic acid production.

Asia-Pacific Acetic Acid Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific acetic acid market, offering valuable insights into market dynamics, competitive landscape, and future growth prospects. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes rigorous research methodologies and data analysis to present a clear and actionable understanding of this dynamic market. It's an essential resource for industry stakeholders, investors, and strategic decision-makers seeking to navigate the complexities of the Asia-Pacific acetic acid landscape.

Asia-Pacific Acetic Acid Market Market Structure & Competitive Dynamics

This section analyzes the competitive intensity and market structure of the Asia-Pacific acetic acid market. We delve into the market concentration, examining the market share held by key players like Celanese Corporation, Eastman Chemical Company, and SABIC. The report also explores innovation ecosystems, identifying key R&D activities and technological advancements shaping the market. Regulatory frameworks impacting production, distribution, and sales are assessed, including environmental regulations and trade policies. Furthermore, the analysis covers product substitutes, such as other organic acids, and their impact on market share. The report scrutinizes end-user trends across various sectors including food & beverage, textiles, and pharmaceuticals, analyzing their influence on demand. Finally, Mergers & Acquisitions (M&A) activities within the Asia-Pacific acetic acid market are examined, analyzing deal values and their impact on market consolidation. For instance, the Anupam Rasayan India Ltd acquisition of a significant stake in Tanfac Industries Ltd in March 2022 illustrates the strategic maneuvering in the sector. The report details these and other M&A activities, providing a quantifiable assessment of deal values and their impact on market concentration.

Asia-Pacific Acetic Acid Market Industry Trends & Insights

This section provides a detailed analysis of the Asia-Pacific acetic acid market trends, focusing on market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report projects a Compound Annual Growth Rate (CAGR) of xx% for the forecast period (2025-2033), driven by factors such as increasing demand from various end-use industries, including the expanding food and beverage sector in developing Asian economies. We will explore the impact of technological disruptions, such as the adoption of more efficient production methods and the emergence of green acetic acid production technologies. The report will delve into the changing consumer preferences and their influence on demand for different types of acetic acid, focusing on the growing demand for food-grade acetic acid and the increasing awareness of sustainability concerns influencing consumer choices. The analysis also considers the evolving competitive dynamics, including the entry of new players, strategic partnerships, and the intensifying competition based on pricing, quality, and product differentiation. Market penetration rates in various segments will be analyzed to highlight growth potential and market saturation levels.

Dominant Markets & Segments in Asia-Pacific Acetic Acid Market

This section pinpoints the leading regions, countries, and segments within the Asia-Pacific acetic acid market. A detailed dominance analysis is provided, explaining the factors contributing to the market leadership of specific regions or segments.

- Key Drivers of Dominance:

- Favorable government policies and economic growth.

- Robust infrastructure development.

- Strong presence of major acetic acid producers.

- High demand from various downstream industries.

- Availability of raw materials.

The report provides a thorough analysis of the dominant regions, highlighting the specific factors contributing to their market leadership, such as economic policies promoting industrial growth, robust infrastructure facilitating efficient production and distribution, and the presence of large acetic acid manufacturing facilities. The analysis will delve into the underlying dynamics driving the dominance of specific segments, examining factors such as pricing, technology adoption, and specific application needs.

Asia-Pacific Acetic Acid Market Product Innovations

This section examines recent product developments, applications, and competitive advantages in the Asia-Pacific acetic acid market. The focus will be on technological trends like the increasing adoption of green and sustainable production methods, such as Jubilant Ingrevia's new Green Ethanol based food-grade Acetic Acid plant. The report will assess how these innovations improve product performance, reduce production costs, and enhance environmental sustainability, analyzing their impact on market competitiveness. The analysis will also include an evaluation of the market fit of new products, assessing their ability to meet evolving consumer needs and industry demands.

Report Segmentation & Scope

The report segments the Asia-Pacific acetic acid market based on several key parameters. This detailed segmentation allows for granular market size estimation and growth projection analysis. We will analyze market segments based on factors such as product type (glacial acetic acid, dilute acetic acid, etc.), application (food & beverage, textiles, pharmaceuticals, etc.), and region (China, India, Japan, Southeast Asia, etc.). For each segment, detailed growth projections, market sizes, and competitive dynamics will be presented. The report will discuss the growth potential of each segment, based on factors such as evolving consumer demand, technological advancements, and regulatory changes.

Key Drivers of Asia-Pacific Acetic Acid Market Growth

Several factors propel the growth of the Asia-Pacific acetic acid market. These include the increasing demand from various end-use industries, particularly the food and beverage, and chemical industries. Technological advancements in production processes, leading to enhanced efficiency and reduced costs, are also contributing to market growth. Furthermore, supportive government policies and regulations in several Asian countries promote investments in chemical manufacturing, further bolstering market expansion. Finally, the rising disposable incomes and changing lifestyles in many Asian economies fuel the demand for various products containing acetic acid as a key ingredient.

Challenges in the Asia-Pacific Acetic Acid Market Sector

The Asia-Pacific acetic acid market faces certain challenges. Fluctuations in raw material prices, particularly crude oil, can impact production costs and profitability. Stringent environmental regulations can add to the operational costs and require investments in pollution control technologies. Intense competition among existing players and the potential entry of new entrants may also put pressure on pricing and margins. Supply chain disruptions, caused by geopolitical uncertainties or natural disasters, can affect the availability of acetic acid and disrupt market stability. These challenges will be quantified and analyzed based on market data and industry insights.

Leading Players in the Asia-Pacific Acetic Acid Market Market

- Celanese Corporation

- Chang Chun Group

- Daicel Corporation

- Eastman Chemical Company

- Gnfc Limited

- INEOS

- Jiangsu Sopo (Group) Co Ltd

- Kingboard Holdings Limited

- LyondellBasell Industries Holdings B V

- Mitsubishi Chemical Corporation

- Petrochina Company Limited

- SABIC

- Shandong Hualu Hengsheng Chemical Co Ltd

- Shanghai Huayi Holding Group Co Ltd

- Tanfac Industries Ltd

- Yankuang Group

- *List Not Exhaustive

Key Developments in Asia-Pacific Acetic Acid Market Sector

- April 2022: Jubilant Ingrevia Limited commissioned a new Green Ethanol-based food-grade Acetic Acid plant in Gajraula, Uttar Pradesh, India, with a 25,000-ton annual capacity. This significantly expands the supply of food-grade acetic acid and promotes sustainable production practices.

- March 2022: Anupam Rasayan India Ltd acquired 24.96% of Tanfac Industries Ltd, strengthening its position in the Indian acetic acid market and potentially influencing pricing and market share.

Strategic Asia-Pacific Acetic Acid Market Market Outlook

The Asia-Pacific acetic acid market exhibits significant growth potential driven by several key factors. The rising demand from expanding downstream sectors, coupled with ongoing technological advancements in production and sustainability, will fuel market expansion. Strategic partnerships and M&A activities will continue to shape the competitive landscape. Companies focusing on innovation, efficiency, and sustainability will be well-positioned to capitalize on emerging opportunities. The market's future trajectory will be strongly influenced by economic growth in the region, alongside evolving consumer preferences and regulatory changes. The report provides actionable strategies and insights for companies seeking to thrive in this dynamic market.

Asia-Pacific Acetic Acid Market Segmentation

-

1. Derivative

- 1.1. Vinyl Acetate Monomer (VAM)

- 1.2. Purified Terephthalic Acid (PTA)

- 1.3. Ethyl Acetate

- 1.4. Acetic Anhydride

- 1.5. Other Derivatives

-

2. Application

- 2.1. Plastics and Polymers

- 2.2. Food and Beverage

- 2.3. Adhesives, Paints, and Coatings

- 2.4. Textile

- 2.5. Medical

- 2.6. Other Applications

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. India

- 3.1.3. Japan

- 3.1.4. South Korea

- 3.1.5. Indonesia

- 3.1.6. Thailand

- 3.1.7. Malaysia

- 3.1.8. Philippines

- 3.1.9. Vietnam

- 3.1.10. Australia and New Zealand

- 3.1.11. Rest of Asia-Pacific

-

3.1. Asia-Pacific

Asia-Pacific Acetic Acid Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Indonesia

- 1.6. Thailand

- 1.7. Malaysia

- 1.8. Philippines

- 1.9. Vietnam

- 1.10. Australia and New Zealand

- 1.11. Rest of Asia Pacific

Asia-Pacific Acetic Acid Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Vinyl Acetate Monomer (VAM); Growing Paints and Coatings Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Vinyl Acetate Monomer (VAM); Growing Paints and Coatings Industry; Other Drivers

- 3.4. Market Trends

- 3.4.1 Increasing Applications in the Adhesives

- 3.4.2 Paints

- 3.4.3 and Coatings Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Acetic Acid Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Derivative

- 5.1.1. Vinyl Acetate Monomer (VAM)

- 5.1.2. Purified Terephthalic Acid (PTA)

- 5.1.3. Ethyl Acetate

- 5.1.4. Acetic Anhydride

- 5.1.5. Other Derivatives

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Plastics and Polymers

- 5.2.2. Food and Beverage

- 5.2.3. Adhesives, Paints, and Coatings

- 5.2.4. Textile

- 5.2.5. Medical

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. India

- 5.3.1.3. Japan

- 5.3.1.4. South Korea

- 5.3.1.5. Indonesia

- 5.3.1.6. Thailand

- 5.3.1.7. Malaysia

- 5.3.1.8. Philippines

- 5.3.1.9. Vietnam

- 5.3.1.10. Australia and New Zealand

- 5.3.1.11. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Derivative

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Celanese Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chang Chun Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daicel Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eastman Chemical Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gnfc Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 INEOS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jiangsu Sopo (Group) Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kingboard Holdings Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 LyondellBasell Industries Holdings B V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsubishi Chemical Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Petrochina Company Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SABIC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Shandong Hualu Hengsheng Chemical Co Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Shanghai Huayi Holding Group Co Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Tanfac Industries Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Yankuang Group*List Not Exhaustive

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Celanese Corporation

List of Figures

- Figure 1: Global Asia-Pacific Acetic Acid Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Asia-Pacific Acetic Acid Market Revenue (Million), by Derivative 2024 & 2032

- Figure 3: Asia Pacific Asia-Pacific Acetic Acid Market Revenue Share (%), by Derivative 2024 & 2032

- Figure 4: Asia Pacific Asia-Pacific Acetic Acid Market Revenue (Million), by Application 2024 & 2032

- Figure 5: Asia Pacific Asia-Pacific Acetic Acid Market Revenue Share (%), by Application 2024 & 2032

- Figure 6: Asia Pacific Asia-Pacific Acetic Acid Market Revenue (Million), by Geography 2024 & 2032

- Figure 7: Asia Pacific Asia-Pacific Acetic Acid Market Revenue Share (%), by Geography 2024 & 2032

- Figure 8: Asia Pacific Asia-Pacific Acetic Acid Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific Asia-Pacific Acetic Acid Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Asia-Pacific Acetic Acid Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Asia-Pacific Acetic Acid Market Revenue Million Forecast, by Derivative 2019 & 2032

- Table 3: Global Asia-Pacific Acetic Acid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Asia-Pacific Acetic Acid Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global Asia-Pacific Acetic Acid Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Asia-Pacific Acetic Acid Market Revenue Million Forecast, by Derivative 2019 & 2032

- Table 7: Global Asia-Pacific Acetic Acid Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global Asia-Pacific Acetic Acid Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 9: Global Asia-Pacific Acetic Acid Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Korea Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Indonesia Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Thailand Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Malaysia Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Philippines Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Vietnam Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia and New Zealand Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Asia-Pacific Acetic Acid Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Acetic Acid Market?

The projected CAGR is approximately 5.26%.

2. Which companies are prominent players in the Asia-Pacific Acetic Acid Market?

Key companies in the market include Celanese Corporation, Chang Chun Group, Daicel Corporation, Eastman Chemical Company, Gnfc Limited, INEOS, Jiangsu Sopo (Group) Co Ltd, Kingboard Holdings Limited, LyondellBasell Industries Holdings B V, Mitsubishi Chemical Corporation, Petrochina Company Limited, SABIC, Shandong Hualu Hengsheng Chemical Co Ltd, Shanghai Huayi Holding Group Co Ltd, Tanfac Industries Ltd, Yankuang Group*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Acetic Acid Market?

The market segments include Derivative, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Vinyl Acetate Monomer (VAM); Growing Paints and Coatings Industry; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Applications in the Adhesives. Paints. and Coatings Industry.

7. Are there any restraints impacting market growth?

Increasing Demand for Vinyl Acetate Monomer (VAM); Growing Paints and Coatings Industry; Other Drivers.

8. Can you provide examples of recent developments in the market?

In April 2022, Jubilant Ingrevia Limited announced the commissioning of its new Green Ethanol based food-grade Acetic Acid plant at its manufacturing facility in Gajraula, Uttar Pradesh. The plant has a production capacity of 25,000 tons of food-grade acetic acid per annum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Acetic Acid Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Acetic Acid Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Acetic Acid Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Acetic Acid Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence