Key Insights

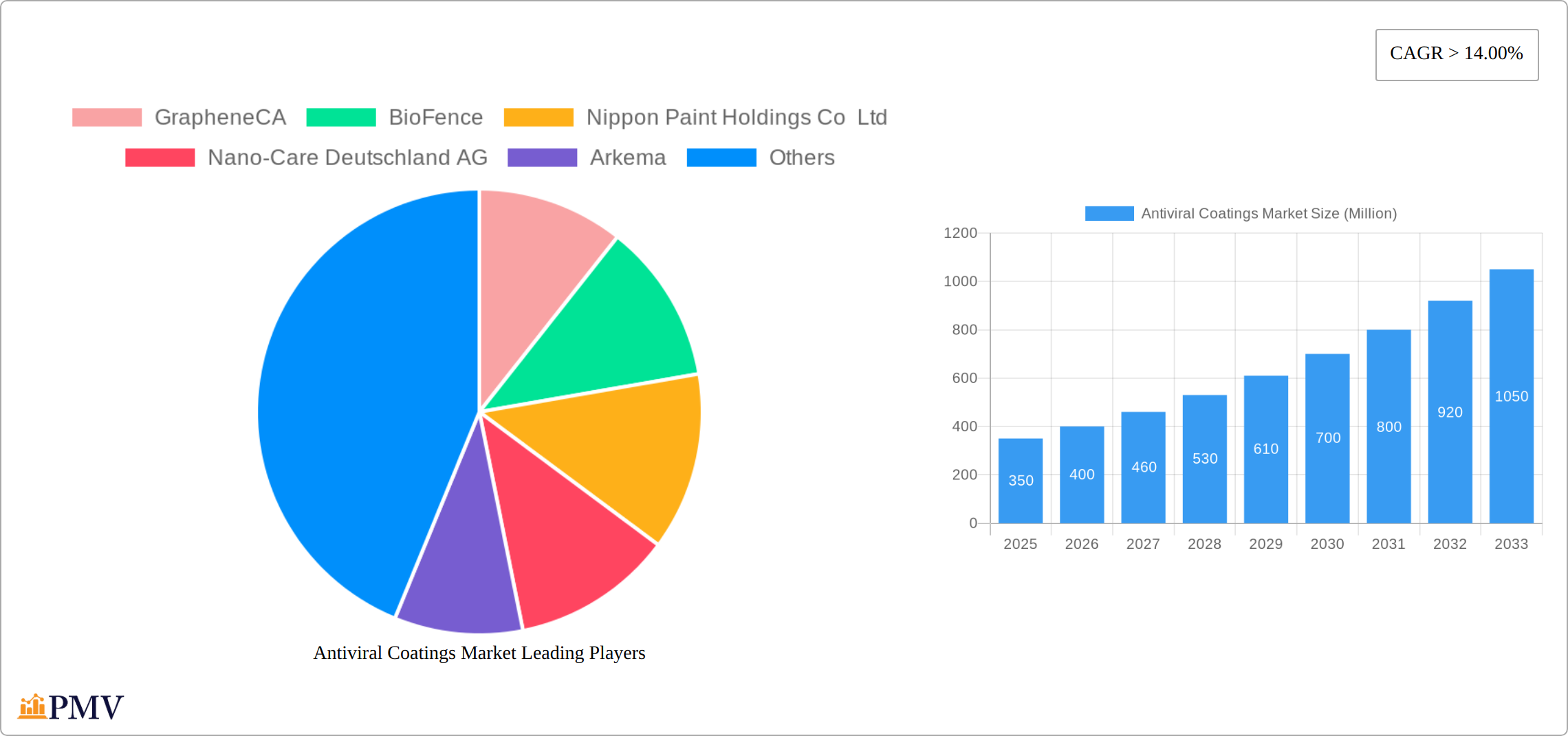

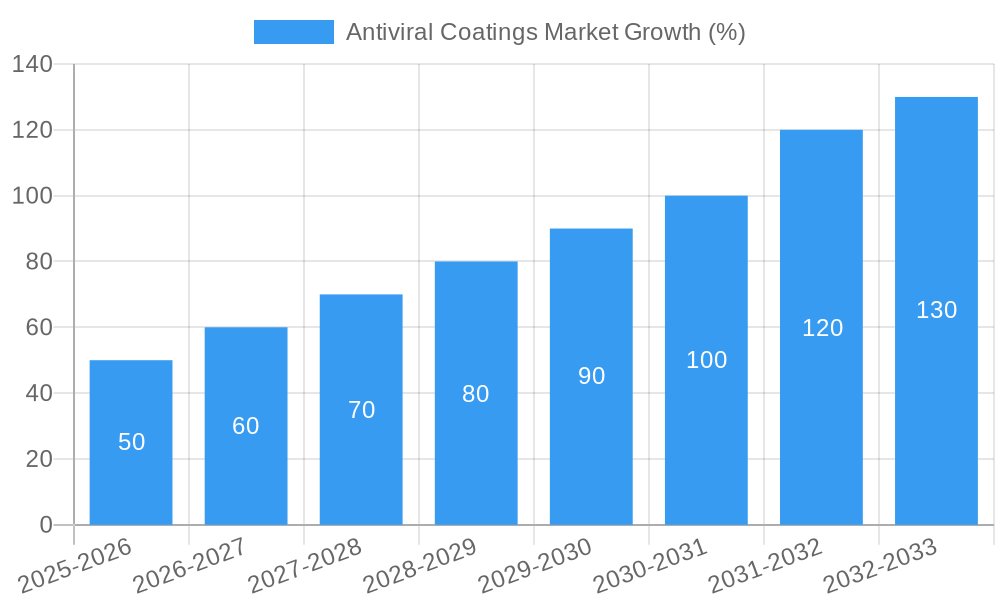

The antiviral coatings market is experiencing robust growth, driven by increasing concerns over infectious diseases and the demand for hygienic environments. The market's Compound Annual Growth Rate (CAGR) exceeding 14% from 2019 to 2024 indicates a significant upward trajectory, projected to continue through 2033. This expansion is fueled by several key drivers: the rising prevalence of antimicrobial-resistant bacteria, increasing healthcare expenditure globally, stringent hygiene regulations across various sectors (healthcare, hospitality, transportation), and growing awareness among consumers regarding infection control. Technological advancements leading to the development of more effective and durable antiviral coatings further contribute to market growth. While the precise market size for 2025 is unavailable, considering a 14%+ CAGR and a likely substantial base in 2019, a reasonable estimate would place the 2025 market value in the hundreds of millions of dollars. Market segmentation reveals diverse applications, encompassing healthcare facilities, public transportation, educational institutions, and consumer products. Key players, including GrapheneCA, BioFence, Nippon Paint, and others, are actively engaged in research and development, expanding their product portfolios, and forging strategic partnerships to strengthen their market positions. The market is expected to witness significant innovation in materials science, leading to the introduction of more sustainable and cost-effective antiviral coating solutions in the coming years.

Despite its growth potential, the antiviral coatings market faces some challenges. High initial investment costs for implementation and the need for specialized application techniques can act as restraints. Furthermore, the long-term efficacy and durability of certain coatings, along with potential regulatory hurdles in different regions, remain important considerations. However, ongoing research and development efforts aimed at overcoming these limitations, coupled with the persistent demand for enhanced hygiene solutions, are expected to minimize these restraints and drive continued market expansion throughout the forecast period. The market's future hinges on further innovation, coupled with wider adoption across various sectors and improved consumer understanding of the benefits offered by these advanced coatings.

Antiviral Coatings Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Antiviral Coatings Market, offering actionable insights for businesses and investors. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report analyzes market dynamics, competitive landscapes, and future growth opportunities. The market is expected to reach xx Million by 2033, growing at a CAGR of xx% during the forecast period.

Antiviral Coatings Market Market Structure & Competitive Dynamics

The Antiviral Coatings Market presents a moderately fragmented structure, featuring a dynamic interplay between large multinational corporations and specialized SMEs actively vying for market share. Market concentration remains relatively low, with the top five players holding an estimated [Insert Specific Percentage]% of the market share in 2025. This competitive landscape fuels innovation and drives continuous enhancements in product offerings. The regulatory environment varies significantly across different regions, influencing product approvals and market access. Key regulations impacting market entry and growth include [Mention Specific Regulations or Standards, e.g., EPA registrations, FDA approvals, ISO standards]. The market anticipates considerable M&A activity in the coming years, driven by the strategic need to expand product portfolios and penetrate new markets. Recent M&A deal values have ranged from [Insert Specific Value] Million to [Insert Specific Value] Million, reflecting the substantial growth potential within this sector. Traditional disinfectants and sterilization methods pose a competitive challenge as product substitutes; however, the burgeoning demand for convenient and durable antiviral protection is a major growth driver. A significant trend among end-users favors sustainable and environmentally friendly products, presenting lucrative opportunities for manufacturers prioritizing eco-conscious formulations and production processes.

- Market Concentration: Moderately fragmented (top 5 players: [Insert Specific Percentage]% market share in 2025)

- Innovation Ecosystems: Robust focus on nanotechnology, bio-based materials, and advanced polymer chemistry.

- Regulatory Frameworks: Regionally diverse, impacting product approvals and necessitating compliance with varying standards.

- Product Substitutes: Traditional disinfectants and sterilization methods, posing a competitive challenge.

- End-User Trends: Increasing demand for sustainable, long-lasting, and high-performing antiviral solutions.

- M&A Activities: Projected surge in M&A activity, with deal values anticipated to range from [Insert Specific Value] Million to [Insert Specific Value] Million.

Antiviral Coatings Market Industry Trends & Insights

The Antiviral Coatings Market is experiencing robust growth, driven by several key factors. The increasing prevalence of infectious diseases, coupled with heightened awareness of hygiene and sanitation post-pandemic, is fueling demand for antiviral coatings across various sectors. Technological advancements, particularly in nanotechnology and material science, are leading to the development of more effective and durable coatings. Consumer preferences are shifting towards products that offer long-term protection and are easy to apply. The market is also witnessing increased adoption of antiviral coatings in healthcare facilities, public transportation, and commercial spaces. The market is expected to witness strong growth, with a projected CAGR of xx% from 2025 to 2033. Market penetration in key sectors like healthcare remains relatively low, offering significant growth potential. Competitive dynamics are characterized by product differentiation, focusing on efficacy, longevity, and ease of application.

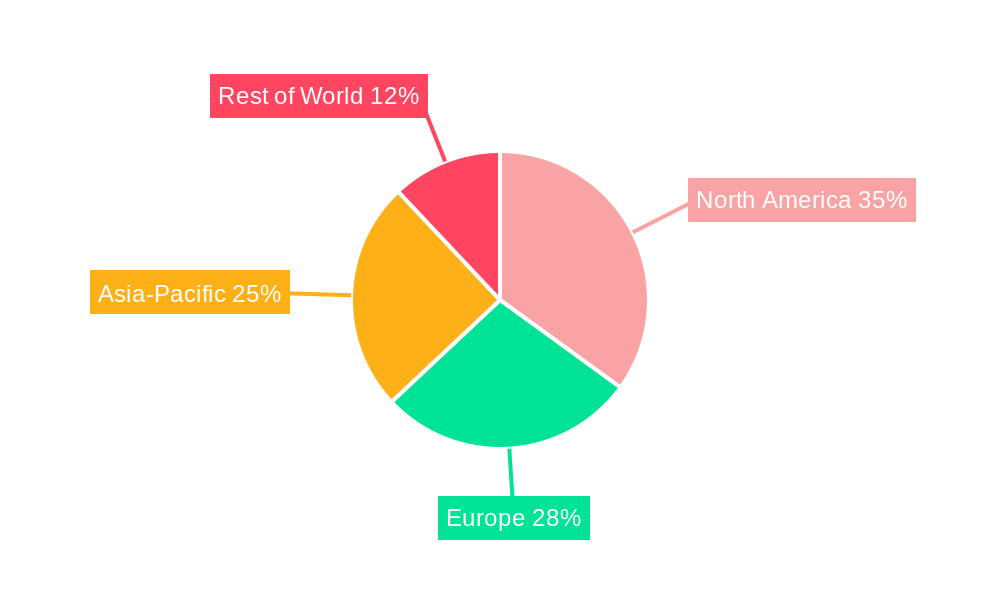

Dominant Markets & Segments in Antiviral Coatings Market

The North American region currently holds a leading position in the Antiviral Coatings Market, driven by factors such as strong regulatory support for new technologies, a robust healthcare infrastructure, and high consumer awareness of hygiene. Key growth drivers within North America include:

- Strong regulatory support for innovative technologies: Facilitates faster market entry for new antiviral coating products.

- Robust healthcare infrastructure: High demand for antiviral coatings in hospitals and healthcare facilities.

- High consumer spending power: Increased willingness to invest in health and hygiene related products.

Europe is also a significant market, with strong growth potential in countries such as Germany and the UK. The Asia-Pacific region is expected to witness significant growth during the forecast period, propelled by rapid economic development and rising urbanization in several countries. Detailed dominance analysis points to higher adoption rates in developed nations due to increased awareness and better infrastructure to support wider application.

Antiviral Coatings Market Product Innovations

Recent advancements in nanotechnology have led to the development of highly effective antiviral coatings with enhanced durability and longevity. These innovations are enabling the development of coatings with broader applications across various sectors, including healthcare, transportation, and consumer products. Key technological trends include the use of nanoparticles, self-cleaning surfaces, and photocatalytic materials. The market fit for these new products is very strong, due to the increased demand for effective and long-lasting antiviral protection.

Report Segmentation & Scope

The Antiviral Coatings Market is segmented by coating type (e.g., water-based, solvent-based, powder coatings, UV-curable), application (e.g., healthcare, transportation, consumer products, industrial, food processing), and region (e.g., North America, Europe, Asia-Pacific, Latin America, Middle East & Africa). Each segment exhibits unique growth trajectories and competitive dynamics. The water-based segment is projected to experience significant growth driven by increasing environmental awareness and stricter regulations. The healthcare application segment is anticipated to maintain its dominance, fueled by the crucial need for robust infection control in healthcare facilities. North America is expected to remain a leading market, followed by Europe and the rapidly expanding Asia-Pacific region, which shows substantial growth potential. Further segmentation can be explored based on the target virus (e.g., influenza, COVID-19, other enveloped viruses).

Key Drivers of Antiviral Coatings Market Growth

The Antiviral Coatings Market is propelled by several factors: the increasing incidence of infectious diseases, heightened hygiene awareness, technological advancements in nanomaterials and bio-based coatings, growing demand for sustainable solutions, and supportive government regulations promoting hygiene and infection control. The rising adoption of antiviral coatings in diverse sectors like healthcare, public transport, and consumer goods adds further impetus to market growth. Stringent government regulations and standards concerning hygiene and sanitation in public places also contribute significantly.

Challenges in the Antiviral Coatings Market Sector

The market faces several challenges, including the relatively high cost of advanced antiviral coatings compared to traditional methods, potential regulatory hurdles for new product approvals and registrations, concerns regarding the long-term durability and effectiveness of some coatings against emerging viral variants, and the risk of supply chain disruptions. Intense competitive pressures from established disinfectant methods also hinder rapid market penetration. Ensuring the efficacy of antiviral coatings against evolving viral strains demands continuous research, development, and innovation. Furthermore, consumer education and awareness regarding the benefits and proper application of these coatings are vital for market growth.

Leading Players in the Antiviral Coatings Market Market

- GrapheneCA

- BioFence

- Nippon Paint Holdings Co Ltd

- Nano-Care Deutschland AG

- Arkema

- Hydromer

- Grand Polycoats

- Novapura AG

- Kastus Technologies Company Limited

- Bio Gate AG

- KOBE STEEL LTD

- PPG Industries Inc

- *List Not Exhaustive

Key Developments in Antiviral Coatings Market Sector

- February 2022: Nippon Paint successfully launched two new antiviral water-based paint products under its PROTECTON brand, specifically designed for floors and interior walls. This expansion of their product portfolio directly targets a significant and growing market segment.

- August 2022: PPG Industries Inc. received prestigious recognition with two 2022 R&D 100 awards for its innovative Copper Armor antimicrobial paint and Comex Vinimex Total antiviral and antibacterial paint. This achievement underscores the company's dedication to innovation and reinforces its market leadership position, significantly boosting brand image and consumer trust.

- [Add other key developments with dates and descriptions]

Strategic Antiviral Coatings Market Market Outlook

The Antiviral Coatings Market presents significant growth opportunities, driven by ongoing technological advancements, rising consumer demand, and supportive government regulations. Strategic partnerships, focused research and development efforts, and expansion into new geographical markets will be critical for success. Companies focused on sustainable and eco-friendly solutions are well-positioned to capture a larger market share. The long-term outlook remains positive, with continued market expansion expected throughout the forecast period.

Antiviral Coatings Market Segmentation

-

1. Material

- 1.1. Copper

- 1.2. Graphene

- 1.3. Silver

- 1.4. Other Material Types

-

2. Application

- 2.1. Construction

- 2.2. Home Appliances

- 2.3. Healthcare

- 2.4. Textiles and Apparel

- 2.5. Other Applications

Antiviral Coatings Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Antiviral Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 14.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Demand from the Construction Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Demand from the Construction Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. High Demand from Construction Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antiviral Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Copper

- 5.1.2. Graphene

- 5.1.3. Silver

- 5.1.4. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Construction

- 5.2.2. Home Appliances

- 5.2.3. Healthcare

- 5.2.4. Textiles and Apparel

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Asia Pacific Antiviral Coatings Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Copper

- 6.1.2. Graphene

- 6.1.3. Silver

- 6.1.4. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Construction

- 6.2.2. Home Appliances

- 6.2.3. Healthcare

- 6.2.4. Textiles and Apparel

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. North America Antiviral Coatings Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Copper

- 7.1.2. Graphene

- 7.1.3. Silver

- 7.1.4. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Construction

- 7.2.2. Home Appliances

- 7.2.3. Healthcare

- 7.2.4. Textiles and Apparel

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Antiviral Coatings Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Copper

- 8.1.2. Graphene

- 8.1.3. Silver

- 8.1.4. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Construction

- 8.2.2. Home Appliances

- 8.2.3. Healthcare

- 8.2.4. Textiles and Apparel

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Antiviral Coatings Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Copper

- 9.1.2. Graphene

- 9.1.3. Silver

- 9.1.4. Other Material Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Construction

- 9.2.2. Home Appliances

- 9.2.3. Healthcare

- 9.2.4. Textiles and Apparel

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Antiviral Coatings Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Copper

- 10.1.2. Graphene

- 10.1.3. Silver

- 10.1.4. Other Material Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Construction

- 10.2.2. Home Appliances

- 10.2.3. Healthcare

- 10.2.4. Textiles and Apparel

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 GrapheneCA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BioFence

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nippon Paint Holdings Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nano-Care Deutschland AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arkema

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hydromer

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grand Polycoats

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Novapura AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kastus Technologies Company Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bio Gate AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 KOBE STEEL LTD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PPG Industries Inc *List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 GrapheneCA

List of Figures

- Figure 1: Global Antiviral Coatings Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Antiviral Coatings Market Revenue (Million), by Material 2024 & 2032

- Figure 3: Asia Pacific Antiviral Coatings Market Revenue Share (%), by Material 2024 & 2032

- Figure 4: Asia Pacific Antiviral Coatings Market Revenue (Million), by Application 2024 & 2032

- Figure 5: Asia Pacific Antiviral Coatings Market Revenue Share (%), by Application 2024 & 2032

- Figure 6: Asia Pacific Antiviral Coatings Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Antiviral Coatings Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: North America Antiviral Coatings Market Revenue (Million), by Material 2024 & 2032

- Figure 9: North America Antiviral Coatings Market Revenue Share (%), by Material 2024 & 2032

- Figure 10: North America Antiviral Coatings Market Revenue (Million), by Application 2024 & 2032

- Figure 11: North America Antiviral Coatings Market Revenue Share (%), by Application 2024 & 2032

- Figure 12: North America Antiviral Coatings Market Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Antiviral Coatings Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Antiviral Coatings Market Revenue (Million), by Material 2024 & 2032

- Figure 15: Europe Antiviral Coatings Market Revenue Share (%), by Material 2024 & 2032

- Figure 16: Europe Antiviral Coatings Market Revenue (Million), by Application 2024 & 2032

- Figure 17: Europe Antiviral Coatings Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Antiviral Coatings Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Antiviral Coatings Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Antiviral Coatings Market Revenue (Million), by Material 2024 & 2032

- Figure 21: South America Antiviral Coatings Market Revenue Share (%), by Material 2024 & 2032

- Figure 22: South America Antiviral Coatings Market Revenue (Million), by Application 2024 & 2032

- Figure 23: South America Antiviral Coatings Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: South America Antiviral Coatings Market Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Antiviral Coatings Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East and Africa Antiviral Coatings Market Revenue (Million), by Material 2024 & 2032

- Figure 27: Middle East and Africa Antiviral Coatings Market Revenue Share (%), by Material 2024 & 2032

- Figure 28: Middle East and Africa Antiviral Coatings Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Middle East and Africa Antiviral Coatings Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Middle East and Africa Antiviral Coatings Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Antiviral Coatings Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Antiviral Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Antiviral Coatings Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Global Antiviral Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Antiviral Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Antiviral Coatings Market Revenue Million Forecast, by Material 2019 & 2032

- Table 6: Global Antiviral Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Global Antiviral Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia Pacific Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Antiviral Coatings Market Revenue Million Forecast, by Material 2019 & 2032

- Table 14: Global Antiviral Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Antiviral Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Antiviral Coatings Market Revenue Million Forecast, by Material 2019 & 2032

- Table 20: Global Antiviral Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Antiviral Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Germany Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: France Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Antiviral Coatings Market Revenue Million Forecast, by Material 2019 & 2032

- Table 28: Global Antiviral Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Antiviral Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Brazil Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Argentina Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Antiviral Coatings Market Revenue Million Forecast, by Material 2019 & 2032

- Table 34: Global Antiviral Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Antiviral Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Saudi Arabia Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East and Africa Antiviral Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antiviral Coatings Market?

The projected CAGR is approximately > 14.00%.

2. Which companies are prominent players in the Antiviral Coatings Market?

Key companies in the market include GrapheneCA, BioFence, Nippon Paint Holdings Co Ltd, Nano-Care Deutschland AG, Arkema, Hydromer, Grand Polycoats, Novapura AG, Kastus Technologies Company Limited, Bio Gate AG, KOBE STEEL LTD, PPG Industries Inc *List Not Exhaustive.

3. What are the main segments of the Antiviral Coatings Market?

The market segments include Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Demand from the Construction Sector; Other Drivers.

6. What are the notable trends driving market growth?

High Demand from Construction Segment.

7. Are there any restraints impacting market growth?

High Demand from the Construction Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

August 2022: PPG announced that two of its industry-leading antimicrobial and antiviral products were recognized with 2022 R&D 100 awards in the mechanical/materials category - The company stated that the Copper Armor antimicrobial paint by PPG with Corning Guardiant technology and Comex Vinimex Total antiviral and antibacterial paint were both honored with the award

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antiviral Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antiviral Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antiviral Coatings Market?

To stay informed about further developments, trends, and reports in the Antiviral Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence