Key Insights

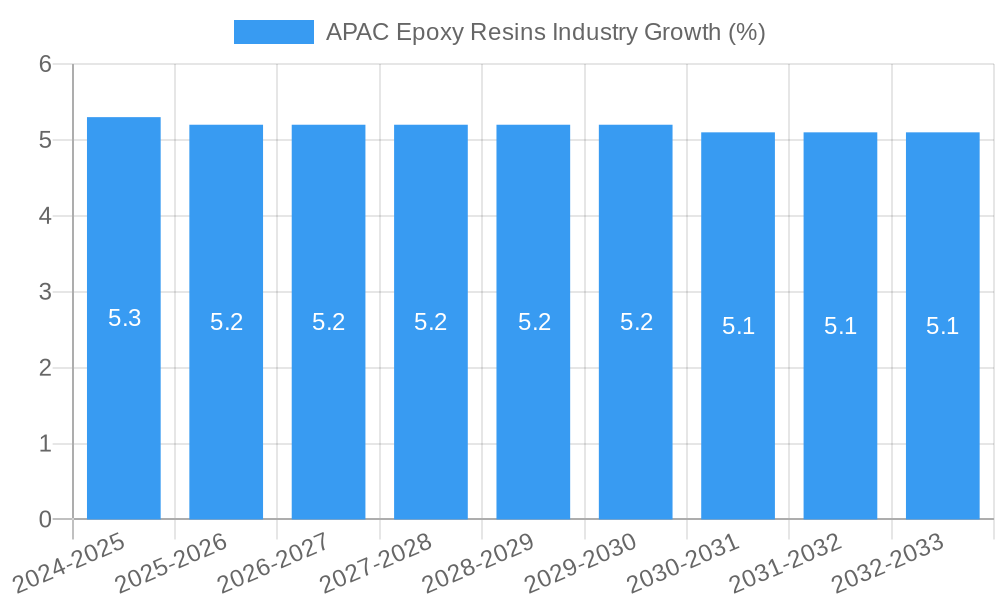

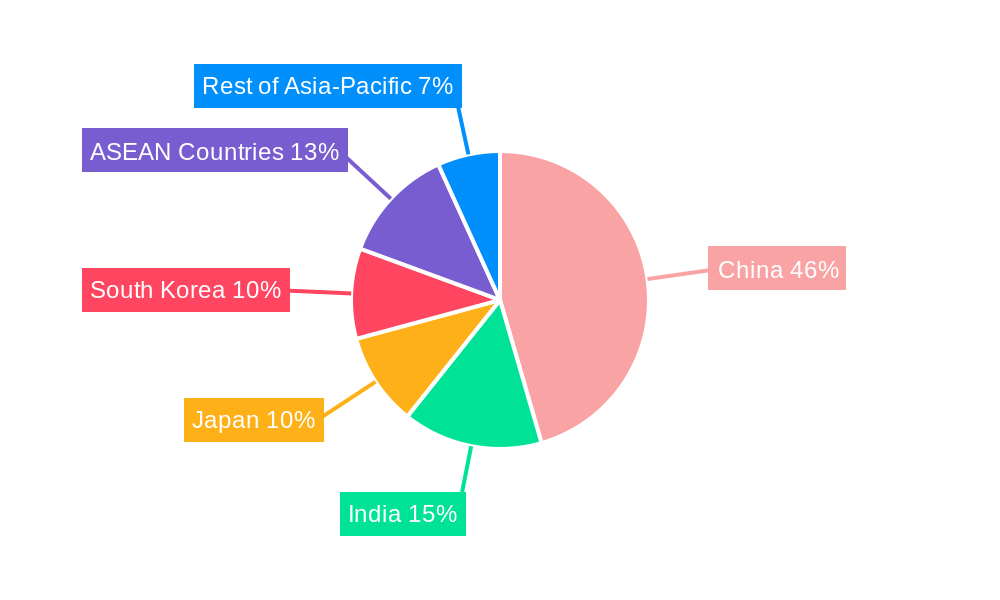

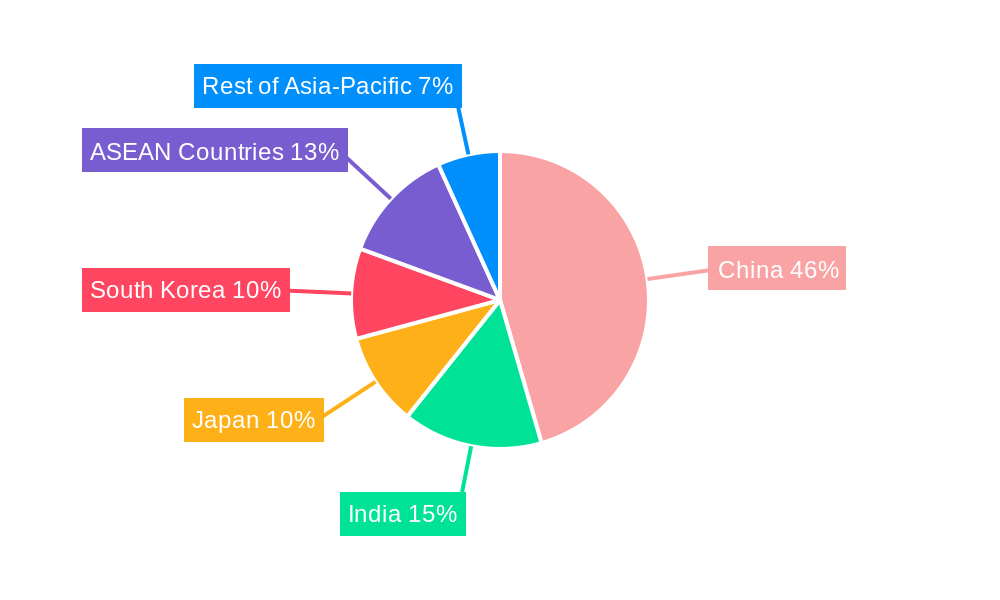

The Asia Pacific (APAC) Epoxy Resins Market is poised for significant expansion, driven by robust industrial growth and increasing demand across diverse applications. The market was valued at an estimated $8.06 billion in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.3% from 2025 to 2033. This steady upward trajectory is fueled by the region's burgeoning manufacturing sector, particularly in China and India, which are major consumers of epoxy resins for paints and coatings, adhesives, composites, and electrical and electronic components. The rising investments in infrastructure development, renewable energy projects (like wind turbines), and the automotive industry further underpin this growth. Innovations in resin formulations offering enhanced performance characteristics, such as improved chemical resistance, thermal stability, and mechanical strength, are also key market drivers, enabling their adoption in more demanding applications.

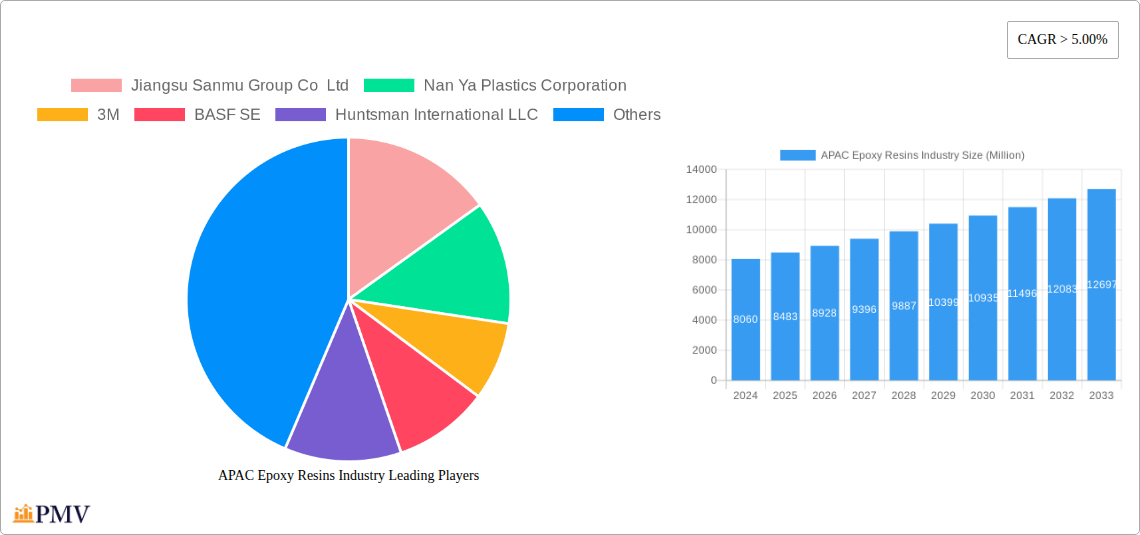

However, the market is not without its challenges. Fluctuations in the prices of key raw materials, such as Bisphenol A (BPA), Epichlorohydrin (ECH), and formaldehyde, can impact profit margins for manufacturers. Stringent environmental regulations concerning the production and use of certain chemicals may also necessitate costly process modifications and the development of eco-friendly alternatives. Geographically, China dominates the APAC epoxy resins market due to its extensive manufacturing base and significant domestic consumption. India is emerging as a strong growth region, supported by government initiatives promoting manufacturing and infrastructure development. The ASEAN countries and other parts of the APAC region are also witnessing increasing adoption of epoxy resins, driven by their expanding industrial landscapes. Key players like Jiangsu Sanmu Group, Nan Ya Plastics, BASF SE, and Huntsman International are actively investing in R&D and capacity expansion to capitalize on these regional opportunities and maintain a competitive edge.

APAC Epoxy Resins Industry Market Report: Comprehensive Analysis and Strategic Outlook 2019–2033

This comprehensive report delves deep into the APAC Epoxy Resins Industry, offering an unparalleled analysis of market dynamics, key trends, and future projections. Covering the historical period of 2019–2024, base year 2025, estimated year 2025, and a robust forecast period from 2025 to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning Asia-Pacific epoxy resins market. We meticulously examine key segments including raw materials like DGBEA (Bisphenol A and ECH), DGBEF (Bisphenol F and ECH), Novolac, Aliphatic, and Glycidylamine, alongside critical applications such as Paints and Coatings, Adhesives and Sealants, Composites, Electrical and Electronics, and Wind Turbines. Our geographical analysis spans China, India, Japan, South Korea, ASEAN Countries, and the Rest of Asia-Pacific, providing granular insights into regional market performance. The report also features a detailed look at prominent companies including Jiangsu Sanmu Group Co Ltd, Nan Ya Plastics Corporation, 3M, BASF SE, Huntsman International LLC, Aditya Birla Chemicals, Daicel Corporation, Hexion, Chang Chun Plastics Co Ltd, Kukdo Chemicals Co Ltd, Olin Corporation, and Covestro AG, among others, illuminating their strategic contributions to the epoxy resin market APAC.

APAC Epoxy Resins Industry Market Structure & Competitive Dynamics

The APAC Epoxy Resins Industry exhibits a moderately concentrated market structure, with key players like Nan Ya Plastics Corporation, Jiangsu Sanmu Group Co Ltd, and BASF SE holding significant market shares. Innovation ecosystems are thriving, particularly in China and South Korea, driven by substantial R&D investments in advanced formulations and sustainable epoxy solutions. Regulatory frameworks, while evolving, generally favor market growth, with a focus on environmental compliance and product safety. Product substitutes, such as polyurethanes and polyesters, exist but often fall short of epoxy resins' superior mechanical strength, chemical resistance, and thermal stability, particularly in demanding applications like composite materials and aerospace adhesives. End-user trends are strongly influenced by the rapid expansion of infrastructure development, the booming automotive sector, and the growing adoption of renewable energy sources, especially wind power. Mergers and acquisitions (M&A) activities are a notable aspect of market dynamics, with deal values often ranging in the hundreds of millions of US dollars as companies seek to consolidate their market position, expand their product portfolios, or gain access to new technologies and geographical markets. For instance, strategic acquisitions aimed at bolstering capacities for epoxy resin manufacturing or acquiring specialized product lines for high-performance coatings are frequent occurrences. This dynamic landscape necessitates continuous adaptation and strategic foresight for sustained competitive advantage within the APAC epoxy resin market.

APAC Epoxy Resins Industry Industry Trends & Insights

The APAC Epoxy Resins Industry is on a robust growth trajectory, propelled by several interlocking trends and insights that are reshaping the market landscape. A primary market growth driver is the escalating demand from the paints and coatings sector, fueled by rapid urbanization and infrastructure development across the region, particularly in emerging economies like India and Vietnam. This sector alone accounts for a substantial portion of the epoxy resin consumption. Technological disruptions are continuously enhancing the performance characteristics of epoxy resins, leading to their wider adoption in niche and high-value applications. Developments in bio-based epoxy resins and waterborne epoxy systems are addressing growing environmental concerns and regulatory pressures, presenting significant opportunities for manufacturers focused on sustainability. The electrical and electronics industry remains a cornerstone of demand, driven by the proliferation of consumer electronics, electric vehicles, and advanced semiconductor manufacturing, all of which rely on epoxy resins for insulation, encapsulation, and structural integrity. Consumer preferences are increasingly leaning towards durable, high-performance, and aesthetically pleasing products, which epoxy resins effectively enable in applications ranging from automotive finishes to protective industrial coatings. Competitive dynamics are intensifying, with both established global players and agile regional manufacturers vying for market share. Strategic partnerships and vertical integration are common strategies employed to secure raw material supply chains and enhance cost competitiveness. The market penetration of specialized epoxy formulations is steadily increasing, indicating a shift towards customized solutions tailored to specific end-user requirements. The Compound Annual Growth Rate (CAGR) for the APAC epoxy resins market is projected to be robust, estimated at approximately 6.5% to 7.5% over the forecast period, a testament to the sustained demand across diverse application segments. The increasing investment in renewable energy, especially wind turbine manufacturing in countries like China and India, is a significant catalyst, creating substantial demand for high-strength epoxy composites used in rotor blades. Furthermore, the growing sophistication of manufacturing processes in the automotive sector, with an emphasis on lightweighting and enhanced durability, further bolsters the demand for epoxy-based adhesives and coatings. The epoxy resin market size in APAC is expected to surpass several hundred billion US dollars by the end of the forecast period, underscoring its immense economic significance.

Dominant Markets & Segments in APAC Epoxy Resins Industry

The APAC Epoxy Resins Industry is characterized by distinct dominant markets and segments, each contributing significantly to the overall growth and dynamics of the region.

Dominant Geography: China

- Economic Policies and Infrastructure Development: China's strong government support for manufacturing, coupled with massive infrastructure projects (high-speed rail, airports, urban development), drives substantial demand for epoxy resins in construction coatings, adhesives, and composite materials. China is the largest market for epoxy resin applications.

- Manufacturing Hub: As the world's manufacturing powerhouse, China consumes vast quantities of epoxy resins for its booming electronics, automotive, and consumer goods industries. The sheer scale of production in these sectors directly translates to high epoxy resin demand.

- Investment in R&D and Capacity Expansion: Chinese manufacturers are increasingly investing in research and development for advanced epoxy formulations and are significantly expanding production capacities, solidifying China's dominance.

Dominant Raw Material: DGBEA (Bisphenol A and ECH)

- Versatility and Cost-Effectiveness: DGBEA-based epoxy resins are the most widely used due to their excellent balance of properties, including good mechanical strength, chemical resistance, and electrical insulation, coupled with relative cost-effectiveness. This makes them the workhorse for a majority of epoxy resin applications.

- Extensive Application in Coatings and Adhesives: The inherent properties of DGBEA resins make them ideal for formulating high-performance paints and coatings for industrial, marine, and architectural purposes, as well as for a broad spectrum of adhesives and sealants used in construction and manufacturing.

- Supply Chain Robustness: The availability and established production infrastructure for Bisphenol A (BPA) and Epichlorohydrin (ECH) contribute to the consistent supply and competitive pricing of DGBEA-based resins, ensuring sustained demand.

Dominant Application: Paints and Coatings

- Protective and Decorative Demand: The insatiable demand for protective and decorative coatings across diverse sectors – from industrial equipment and marine structures to automotive finishes and architectural surfaces – positions paints and coatings as the leading application segment. Epoxy coatings offer superior durability, corrosion resistance, and chemical inertness.

- Infrastructure and Construction Boom: The ongoing construction and infrastructure development in countries like China and India directly fuels the demand for high-performance epoxy coatings for floors, walls, and protective barriers, ensuring sustained growth.

- Growth in Automotive and Industrial Sectors: The automotive industry's focus on enhanced aesthetics and durability, along with the industrial sector's need for robust protective finishes, continuously drives the consumption of epoxy-based paints and coatings.

Emerging Growth Markets: India and ASEAN Countries

- Rapid Industrialization and Urbanization: India and the ASEAN nations are experiencing rapid industrialization and urbanization, leading to increased demand for construction materials, automotive components, and consumer goods, all of which utilize epoxy resins.

- Government Initiatives: Favorable government policies promoting manufacturing (e.g., "Make in India") and infrastructure development in these regions are creating significant growth opportunities for the APAC epoxy resins industry.

- Growing Wind Energy Sector: The expansion of the renewable energy sector, particularly wind power, in India and Southeast Asia, is a key driver for composite applications of epoxy resins.

- Versatility and Cost-Effectiveness: DGBEA-based epoxy resins are the most widely used due to their excellent balance of properties, including good mechanical strength, chemical resistance, and electrical insulation, coupled with relative cost-effectiveness. This makes them the workhorse for a majority of epoxy resin applications.

- Extensive Application in Coatings and Adhesives: The inherent properties of DGBEA resins make them ideal for formulating high-performance paints and coatings for industrial, marine, and architectural purposes, as well as for a broad spectrum of adhesives and sealants used in construction and manufacturing.

- Supply Chain Robustness: The availability and established production infrastructure for Bisphenol A (BPA) and Epichlorohydrin (ECH) contribute to the consistent supply and competitive pricing of DGBEA-based resins, ensuring sustained demand.

Dominant Application: Paints and Coatings

- Protective and Decorative Demand: The insatiable demand for protective and decorative coatings across diverse sectors – from industrial equipment and marine structures to automotive finishes and architectural surfaces – positions paints and coatings as the leading application segment. Epoxy coatings offer superior durability, corrosion resistance, and chemical inertness.

- Infrastructure and Construction Boom: The ongoing construction and infrastructure development in countries like China and India directly fuels the demand for high-performance epoxy coatings for floors, walls, and protective barriers, ensuring sustained growth.

- Growth in Automotive and Industrial Sectors: The automotive industry's focus on enhanced aesthetics and durability, along with the industrial sector's need for robust protective finishes, continuously drives the consumption of epoxy-based paints and coatings.

Emerging Growth Markets: India and ASEAN Countries

- Rapid Industrialization and Urbanization: India and the ASEAN nations are experiencing rapid industrialization and urbanization, leading to increased demand for construction materials, automotive components, and consumer goods, all of which utilize epoxy resins.

- Government Initiatives: Favorable government policies promoting manufacturing (e.g., "Make in India") and infrastructure development in these regions are creating significant growth opportunities for the APAC epoxy resins industry.

- Growing Wind Energy Sector: The expansion of the renewable energy sector, particularly wind power, in India and Southeast Asia, is a key driver for composite applications of epoxy resins.

- Rapid Industrialization and Urbanization: India and the ASEAN nations are experiencing rapid industrialization and urbanization, leading to increased demand for construction materials, automotive components, and consumer goods, all of which utilize epoxy resins.

- Government Initiatives: Favorable government policies promoting manufacturing (e.g., "Make in India") and infrastructure development in these regions are creating significant growth opportunities for the APAC epoxy resins industry.

- Growing Wind Energy Sector: The expansion of the renewable energy sector, particularly wind power, in India and Southeast Asia, is a key driver for composite applications of epoxy resins.

The interplay of these dominant geographical, raw material, and application segments, alongside emerging growth pockets, dictates the strategic focus and investment opportunities within the APAC epoxy resins market.

APAC Epoxy Resins Industry Product Innovations

Product innovations in the APAC Epoxy Resins Industry are increasingly focused on sustainability, enhanced performance, and specialized functionalities. Developments in bio-based epoxy resins, derived from renewable resources, are gaining traction, offering eco-friendly alternatives with comparable performance to traditional counterparts. Advancements in waterborne epoxy systems are addressing environmental regulations by reducing volatile organic compound (VOC) emissions, making them ideal for coatings and adhesives in sensitive applications. Furthermore, innovations in curing agents and modifiers are enabling the development of epoxy systems with superior thermal stability, improved flexibility, and enhanced adhesion to challenging substrates. These technological advancements are crucial for meeting the evolving demands of industries like aerospace, automotive, and electronics, where lightweighting, durability, and specific performance characteristics are paramount. The competitive advantage lies in companies that can effectively translate these innovations into commercially viable solutions, catering to niche markets and offering tailor-made products with a strong market fit.

Report Segmentation & Scope

This report meticulously segments the APAC Epoxy Resins Industry by key parameters to provide a comprehensive market view.

- Raw Materials: The analysis covers the market dynamics for DGBEA (Bisphenol A and ECH), DGBEF (Bisphenol F and ECH), Novolac (Formaldehyde and Phenols), Aliphatic (Aliphatic Alcohols), and Glycidylamine (Aromatic Amines and ECH), alongside a category for "Other Raw Materials." Each segment's growth projections and market sizes are detailed, reflecting the competitive landscape of precursor supply.

- Applications: The report delves into the market for Paints and Coatings, Adhesives and Sealants, Composites, Electrical and Electronics, and Wind Turbines, alongside "Other Applications." Detailed analysis includes market share, growth rates, and the competitive dynamics within each end-use sector.

- Geography: The geographical scope encompasses China, India, Japan, South Korea, ASEAN Countries, and the Rest of Asia-Pacific. Each region's market size, growth potential, and specific drivers for epoxy resin consumption are thoroughly examined, providing regional insights and competitive landscapes.

Key Drivers of APAC Epoxy Resins Industry Growth

The APAC Epoxy Resins Industry is propelled by a confluence of powerful drivers. Technologically, advancements in formulation science are yielding resins with enhanced mechanical strength, superior chemical resistance, and improved thermal stability, enabling their use in more demanding applications. Economically, the rapid industrialization and urbanization across countries like China, India, and the ASEAN nations are fueling significant growth in construction, automotive manufacturing, and infrastructure development, all key end-users of epoxy resins. Government initiatives promoting manufacturing, renewable energy adoption (especially wind power), and infrastructure upgrades further accelerate demand. For example, China's "Belt and Road Initiative" and India's "Smart Cities Mission" are creating substantial opportunities for epoxy-based construction materials and protective coatings.

Challenges in the APAC Epoxy Resins Industry Sector

Despite its robust growth, the APAC Epoxy Resins Industry Sector faces several challenges. Regulatory hurdles concerning the environmental impact of certain raw materials, particularly Bisphenol A (BPA), and emissions from curing processes are increasing, necessitating the development of greener alternatives. Supply chain disruptions, exacerbated by geopolitical factors and fluctuating raw material prices, can impact manufacturing costs and availability. Competitive pressures from alternative materials like polyurethanes and advanced composites, while often less versatile, pose a constant threat in specific applications. Furthermore, the capital-intensive nature of epoxy resin manufacturing and the need for specialized technical expertise can be barriers to entry for new players, particularly in the high-performance segments.

Leading Players in the APAC Epoxy Resins Industry Market

- Jiangsu Sanmu Group Co Ltd

- Nan Ya Plastics Corporation

- 3M

- BASF SE

- Huntsman International LLC

- Aditya Birla Chemicals

- Daicel Corporation

- Hexion

- Chang Chun Plastics Co Ltd

- Kukdo Chemicals Co Ltd

- Olin Corporation

- Covestro AG

- Atul Ltd

Key Developments in APAC Epoxy Resins Industry Sector

- 2024 (Q1): BASF SE announces expansion of its epoxy resin production capacity in South Korea to meet growing demand in the automotive and electronics sectors.

- 2023 (Q4): Nan Ya Plastics Corporation launches a new series of high-performance epoxy resins for wind turbine blade manufacturing, boasting enhanced strength and durability.

- 2023 (Q2): Huntsman International LLC acquires a specialty adhesives company in India to strengthen its footprint in the rapidly growing Indian market for construction and industrial adhesives.

- 2023 (Q1): Jiangsu Sanmu Group Co Ltd invests heavily in R&D for bio-based epoxy resin development, aiming to offer sustainable solutions to the coatings industry.

- 2022 (Q4): The Indian government's incentives for domestic manufacturing boost local production of epoxy resin precursors, benefiting players like Aditya Birla Chemicals.

- 2022 (Q3): Kukdo Chemicals Co Ltd develops advanced epoxy formulations for electric vehicle battery encapsulation, addressing the critical need for thermal management and protection.

- 2022 (Q1): Olin Corporation announces strategic partnerships in Southeast Asia to enhance its distribution network for epoxy resins and related chemicals.

Strategic APAC Epoxy Resins Industry Market Outlook

The strategic APAC Epoxy Resins Industry Market Outlook points towards sustained high growth, driven by ongoing technological advancements and evolving end-user demands. The increasing emphasis on sustainability will accelerate the adoption of bio-based and low-VOC epoxy systems, presenting significant opportunities for innovative manufacturers. The booming renewable energy sector, particularly wind power, and the expanding electric vehicle market will continue to be major demand accelerators for high-performance epoxy composites and adhesives. Strategic opportunities lie in vertical integration to secure raw material supply, expansion into high-growth emerging markets within ASEAN and India, and the development of niche, high-value epoxy formulations for specialized applications in electronics and aerospace. Companies that can effectively navigate regulatory landscapes and invest in eco-friendly solutions will be best positioned for long-term success and market leadership in this dynamic and expanding industry. The market's trajectory indicates continued expansion, with an increasing focus on value-added products and sustainable practices.

APAC Epoxy Resins Industry Segmentation

-

1. Raw Material

- 1.1. DGBEA (Bisphenol A and ECH)

- 1.2. DGBEF (Bisphenol F and ECH)

- 1.3. Novolac (Formaldehyde and Phenols)

- 1.4. Aliphatic (Aliphatic Alcohols)

- 1.5. Glycidylamine (Aromatic Amines and ECH)

- 1.6. Other Raw Materials

-

2. Application

- 2.1. Paints and Coatings

- 2.2. Adhesives and Sealants

- 2.3. Composites

- 2.4. Electrical and Electronics

- 2.5. Wind Turbines

- 2.6. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

APAC Epoxy Resins Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

APAC Epoxy Resins Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Strong Growth of the Construction Industry; Rising Demand for Electrical and Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; Hazardous Impact of Epoxy on Health; Impact of COVID-19 Pandemic; Other Restraints

- 3.4. Market Trends

- 3.4.1. Paints and Coatings Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. DGBEA (Bisphenol A and ECH)

- 5.1.2. DGBEF (Bisphenol F and ECH)

- 5.1.3. Novolac (Formaldehyde and Phenols)

- 5.1.4. Aliphatic (Aliphatic Alcohols)

- 5.1.5. Glycidylamine (Aromatic Amines and ECH)

- 5.1.6. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Paints and Coatings

- 5.2.2. Adhesives and Sealants

- 5.2.3. Composites

- 5.2.4. Electrical and Electronics

- 5.2.5. Wind Turbines

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. China APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. DGBEA (Bisphenol A and ECH)

- 6.1.2. DGBEF (Bisphenol F and ECH)

- 6.1.3. Novolac (Formaldehyde and Phenols)

- 6.1.4. Aliphatic (Aliphatic Alcohols)

- 6.1.5. Glycidylamine (Aromatic Amines and ECH)

- 6.1.6. Other Raw Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Paints and Coatings

- 6.2.2. Adhesives and Sealants

- 6.2.3. Composites

- 6.2.4. Electrical and Electronics

- 6.2.5. Wind Turbines

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. India APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. DGBEA (Bisphenol A and ECH)

- 7.1.2. DGBEF (Bisphenol F and ECH)

- 7.1.3. Novolac (Formaldehyde and Phenols)

- 7.1.4. Aliphatic (Aliphatic Alcohols)

- 7.1.5. Glycidylamine (Aromatic Amines and ECH)

- 7.1.6. Other Raw Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Paints and Coatings

- 7.2.2. Adhesives and Sealants

- 7.2.3. Composites

- 7.2.4. Electrical and Electronics

- 7.2.5. Wind Turbines

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Japan APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. DGBEA (Bisphenol A and ECH)

- 8.1.2. DGBEF (Bisphenol F and ECH)

- 8.1.3. Novolac (Formaldehyde and Phenols)

- 8.1.4. Aliphatic (Aliphatic Alcohols)

- 8.1.5. Glycidylamine (Aromatic Amines and ECH)

- 8.1.6. Other Raw Materials

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Paints and Coatings

- 8.2.2. Adhesives and Sealants

- 8.2.3. Composites

- 8.2.4. Electrical and Electronics

- 8.2.5. Wind Turbines

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. South Korea APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. DGBEA (Bisphenol A and ECH)

- 9.1.2. DGBEF (Bisphenol F and ECH)

- 9.1.3. Novolac (Formaldehyde and Phenols)

- 9.1.4. Aliphatic (Aliphatic Alcohols)

- 9.1.5. Glycidylamine (Aromatic Amines and ECH)

- 9.1.6. Other Raw Materials

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Paints and Coatings

- 9.2.2. Adhesives and Sealants

- 9.2.3. Composites

- 9.2.4. Electrical and Electronics

- 9.2.5. Wind Turbines

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. ASEAN Countries APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. DGBEA (Bisphenol A and ECH)

- 10.1.2. DGBEF (Bisphenol F and ECH)

- 10.1.3. Novolac (Formaldehyde and Phenols)

- 10.1.4. Aliphatic (Aliphatic Alcohols)

- 10.1.5. Glycidylamine (Aromatic Amines and ECH)

- 10.1.6. Other Raw Materials

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Paints and Coatings

- 10.2.2. Adhesives and Sealants

- 10.2.3. Composites

- 10.2.4. Electrical and Electronics

- 10.2.5. Wind Turbines

- 10.2.6. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Rest of Asia Pacific APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 11.1.1. DGBEA (Bisphenol A and ECH)

- 11.1.2. DGBEF (Bisphenol F and ECH)

- 11.1.3. Novolac (Formaldehyde and Phenols)

- 11.1.4. Aliphatic (Aliphatic Alcohols)

- 11.1.5. Glycidylamine (Aromatic Amines and ECH)

- 11.1.6. Other Raw Materials

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Paints and Coatings

- 11.2.2. Adhesives and Sealants

- 11.2.3. Composites

- 11.2.4. Electrical and Electronics

- 11.2.5. Wind Turbines

- 11.2.6. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 12. North America APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Spain

- 13.1.5 Italy

- 13.1.6 Spain

- 13.1.7 Belgium

- 13.1.8 Netherland

- 13.1.9 Nordics

- 13.1.10 Rest of Europe

- 14. Asia Pacific APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Southeast Asia

- 14.1.6 Australia

- 14.1.7 Indonesia

- 14.1.8 Phillipes

- 14.1.9 Singapore

- 14.1.10 Thailandc

- 14.1.11 Rest of Asia Pacific

- 15. South America APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Peru

- 15.1.4 Chile

- 15.1.5 Colombia

- 15.1.6 Ecuador

- 15.1.7 Venezuela

- 15.1.8 Rest of South America

- 16. MEA APAC Epoxy Resins Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Jiangsu Sanmu Group Co Ltd

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Nan Ya Plastics Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 3M

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 BASF SE

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Huntsman International LLC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Aditya Birla Chemicals

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Daicel Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Hexion

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Chang Chun Plastics Co Ltd

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Kukdo Chemicals Co Ltd

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Olin Corporation*List Not Exhaustive

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Covestro AG

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Atul Ltd

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.1 Jiangsu Sanmu Group Co Ltd

List of Figures

- Figure 1: Global APAC Epoxy Resins Industry Revenue Breakdown (undefined, %) by Region 2024 & 2032

- Figure 2: North America APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 3: North America APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 5: Europe APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 7: Asia Pacific APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 9: South America APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 11: MEA APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: China APAC Epoxy Resins Industry Revenue (undefined), by Raw Material 2024 & 2032

- Figure 13: China APAC Epoxy Resins Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 14: China APAC Epoxy Resins Industry Revenue (undefined), by Application 2024 & 2032

- Figure 15: China APAC Epoxy Resins Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: China APAC Epoxy Resins Industry Revenue (undefined), by Geography 2024 & 2032

- Figure 17: China APAC Epoxy Resins Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 18: China APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 19: China APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: India APAC Epoxy Resins Industry Revenue (undefined), by Raw Material 2024 & 2032

- Figure 21: India APAC Epoxy Resins Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 22: India APAC Epoxy Resins Industry Revenue (undefined), by Application 2024 & 2032

- Figure 23: India APAC Epoxy Resins Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: India APAC Epoxy Resins Industry Revenue (undefined), by Geography 2024 & 2032

- Figure 25: India APAC Epoxy Resins Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 26: India APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 27: India APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Japan APAC Epoxy Resins Industry Revenue (undefined), by Raw Material 2024 & 2032

- Figure 29: Japan APAC Epoxy Resins Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 30: Japan APAC Epoxy Resins Industry Revenue (undefined), by Application 2024 & 2032

- Figure 31: Japan APAC Epoxy Resins Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Japan APAC Epoxy Resins Industry Revenue (undefined), by Geography 2024 & 2032

- Figure 33: Japan APAC Epoxy Resins Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 34: Japan APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 35: Japan APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South Korea APAC Epoxy Resins Industry Revenue (undefined), by Raw Material 2024 & 2032

- Figure 37: South Korea APAC Epoxy Resins Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 38: South Korea APAC Epoxy Resins Industry Revenue (undefined), by Application 2024 & 2032

- Figure 39: South Korea APAC Epoxy Resins Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: South Korea APAC Epoxy Resins Industry Revenue (undefined), by Geography 2024 & 2032

- Figure 41: South Korea APAC Epoxy Resins Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 42: South Korea APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 43: South Korea APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: ASEAN Countries APAC Epoxy Resins Industry Revenue (undefined), by Raw Material 2024 & 2032

- Figure 45: ASEAN Countries APAC Epoxy Resins Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 46: ASEAN Countries APAC Epoxy Resins Industry Revenue (undefined), by Application 2024 & 2032

- Figure 47: ASEAN Countries APAC Epoxy Resins Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: ASEAN Countries APAC Epoxy Resins Industry Revenue (undefined), by Geography 2024 & 2032

- Figure 49: ASEAN Countries APAC Epoxy Resins Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 50: ASEAN Countries APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 51: ASEAN Countries APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Rest of Asia Pacific APAC Epoxy Resins Industry Revenue (undefined), by Raw Material 2024 & 2032

- Figure 53: Rest of Asia Pacific APAC Epoxy Resins Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 54: Rest of Asia Pacific APAC Epoxy Resins Industry Revenue (undefined), by Application 2024 & 2032

- Figure 55: Rest of Asia Pacific APAC Epoxy Resins Industry Revenue Share (%), by Application 2024 & 2032

- Figure 56: Rest of Asia Pacific APAC Epoxy Resins Industry Revenue (undefined), by Geography 2024 & 2032

- Figure 57: Rest of Asia Pacific APAC Epoxy Resins Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 58: Rest of Asia Pacific APAC Epoxy Resins Industry Revenue (undefined), by Country 2024 & 2032

- Figure 59: Rest of Asia Pacific APAC Epoxy Resins Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Region 2019 & 2032

- Table 2: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Raw Material 2019 & 2032

- Table 3: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Application 2019 & 2032

- Table 4: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Geography 2019 & 2032

- Table 5: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Region 2019 & 2032

- Table 6: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 7: United States APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 8: Canada APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 9: Mexico APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 10: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 11: Germany APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 13: France APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 14: Spain APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 15: Italy APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 16: Spain APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 17: Belgium APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 18: Netherland APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 19: Nordics APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 21: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 22: China APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 23: Japan APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 24: India APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 25: South Korea APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 27: Australia APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 28: Indonesia APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 29: Phillipes APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 30: Singapore APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 31: Thailandc APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 33: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 34: Brazil APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 35: Argentina APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 36: Peru APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 37: Chile APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 38: Colombia APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 39: Ecuador APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 40: Venezuela APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 42: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 43: United Arab Emirates APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 44: Saudi Arabia APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 45: South Africa APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 46: Rest of Middle East and Africa APAC Epoxy Resins Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 47: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Raw Material 2019 & 2032

- Table 48: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Application 2019 & 2032

- Table 49: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Geography 2019 & 2032

- Table 50: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 51: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Raw Material 2019 & 2032

- Table 52: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Application 2019 & 2032

- Table 53: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Geography 2019 & 2032

- Table 54: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 55: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Raw Material 2019 & 2032

- Table 56: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Application 2019 & 2032

- Table 57: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Geography 2019 & 2032

- Table 58: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 59: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Raw Material 2019 & 2032

- Table 60: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Application 2019 & 2032

- Table 61: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Geography 2019 & 2032

- Table 62: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 63: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Raw Material 2019 & 2032

- Table 64: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Application 2019 & 2032

- Table 65: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Geography 2019 & 2032

- Table 66: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 67: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Raw Material 2019 & 2032

- Table 68: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Application 2019 & 2032

- Table 69: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Geography 2019 & 2032

- Table 70: Global APAC Epoxy Resins Industry Revenue undefined Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Epoxy Resins Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the APAC Epoxy Resins Industry?

Key companies in the market include Jiangsu Sanmu Group Co Ltd, Nan Ya Plastics Corporation, 3M, BASF SE, Huntsman International LLC, Aditya Birla Chemicals, Daicel Corporation, Hexion, Chang Chun Plastics Co Ltd, Kukdo Chemicals Co Ltd, Olin Corporation*List Not Exhaustive, Covestro AG, Atul Ltd.

3. What are the main segments of the APAC Epoxy Resins Industry?

The market segments include Raw Material, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Strong Growth of the Construction Industry; Rising Demand for Electrical and Electronic Devices.

6. What are the notable trends driving market growth?

Paints and Coatings Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Hazardous Impact of Epoxy on Health; Impact of COVID-19 Pandemic; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Epoxy Resins Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Epoxy Resins Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Epoxy Resins Industry?

To stay informed about further developments, trends, and reports in the APAC Epoxy Resins Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence