Key Insights

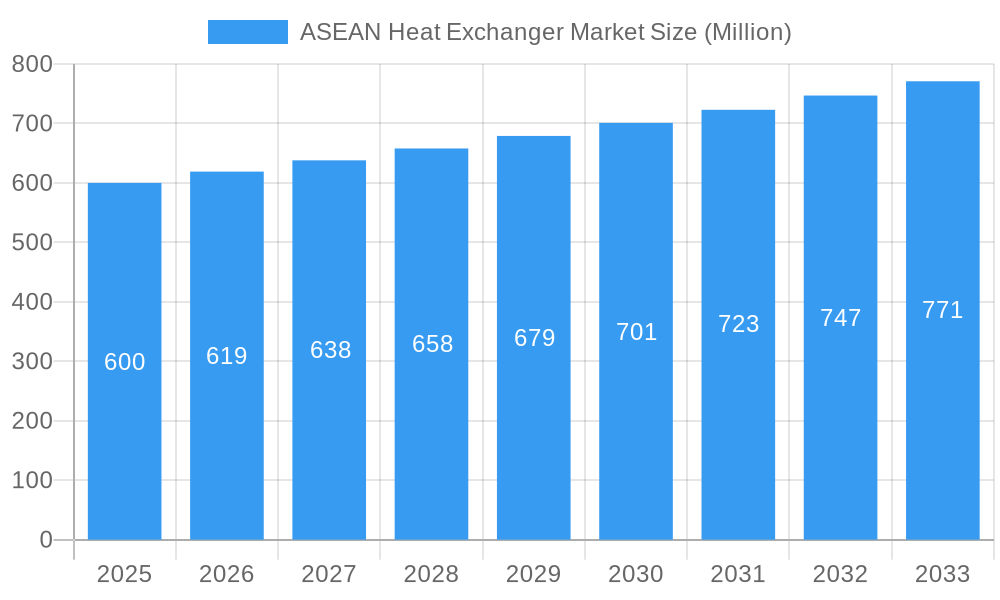

The ASEAN heat exchanger market is poised for significant expansion, propelled by the robust growth of core industrial sectors including oil & gas, power generation, and chemical processing. The market's projected Compound Annual Growth Rate (CAGR) of 8.4% indicates a consistent surge in demand for advanced heat transfer solutions. Key growth drivers encompass escalating energy consumption, stringent environmental mandates promoting energy efficiency, and ongoing infrastructure development across ASEAN nations. The increasing adoption of high-efficiency, compact heat exchanger technologies, such as plate and frame types, further fuels market acceleration. The estimated ASEAN heat exchanger market size for 2025 is projected to reach $18.7 billion.

ASEAN Heat Exchanger Market Market Size (In Billion)

Market growth in ASEAN is anticipated to sustain through the forecast period (2025-2033), driven by amplified investments in renewable energy and the widespread adoption of energy-efficient technologies across industries. However, potential restraints include volatile raw material costs and supply chain vulnerabilities. Segmentation analysis reveals that while Shell and Tube heat exchangers currently lead, the Plate and Frame segment is experiencing rapid growth due to its inherent advantages. The competitive landscape features both global and regional players, vying on price, innovation, and service. This market presents substantial opportunities for suppliers of innovative, sustainable, and cost-effective heat transfer solutions tailored to the evolving needs of ASEAN's industrial base.

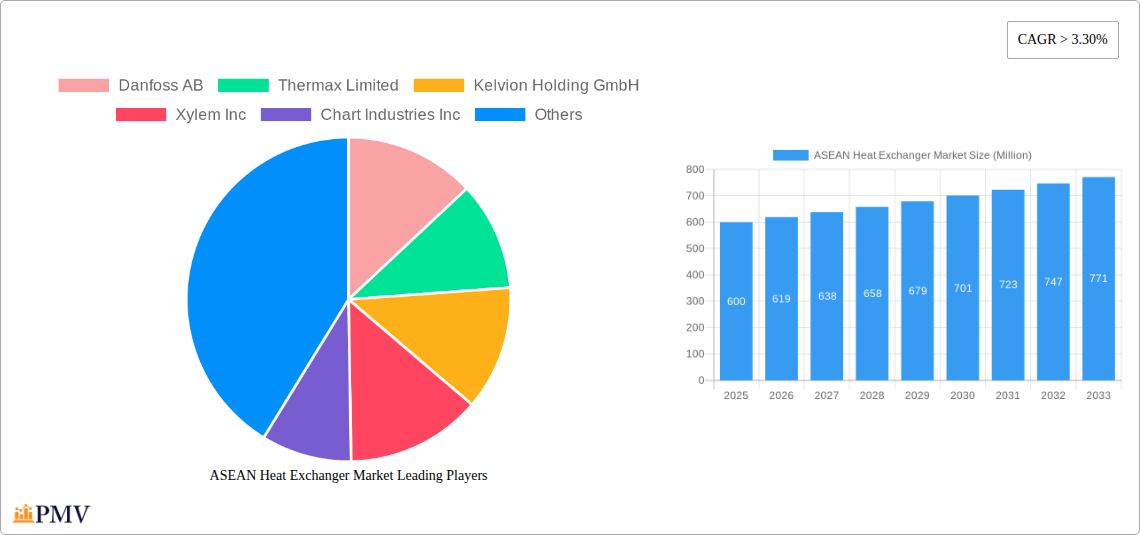

ASEAN Heat Exchanger Market Company Market Share

ASEAN Heat Exchanger Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the ASEAN heat exchanger market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this study dissects market dynamics, competitive landscapes, and future growth potential. The report incorporates detailed segmentation, examining construction types (shell and tube, plate and frame, others) and end-user industries (oil and gas, power generation, chemical, others), offering precise market sizing and growth projections in Millions.

ASEAN Heat Exchanger Market Structure & Competitive Dynamics

The ASEAN heat exchanger market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players, including Danfoss AB, Thermax Limited, Kelvion Holding GmbH, Xylem Inc, Chart Industries Inc, SPX FLOW Inc, Barriquand Technologies Thermiques SAS, General Electric Company, Hisaka Works Ltd, and Alfa Laval AB, compete fiercely through product innovation, technological advancements, and strategic acquisitions. Market share analysis reveals that the top five players collectively control approximately xx% of the market in 2025, indicating a consolidated landscape.

The regulatory environment plays a crucial role, with varying standards and emission regulations across ASEAN nations impacting product design and adoption. The market also witnesses continuous innovation, driven by the need for energy efficiency and environmental sustainability. Furthermore, mergers and acquisitions (M&A) activities are relatively frequent, with deal values exceeding xx Million in the past five years, reflecting the market's consolidation trend and efforts by major players to expand their reach and product portfolios. Substitute products, such as alternative cooling technologies, pose a moderate threat, especially in specific niche applications. Lastly, end-user trends toward automation and digitalization are shaping demand for smart and connected heat exchangers.

ASEAN Heat Exchanger Market Industry Trends & Insights

The ASEAN heat exchanger market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily propelled by burgeoning industrialization across the region, particularly in the oil and gas, power generation, and chemical sectors. Significant investments in infrastructure projects further fuel demand. Technological advancements, such as the adoption of advanced materials and improved designs leading to higher efficiency and reduced maintenance costs, are driving market expansion. Changing consumer preferences towards energy-efficient and environmentally friendly solutions are also shaping the market. Competitive dynamics are characterized by both intense competition and strategic collaborations, with players focusing on innovation, technological differentiation, and cost optimization. Market penetration of advanced heat exchanger technologies, such as plate heat exchangers, is gradually increasing, owing to their superior efficiency and compactness.

Dominant Markets & Segments in ASEAN Heat Exchanger Market

The oil and gas sector emerges as the dominant end-user segment, accounting for xx% of the total market revenue in 2025. This is driven by extensive upstream and downstream operations across several ASEAN nations. The shell and tube construction type holds a significant market share (xx%), owing to its applicability in high-pressure and high-temperature applications. Among nations, Indonesia and Malaysia represent the leading markets, primarily due to substantial investments in their energy and chemical industries and robust economic growth.

- Key Drivers for Oil & Gas Dominance:

- Expansion of refinery capacity.

- Growth in petrochemical production.

- Investments in offshore oil and gas exploration.

- Key Drivers for Shell & Tube Dominance:

- Robust performance in demanding applications.

- Established technology and widespread acceptance.

- Ease of maintenance and repair.

- Key Drivers for Indonesia and Malaysia Dominance:

- Strong economic growth.

- Government initiatives supporting industrial development.

- Large-scale infrastructure projects.

ASEAN Heat Exchanger Market Product Innovations

Recent innovations focus on enhanced heat transfer efficiency, compact designs, and improved corrosion resistance. The market is witnessing the growing adoption of advanced materials like titanium and stainless steel alloys, along with novel designs incorporating features like enhanced turbulence promoters and optimized flow patterns. These innovations cater to the demand for energy efficiency and reduced operational costs, especially in demanding industrial applications. Furthermore, the integration of smart technologies, such as sensors and data analytics, is enabling predictive maintenance and improved operational efficiency. This aligns with the broader industry trend towards Industry 4.0 and digital transformation.

Report Segmentation & Scope

The report provides a detailed segmentation of the ASEAN heat exchanger market based on construction type and end-user industry.

Construction Type: Shell and Tube (market size xx Million in 2025, projected CAGR xx%), Plate and Frame (market size xx Million in 2025, projected CAGR xx%), Other Construction Types (market size xx Million in 2025, projected CAGR xx%). Competitive dynamics vary across segments, with shell and tube dominated by established players and plate and frame showing more diverse competition.

End-User: Oil and Gas (market size xx Million in 2025, projected CAGR xx%), Power Generation (market size xx Million in 2025, projected CAGR xx%), Chemical (market size xx Million in 2025, projected CAGR xx%), Others (market size xx Million in 2025, projected CAGR xx%). The oil and gas sector displays the highest growth, while the chemical sector shows a strong but slightly slower expansion.

Key Drivers of ASEAN Heat Exchanger Market Growth

The market's growth is fueled by several key factors:

- Industrialization: Rapid industrial expansion across ASEAN nations drives demand for heat exchangers in various sectors.

- Infrastructure Development: Significant investments in power generation, oil and gas, and chemical infrastructure projects boost market growth.

- Technological Advancements: Innovations in heat exchanger design and materials improve efficiency and reduce costs.

- Government Policies: Supportive government policies and initiatives promoting industrial development further fuel market expansion.

Challenges in the ASEAN Heat Exchanger Market Sector

Despite the favorable growth outlook, the market faces several challenges:

- Fluctuating Raw Material Prices: Variations in the prices of raw materials, such as metals, impact production costs and profitability.

- Stringent Environmental Regulations: Compliance with increasingly stringent environmental regulations necessitates investments in advanced technologies.

- Intense Competition: Competition from both domestic and international players creates pricing pressures.

Leading Players in the ASEAN Heat Exchanger Market Market

- Danfoss AB

- Thermax Limited

- Kelvion Holding GmbH

- Xylem Inc

- Chart Industries Inc

- SPX FLOW Inc

- Barriquand Technologies Thermiques SAS

- General Electric Company

- Hisaka Works Ltd

- Alfa Laval AB

Key Developments in ASEAN Heat Exchanger Market Sector

June 2021: Leakage issues in Indonesian oil refinery heat exchangers prompted the adoption of Solon Flange Washers and Belleville springs to improve gasket sealing and prevent fugitive emissions. This highlights the ongoing need for robust and reliable heat exchanger solutions in demanding industrial environments.

May 2021: Vitherm secured a replacement order for a steam condenser in a Malaysian oil and gas plant. The use of their welded heat exchanger, with its easy accessibility and 100% cleanability features, underscores the preference for efficient and maintainable technologies in the sector.

Strategic ASEAN Heat Exchanger Market Outlook

The ASEAN heat exchanger market presents significant opportunities for growth, driven by sustained industrial expansion, infrastructure investments, and technological advancements. The focus on energy efficiency and sustainability will further drive demand for advanced heat exchanger technologies. Strategic players can leverage these opportunities by focusing on innovation, cost optimization, and strategic partnerships to consolidate their market positions and capture a larger share of the expanding market. The increasing adoption of digital technologies and smart solutions offers further potential for growth and differentiation.

ASEAN Heat Exchanger Market Segmentation

-

1. Construction Type

- 1.1. Shell and Tube

- 1.2. Plate and Frame

- 1.3. Other Construction Types

-

2. End-User

- 2.1. Oil and Gas

- 2.2. Power Generation

- 2.3. Chemical

- 2.4. Others End-Users

-

3. Geography

- 3.1. Singapore

- 3.2. Malaysia

- 3.3. Thailand

- 3.4. Indonesia

- 3.5. Rest of ASEAN Countries

ASEAN Heat Exchanger Market Segmentation By Geography

- 1. Singapore

- 2. Malaysia

- 3. Thailand

- 4. Indonesia

- 5. Rest of ASEAN Countries

ASEAN Heat Exchanger Market Regional Market Share

Geographic Coverage of ASEAN Heat Exchanger Market

ASEAN Heat Exchanger Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Shell and Tube Heat Exchangers Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 5.1.1. Shell and Tube

- 5.1.2. Plate and Frame

- 5.1.3. Other Construction Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Oil and Gas

- 5.2.2. Power Generation

- 5.2.3. Chemical

- 5.2.4. Others End-Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Singapore

- 5.3.2. Malaysia

- 5.3.3. Thailand

- 5.3.4. Indonesia

- 5.3.5. Rest of ASEAN Countries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Singapore

- 5.4.2. Malaysia

- 5.4.3. Thailand

- 5.4.4. Indonesia

- 5.4.5. Rest of ASEAN Countries

- 5.1. Market Analysis, Insights and Forecast - by Construction Type

- 6. Singapore ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 6.1.1. Shell and Tube

- 6.1.2. Plate and Frame

- 6.1.3. Other Construction Types

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Oil and Gas

- 6.2.2. Power Generation

- 6.2.3. Chemical

- 6.2.4. Others End-Users

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Singapore

- 6.3.2. Malaysia

- 6.3.3. Thailand

- 6.3.4. Indonesia

- 6.3.5. Rest of ASEAN Countries

- 6.1. Market Analysis, Insights and Forecast - by Construction Type

- 7. Malaysia ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 7.1.1. Shell and Tube

- 7.1.2. Plate and Frame

- 7.1.3. Other Construction Types

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Oil and Gas

- 7.2.2. Power Generation

- 7.2.3. Chemical

- 7.2.4. Others End-Users

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Singapore

- 7.3.2. Malaysia

- 7.3.3. Thailand

- 7.3.4. Indonesia

- 7.3.5. Rest of ASEAN Countries

- 7.1. Market Analysis, Insights and Forecast - by Construction Type

- 8. Thailand ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 8.1.1. Shell and Tube

- 8.1.2. Plate and Frame

- 8.1.3. Other Construction Types

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Oil and Gas

- 8.2.2. Power Generation

- 8.2.3. Chemical

- 8.2.4. Others End-Users

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Singapore

- 8.3.2. Malaysia

- 8.3.3. Thailand

- 8.3.4. Indonesia

- 8.3.5. Rest of ASEAN Countries

- 8.1. Market Analysis, Insights and Forecast - by Construction Type

- 9. Indonesia ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 9.1.1. Shell and Tube

- 9.1.2. Plate and Frame

- 9.1.3. Other Construction Types

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Oil and Gas

- 9.2.2. Power Generation

- 9.2.3. Chemical

- 9.2.4. Others End-Users

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Singapore

- 9.3.2. Malaysia

- 9.3.3. Thailand

- 9.3.4. Indonesia

- 9.3.5. Rest of ASEAN Countries

- 9.1. Market Analysis, Insights and Forecast - by Construction Type

- 10. Rest of ASEAN Countries ASEAN Heat Exchanger Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Construction Type

- 10.1.1. Shell and Tube

- 10.1.2. Plate and Frame

- 10.1.3. Other Construction Types

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Oil and Gas

- 10.2.2. Power Generation

- 10.2.3. Chemical

- 10.2.4. Others End-Users

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Singapore

- 10.3.2. Malaysia

- 10.3.3. Thailand

- 10.3.4. Indonesia

- 10.3.5. Rest of ASEAN Countries

- 10.1. Market Analysis, Insights and Forecast - by Construction Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Danfoss AB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thermax Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kelvion Holding GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xylem Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chart Industries Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SPX FLOW Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Barriquand Technologies Thermiques SAS*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Electric Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hisaka Works Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alfa Laval AB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Danfoss AB

List of Figures

- Figure 1: Global ASEAN Heat Exchanger Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Singapore ASEAN Heat Exchanger Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 3: Singapore ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 4: Singapore ASEAN Heat Exchanger Market Revenue (billion), by End-User 2025 & 2033

- Figure 5: Singapore ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: Singapore ASEAN Heat Exchanger Market Revenue (billion), by Geography 2025 & 2033

- Figure 7: Singapore ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Singapore ASEAN Heat Exchanger Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Singapore ASEAN Heat Exchanger Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Malaysia ASEAN Heat Exchanger Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 11: Malaysia ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 12: Malaysia ASEAN Heat Exchanger Market Revenue (billion), by End-User 2025 & 2033

- Figure 13: Malaysia ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2025 & 2033

- Figure 14: Malaysia ASEAN Heat Exchanger Market Revenue (billion), by Geography 2025 & 2033

- Figure 15: Malaysia ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Malaysia ASEAN Heat Exchanger Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Malaysia ASEAN Heat Exchanger Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Thailand ASEAN Heat Exchanger Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 19: Thailand ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 20: Thailand ASEAN Heat Exchanger Market Revenue (billion), by End-User 2025 & 2033

- Figure 21: Thailand ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2025 & 2033

- Figure 22: Thailand ASEAN Heat Exchanger Market Revenue (billion), by Geography 2025 & 2033

- Figure 23: Thailand ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Thailand ASEAN Heat Exchanger Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Thailand ASEAN Heat Exchanger Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Indonesia ASEAN Heat Exchanger Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 27: Indonesia ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 28: Indonesia ASEAN Heat Exchanger Market Revenue (billion), by End-User 2025 & 2033

- Figure 29: Indonesia ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Indonesia ASEAN Heat Exchanger Market Revenue (billion), by Geography 2025 & 2033

- Figure 31: Indonesia ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Indonesia ASEAN Heat Exchanger Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Indonesia ASEAN Heat Exchanger Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue (billion), by Construction Type 2025 & 2033

- Figure 35: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue Share (%), by Construction Type 2025 & 2033

- Figure 36: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue (billion), by End-User 2025 & 2033

- Figure 37: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue Share (%), by End-User 2025 & 2033

- Figure 38: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of ASEAN Countries ASEAN Heat Exchanger Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 2: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 6: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 7: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 10: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 11: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 14: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 18: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 19: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Construction Type 2020 & 2033

- Table 22: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 23: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global ASEAN Heat Exchanger Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Heat Exchanger Market?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the ASEAN Heat Exchanger Market?

Key companies in the market include Danfoss AB, Thermax Limited, Kelvion Holding GmbH, Xylem Inc, Chart Industries Inc, SPX FLOW Inc, Barriquand Technologies Thermiques SAS*List Not Exhaustive, General Electric Company, Hisaka Works Ltd, Alfa Laval AB.

3. What are the main segments of the ASEAN Heat Exchanger Market?

The market segments include Construction Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.7 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrialization across the World4.; Expansion and Development of New Power Plants.

6. What are the notable trends driving market growth?

Shell and Tube Heat Exchangers Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In June 2021, field engineers at an oil refinery in Indonesia were working to resolve issues (certain industries that utilize piping flange joint assemblies, such as petrochemical, dictate a low tolerance for leaks, or fugitive emissions. Areas subject to high temperatures and thermal cycling can cause stress to flange joints, causing the bolted connections to lose tension and leak fugitive emissions) with leaking heat exchangers. Hence, the team approached Solon Manufacturing Co. about live loading Solon Flange Washers or Belleville springs with higher loads designed to be used in flange applications, onto the gasket in order to maintain sufficient bolt tension and resultant gasket stresses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Heat Exchanger Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Heat Exchanger Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Heat Exchanger Market?

To stay informed about further developments, trends, and reports in the ASEAN Heat Exchanger Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence