Key Insights

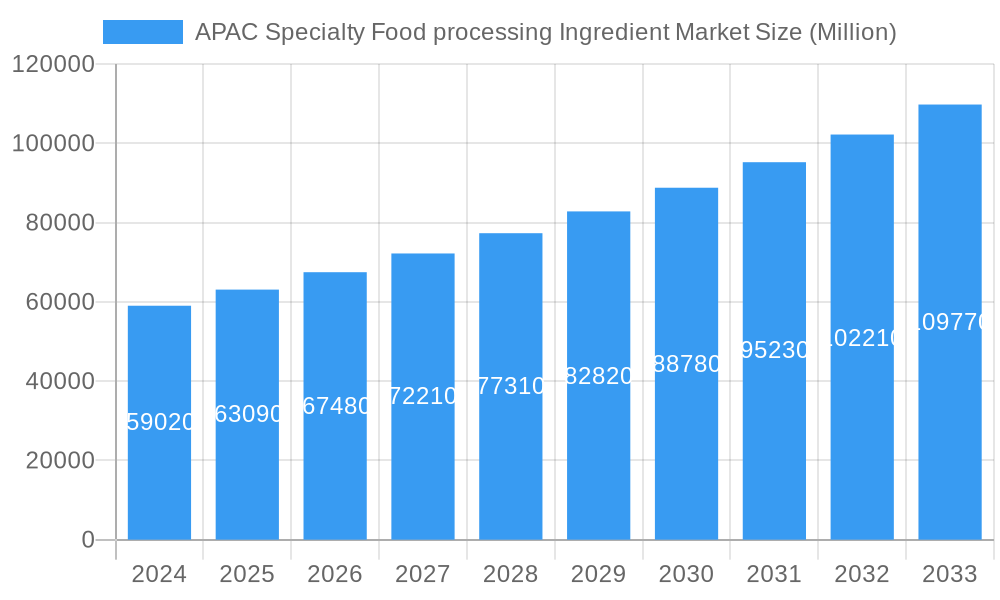

The APAC Specialty Food Processing Ingredient Market is poised for robust growth, demonstrating a significant upward trajectory fueled by evolving consumer preferences and a rising demand for innovative food products across the region. With an estimated market size of $59.02 billion in 2024, this sector is on a strong growth path, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.94% from 2025 to 2033. This expansion is primarily driven by a confluence of factors, including the increasing disposable income and a growing health-conscious consumer base in Asia Pacific, which is actively seeking out functional and premium food options. Furthermore, the burgeoning middle class, coupled with rapid urbanization, is leading to a greater adoption of processed and convenience foods, thereby elevating the demand for specialized ingredients that enhance taste, texture, nutritional value, and shelf-life.

APAC Specialty Food processing Ingredient Market Market Size (In Billion)

Key segments like Sweeteners & Starches, Flavors & Colorants, and Proteins are expected to witness substantial demand, aligning with the need for both indulgence and healthier alternatives in the food industry. The application landscape is equally dynamic, with Bakery & Confectionery and Beverages emerging as major growth areas, reflecting the region's love for sweet treats and a rising preference for a wider variety of beverages. While the market is experiencing strong momentum, potential restraints such as stringent regulatory landscapes in certain countries and supply chain volatilities might present challenges. However, the innovation pipeline of leading companies like Cargill, ADM, Kerry, and Tate & Lyle, coupled with emerging trends in plant-based ingredients and sustainable sourcing, are set to propel the APAC Specialty Food Processing Ingredient Market to new heights, solidifying its position as a critical component of the global food ecosystem.

APAC Specialty Food processing Ingredient Market Company Market Share

Here's an SEO-optimized and detailed report description for the APAC Specialty Food Processing Ingredient Market, designed for immediate use without modification:

APAC Specialty Food Processing Ingredient Market: Growth, Trends, and Opportunities 2019–2033

This comprehensive report offers an in-depth analysis of the APAC Specialty Food Processing Ingredient Market, providing crucial insights into market dynamics, competitive landscape, and future growth trajectories. Covering the historical period from 2019 to 2024, base year 2025, and a forecast period extending to 2033, this study is an indispensable resource for stakeholders seeking to capitalize on the region's burgeoning food processing sector. Discover market size, CAGR, key players, and segment-specific opportunities within this vital market.

APAC Specialty Food Processing Ingredient Market Market Structure & Competitive Dynamics

The APAC Specialty Food Processing Ingredient Market exhibits a moderately concentrated structure, with key players like Cargill Incorporated, The Archer Daniels Midland Company, Kerry Inc, Tate & Lyle PLC, Ingredion Incorporated, Koninklijke DSM N.V., DuPont, and Sensient Technologies Corporation holding significant market share. Innovation ecosystems are vibrant, driven by continuous investment in R&D and strategic partnerships for new product development. Regulatory frameworks vary across the region, influencing market entry and product approvals, but generally support growth. Product substitutes are present across various ingredient categories, necessitating constant innovation to maintain competitive advantage. End-user trends are heavily influenced by rising disposable incomes, increasing demand for healthier and more convenient food options, and a growing interest in plant-based alternatives. Mergers and acquisitions (M&A) activities are a notable trend, with deal values in the billions of USD, aimed at expanding product portfolios, geographical reach, and technological capabilities. For instance, acquisitions focused on expanding production facilities in the APAC region are critical for meeting localized demand. The market share of top players is estimated to be xx% as of the base year 2025, with M&A deal values projected to reach over $5 billion annually by 2028.

APAC Specialty Food Processing Ingredient Market Industry Trends & Insights

The APAC Specialty Food Processing Ingredient Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period 2025–2033. This expansion is propelled by a confluence of factors, including the escalating demand for processed foods, driven by urbanization and busy lifestyles across the Asia-Pacific region. Technological disruptions are at the forefront, with advancements in biotechnology and food science enabling the development of novel ingredients that offer enhanced nutritional profiles, improved functionality, and sustainable sourcing. Consumer preferences are shifting towards healthier options, leading to increased demand for natural sweeteners, low-calorie alternatives, and functional ingredients rich in vitamins, minerals, and probiotics. The "clean label" movement continues to gain traction, pushing manufacturers to utilize ingredients with recognizable and natural origins. Competitive dynamics are intensifying, characterized by aggressive R&D investments and strategic collaborations to gain a competitive edge. Market penetration for specialty ingredients is steadily increasing as food manufacturers increasingly recognize their value in product differentiation and meeting evolving consumer needs. Investments in R&D are a critical growth driver, with companies dedicating significant resources to innovate and develop ingredients that align with emerging dietary trends and regulatory standards. The integration of advanced processing technologies is also crucial, allowing for the efficient and cost-effective production of high-quality ingredients.

Dominant Markets & Segments in APAC Specialty Food Processing Ingredient Market

The APAC Specialty Food Processing Ingredient Market demonstrates distinct dominance across various segments and geographical sub-regions. In terms of Type, the Sweetener & Starch segment is a dominant force, driven by widespread application in staple food products and beverages. The Flavors & Colorants segment also holds significant market share, catering to the demand for aesthetically appealing and palatable food products. Regionally, Southeast Asia and East Asia are emerging as dominant markets, fueled by rapid economic development, a burgeoning middle class, and increasing disposable incomes, leading to higher per capita consumption of processed foods.

Leading Regions:

- East Asia: Countries like China and South Korea are at the forefront, with advanced food processing infrastructure and a strong consumer appetite for innovative food products.

- Southeast Asia: Nations such as Indonesia, Thailand, and Vietnam are experiencing rapid growth due to favorable demographics and increasing urbanization.

Dominant Segments (Type):

- Sweetener & Starch: High demand in bakery, confectionery, and beverage industries. Economic policies supporting food security and agricultural output contribute to its dominance.

- Flavors & Colorants: Driven by the demand for visually appealing and taste-enhanced food products. Growing trend of natural and organic ingredients boosts this segment.

- Proteins: Experiencing substantial growth due to the increasing popularity of plant-based diets and the demand for high-protein food products.

Dominant Segments (Application):

- Bakery & Confectionery: A major application area for a wide range of specialty ingredients, from sweeteners and emulsifiers to flavors and colorants. Infrastructure development in food retail supports its growth.

- Beverages: Continuous innovation in beverages, including functional drinks and plant-based alternatives, fuels demand for specialty ingredients like acidulants, sweeteners, and flavors.

The dominance of these segments is further amplified by strategic partnerships aimed at expanding production facilities in the APAC region and collaborations with local food manufacturers to tailor products to specific regional tastes and preferences.

APAC Specialty Food Processing Ingredient Market Product Innovations

Product innovations in the APAC Specialty Food Processing Ingredient Market are largely driven by the pursuit of healthier, more sustainable, and functional ingredients. Manufacturers are focusing on developing plant-based protein isolates, natural sweeteners with enhanced functionality, and clean-label emulsifiers and stabilizers. Technological advancements are enabling the creation of ingredients that offer improved texture, shelf-life extension, and unique flavor profiles, catering to the evolving demands of health-conscious consumers and the growing trend towards convenient food options. These innovations provide competitive advantages by enabling food manufacturers to differentiate their products and meet specific dietary requirements, such as gluten-free, vegan, and low-sugar formulations, thereby capturing a larger market share in a competitive landscape.

Report Segmentation & Scope

This report segments the APAC Specialty Food Processing Ingredient Market by Type and Application. The segmentation by Type includes: Sweetener & Starch, Flavors & Colorants, Acidulants, Emulsifiers, Enzymes, Proteins, Specialty Oils & Fats, and Others. Growth projections for each type are detailed, with Sweetener & Starch and Flavors & Colorants expected to lead in market size, driven by their widespread use. The Application segment encompasses: Bakery & Confectionery, Beverages, Dairy Products, Meat Products, and Other Applications. Bakery & Confectionery and Beverages are projected to exhibit the highest growth rates due to continuous product innovation and consumer demand for convenience and taste. Competitive dynamics within each segment are analyzed, highlighting key players and their market penetration strategies.

Key Drivers of APAC Specialty Food Processing Ingredient Market Growth

Several key drivers are propelling the APAC Specialty Food Processing Ingredient Market. Technologically, advancements in biotechnology and food science are enabling the development of novel, functional, and sustainable ingredients. Economically, rising disposable incomes and a growing middle class across APAC countries are leading to increased demand for processed and convenient food products, thereby escalating the need for specialty ingredients. Regulatory factors, including a growing emphasis on food safety and nutrition labeling in various APAC nations, are also influencing the market by driving the demand for high-quality and compliant ingredients. For instance, government initiatives promoting healthier food choices indirectly boost the market for ingredients like natural sweeteners and functional proteins.

Challenges in the APAC Specialty Food Processing Ingredient Market Sector

Despite its robust growth, the APAC Specialty Food Processing Ingredient Market faces several challenges. Regulatory hurdles and varying food safety standards across different APAC countries can complicate market entry and product homologation. Supply chain disruptions, particularly those related to raw material availability and logistics, can impact ingredient pricing and availability. Competitive pressures from both global and local players necessitate continuous innovation and cost optimization. Furthermore, the rising cost of research and development for novel ingredients, coupled with the need for extensive testing and validation, presents a significant financial barrier for smaller enterprises. Quantifiable impacts include potential delays in product launches and increased operational costs, estimated to affect profit margins by xx% for less agile companies.

Leading Players in the APAC Specialty Food Processing Ingredient Market Market

- Cargill Incorporated

- The Archer Daniels Midland Company

- Kerry Inc

- Tate & Lyle PLC

- Ingredion Incorporated

- Koninklijke DSM N.V.

- DuPont

- Sensient Technologies Corporation

Key Developments in APAC Specialty Food Processing Ingredient Market Sector

- Mergers and Acquisitions: Cargill Incorporated acquired a significant stake in a leading APAC-based sweetener producer in 2023, expanding its product portfolio and market reach.

- Strategic Partnerships: DuPont formed a strategic partnership with a regional food manufacturer in 2024 to co-develop innovative protein solutions for the Asian market.

- Investments in R&D: Kerry Inc. announced substantial investments in its APAC innovation centers in 2023, focusing on developing next-generation flavors and health ingredients.

- Expansion of Production Facilities: Ingredion Incorporated completed the expansion of its starch processing facility in Southeast Asia in early 2024, boosting its production capacity by xx%.

- Collaboration with Startups: Tate & Lyle PLC collaborated with a food-tech startup in 2023 to explore novel applications for specialty fibers, driving innovation in the healthy snacking segment.

Strategic APAC Specialty Food Processing Ingredient Market Market Outlook

The strategic outlook for the APAC Specialty Food Processing Ingredient Market remains highly optimistic, fueled by sustained economic growth and evolving consumer demands for healthier, more convenient, and sustainably sourced food products. Key growth accelerators include an increasing focus on plant-based ingredients, functional foods, and clean-label solutions. Opportunities abound for companies that can leverage innovation, invest in regional production capabilities, and forge strategic partnerships to navigate the diverse regulatory landscapes. The market is poised for significant expansion, driven by ongoing investments in R&D and the development of cutting-edge technologies, presenting a fertile ground for market players to enhance their product offerings and capture a larger share of this dynamic and growing sector.

APAC Specialty Food processing Ingredient Market Segmentation

-

1. Type

- 1.1. Sweetener & Starch

- 1.2. Flavors & Colorants

- 1.3. Acidulants

- 1.4. Emulsifiers

- 1.5. Enzymes

- 1.6. Proteins

- 1.7. Speciality Oils & Fats

- 1.8. Others

-

2. Application

- 2.1. Bakery & Confectionery

- 2.2. Beverages

- 2.3. Dairy Products

- 2.4. Meat Products

- 2.5. Other Applications

APAC Specialty Food processing Ingredient Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Specialty Food processing Ingredient Market Regional Market Share

Geographic Coverage of APAC Specialty Food processing Ingredient Market

APAC Specialty Food processing Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Acquisitive Demand of Specialty Food Ingredients in Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Specialty Food processing Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sweetener & Starch

- 5.1.2. Flavors & Colorants

- 5.1.3. Acidulants

- 5.1.4. Emulsifiers

- 5.1.5. Enzymes

- 5.1.6. Proteins

- 5.1.7. Speciality Oils & Fats

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery & Confectionery

- 5.2.2. Beverages

- 5.2.3. Dairy Products

- 5.2.4. Meat Products

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Specialty Food processing Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sweetener & Starch

- 6.1.2. Flavors & Colorants

- 6.1.3. Acidulants

- 6.1.4. Emulsifiers

- 6.1.5. Enzymes

- 6.1.6. Proteins

- 6.1.7. Speciality Oils & Fats

- 6.1.8. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery & Confectionery

- 6.2.2. Beverages

- 6.2.3. Dairy Products

- 6.2.4. Meat Products

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Specialty Food processing Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sweetener & Starch

- 7.1.2. Flavors & Colorants

- 7.1.3. Acidulants

- 7.1.4. Emulsifiers

- 7.1.5. Enzymes

- 7.1.6. Proteins

- 7.1.7. Speciality Oils & Fats

- 7.1.8. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery & Confectionery

- 7.2.2. Beverages

- 7.2.3. Dairy Products

- 7.2.4. Meat Products

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Specialty Food processing Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sweetener & Starch

- 8.1.2. Flavors & Colorants

- 8.1.3. Acidulants

- 8.1.4. Emulsifiers

- 8.1.5. Enzymes

- 8.1.6. Proteins

- 8.1.7. Speciality Oils & Fats

- 8.1.8. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery & Confectionery

- 8.2.2. Beverages

- 8.2.3. Dairy Products

- 8.2.4. Meat Products

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Specialty Food processing Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Sweetener & Starch

- 9.1.2. Flavors & Colorants

- 9.1.3. Acidulants

- 9.1.4. Emulsifiers

- 9.1.5. Enzymes

- 9.1.6. Proteins

- 9.1.7. Speciality Oils & Fats

- 9.1.8. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery & Confectionery

- 9.2.2. Beverages

- 9.2.3. Dairy Products

- 9.2.4. Meat Products

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Specialty Food processing Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Sweetener & Starch

- 10.1.2. Flavors & Colorants

- 10.1.3. Acidulants

- 10.1.4. Emulsifiers

- 10.1.5. Enzymes

- 10.1.6. Proteins

- 10.1.7. Speciality Oils & Fats

- 10.1.8. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery & Confectionery

- 10.2.2. Beverages

- 10.2.3. Dairy Products

- 10.2.4. Meat Products

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Archer Daniels Midland Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kerry Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tate & Lyle PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ingredion Incorporated*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koninklijke DSM N V

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DuPont

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sensient Technologies Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global APAC Specialty Food processing Ingredient Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America APAC Specialty Food processing Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America APAC Specialty Food processing Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Specialty Food processing Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: North America APAC Specialty Food processing Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America APAC Specialty Food processing Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America APAC Specialty Food processing Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Specialty Food processing Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: South America APAC Specialty Food processing Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America APAC Specialty Food processing Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: South America APAC Specialty Food processing Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: South America APAC Specialty Food processing Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America APAC Specialty Food processing Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Specialty Food processing Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe APAC Specialty Food processing Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe APAC Specialty Food processing Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe APAC Specialty Food processing Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe APAC Specialty Food processing Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe APAC Specialty Food processing Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Specialty Food processing Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East & Africa APAC Specialty Food processing Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa APAC Specialty Food processing Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Middle East & Africa APAC Specialty Food processing Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East & Africa APAC Specialty Food processing Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Specialty Food processing Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Specialty Food processing Ingredient Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Asia Pacific APAC Specialty Food processing Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific APAC Specialty Food processing Ingredient Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Asia Pacific APAC Specialty Food processing Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific APAC Specialty Food processing Ingredient Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Specialty Food processing Ingredient Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 38: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global APAC Specialty Food processing Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Specialty Food processing Ingredient Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Specialty Food processing Ingredient Market?

The projected CAGR is approximately 6.94%.

2. Which companies are prominent players in the APAC Specialty Food processing Ingredient Market?

Key companies in the market include Cargill Incorporated, The Archer Daniels Midland Company, Kerry Inc, Tate & Lyle PLC, Ingredion Incorporated*List Not Exhaustive, Koninklijke DSM N V, DuPont, Sensient Technologies Corporation.

3. What are the main segments of the APAC Specialty Food processing Ingredient Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Acquisitive Demand of Specialty Food Ingredients in Beverage Industry.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Mergers and acquisitions among major players 2. Strategic partnerships for new product development 3. Investments in R&D and innovation 4. Expansion of production facilities in APAC region 5. Collaboration with startups and academic institutions for cutting-edge technology

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Specialty Food processing Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Specialty Food processing Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Specialty Food processing Ingredient Market?

To stay informed about further developments, trends, and reports in the APAC Specialty Food processing Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence