Key Insights

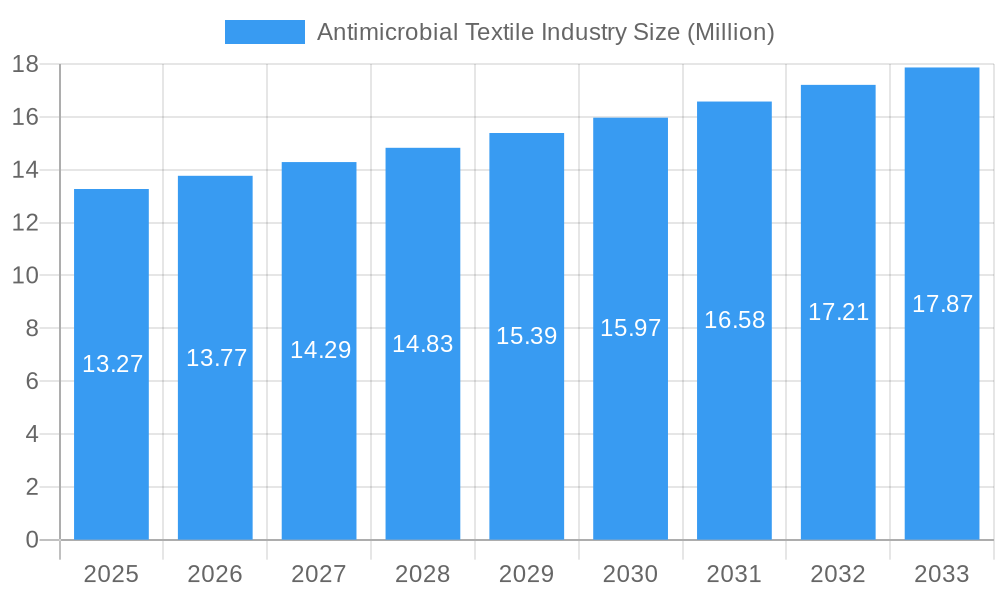

The Antimicrobial Textile Industry is poised for significant expansion, currently valued at approximately $13.27 million. Driven by a growing awareness of hygiene and health concerns across various sectors, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.75% over the forecast period. This robust growth is fueled by an increasing demand for textiles that offer protection against harmful microorganisms in critical applications like medical facilities, public spaces, and everyday apparel. The escalating prevalence of healthcare-associated infections and the consumer's desire for safer products are primary catalysts. Furthermore, technological advancements in incorporating antimicrobial agents, such as quaternary ammonium compounds and nanosilver, into textile fibers are enhancing the efficacy and durability of these specialized fabrics, thereby broadening their application scope and market penetration.

Antimicrobial Textile Industry Market Size (In Million)

Key drivers propelling this market forward include the burgeoning healthcare sector's need for infection control, the expanding sports and activewear industry's focus on odor control and hygiene, and the rising consumer demand for sanitized home textiles. The integration of antimicrobial finishes into everyday apparel and home furnishings is becoming a significant trend, enhancing product value and consumer appeal. However, certain factors may moderate growth, such as the higher cost associated with manufacturing antimicrobial textiles compared to conventional fabrics, and evolving regulatory landscapes concerning the use of specific antimicrobial agents. Despite these challenges, the overarching trend towards preventative health and enhanced product performance indicates a bright future for the antimicrobial textile market.

Antimicrobial Textile Industry Company Market Share

Unlock critical insights into the burgeoning Antimicrobial Textile Industry with this comprehensive market research report. Covering the study period of 2019–2033, with a base year of 2025 and an estimated year of 2025, this report provides a deep dive into market dynamics, industry developments, and future growth trajectories. Explore the impact of advancements in antimicrobial fabrics, odor control textiles, hygienic textiles, and performance textiles across diverse applications. This report is essential for stakeholders seeking to capitalize on the growing demand for enhanced fabric hygiene and longevity in medical textiles, apparel, home textiles, and industrial textiles.

Antimicrobial Textile Industry Market Structure & Competitive Dynamics

The Antimicrobial Textile Industry exhibits a dynamic market structure characterized by increasing competition and strategic collaborations. Market concentration varies across different antimicrobial agent types, with Quaternary Ammonium compounds and other proprietary technologies holding significant shares. Innovation ecosystems are thriving, fueled by R&D investments aimed at developing novel, sustainable, and highly effective antimicrobial solutions. Regulatory frameworks are evolving, influencing product development and market entry, particularly within the medical and consumer goods sectors. Product substitutes, while present, often fall short of the integrated, long-lasting antimicrobial properties offered by treated textiles. End-user trends are leaning towards enhanced hygiene, performance, and durability, driving demand for advanced antimicrobial textiles in everyday products. Merger and acquisition (M&A) activities are on the rise as larger players seek to consolidate their market position and acquire innovative technologies. For instance, recent M&A deals, estimated in the tens of millions of dollars, highlight the strategic importance of this sector. The market share for key antimicrobial agents is subject to ongoing shifts based on technological advancements and regulatory approvals.

Antimicrobial Textile Industry Industry Trends & Insights

The Antimicrobial Textile Industry is poised for robust growth, driven by a confluence of factors including heightened consumer awareness regarding hygiene, increasing healthcare expenditures, and technological advancements in textile treatment. The CAGR for this market is projected to be a significant xx%, reflecting the accelerating adoption of antimicrobial solutions across various applications. Market penetration is steadily increasing, particularly in segments such as activewear, medical uniforms, and bedding, where odor control and infection prevention are paramount. Technological disruptions are continuously reshaping the landscape, with the emergence of new antimicrobial chemistries, nanotechnologies, and bio-based treatments offering enhanced efficacy, durability, and environmental sustainability. Consumer preferences are increasingly shifting towards products that offer added value in terms of health and safety, making antimicrobial textiles a compelling choice. Competitive dynamics are intensifying, with both established textile manufacturers and specialized chemical companies vying for market dominance. The demand for odor-resistant fabrics, bacteria-fighting textiles, and mold-resistant materials is a key growth driver. Furthermore, the expanding applications in home textiles, such as antimicrobial upholstery and towels, are contributing to the overall market expansion. The development of durable antimicrobial finishes that withstand multiple wash cycles is a critical trend, ensuring long-term performance and customer satisfaction. The integration of antimicrobial properties into performance textiles for athletic wear and outdoor gear is also gaining traction, addressing the need for enhanced freshness and hygiene during strenuous activities.

Dominant Markets & Segments in Antimicrobial Textile Industry

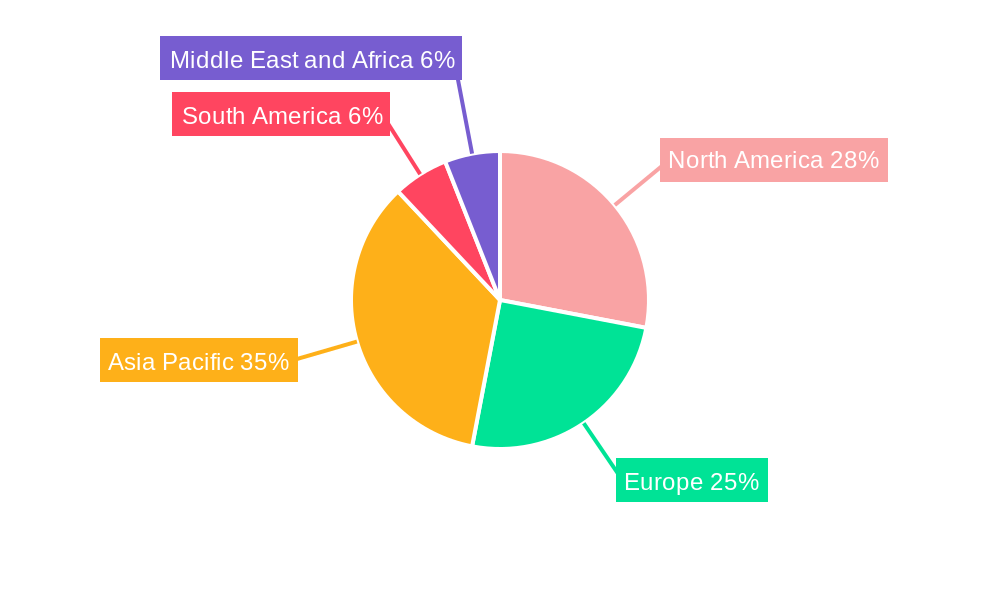

The Antimicrobial Textile Industry is witnessing significant dominance in key regions and segments. North America and Europe currently lead the market, driven by stringent hygiene regulations, high consumer disposable income, and a strong emphasis on advanced materials in healthcare and apparel. Within these regions, Medical Textiles represent a dominant application segment, fueled by the ongoing need for infection control in hospitals, clinics, and surgical settings. The Quaternary Ammonium segment also holds a substantial market share due to its broad-spectrum efficacy and cost-effectiveness. Economic policies promoting healthcare infrastructure development and the growing prevalence of lifestyle-related diseases are significant economic drivers supporting this dominance. Infrastructure advancements in textile manufacturing and R&D facilities further bolster market leadership.

- Leading Region: North America, driven by advanced healthcare systems and high consumer spending on performance apparel.

- Dominant Application Segment: Medical Textiles, including surgical gowns, masks, bedding, and wound dressings.

- Key Drivers for Medical Textiles: Increasing hospital-acquired infection (HAI) rates, rising surgical procedures, and regulatory mandates for sterile environments.

- Prominent Antimicrobial Type: Quaternary Ammonium compounds due to their broad-spectrum activity, rapid action, and effectiveness against a wide range of microbes.

- Emerging Market Potential: Asia-Pacific is projected for significant growth due to expanding healthcare infrastructure, increasing disposable incomes, and rising awareness of hygiene.

- Country-Level Dominance: The United States, Germany, and Japan lead in terms of market size and adoption of advanced antimicrobial textile technologies.

- Impact of Technological Advancements: Innovations in nanoparticle-based antimicrobial treatments and bio-based agents are increasingly influencing segment dominance.

- Consumer Preferences: Growing demand for odor-free activewear and hygienic home textiles is reshaping segment penetration.

Antimicrobial Textile Industry Product Innovations

Product innovations in the Antimicrobial Textile Industry are centered on enhancing efficacy, durability, and sustainability. Recent developments include advanced silver-ion infused textiles, enzyme-based antimicrobial treatments, and bio-compatible antimicrobial polymers. These innovations offer superior performance against a wider range of microorganisms, including resistant strains. Novel application methods are also emerging, such as in-situ polymerization and plasma treatments, ensuring even distribution of antimicrobial agents and long-lasting protection. Competitive advantages are being derived from eco-friendly formulations and treatments that are safe for human contact and the environment, meeting the growing demand for sustainable textile solutions. These advancements are driving the creation of advanced performance fabrics and hygienic materials for diverse industries.

Report Segmentation & Scope

This comprehensive report segments the Antimicrobial Textile Industry by Type and Application. The Type segmentation includes: Quaternary Ammonium, Triclosan, Cyclodextrin, Chitosan, and Others. Each of these categories offers unique properties and applications, contributing to the overall market value of an estimated $XX Million in the base year. The Application segmentation covers Medical Textiles, Apparel, Home Textiles, Industrial Textiles, and Others. Growth projections for these segments vary, with Medical Textiles and Apparel anticipated to experience the highest compound annual growth rates. The scope of this report encompasses a detailed analysis of market size, growth drivers, challenges, and competitive landscapes within each of these segments.

Key Drivers of Antimicrobial Textile Industry Growth

Several key drivers are propelling the growth of the Antimicrobial Textile Industry. Technologically, advancements in antimicrobial chemistries, including nanotechnologies and bio-based treatments, are enabling the development of more effective and sustainable antimicrobial fabrics. Economically, rising global healthcare expenditures and increased consumer awareness of hygiene and health are boosting demand for products with antimicrobial properties. Regulatory factors, such as stricter hygiene standards in healthcare and public spaces, further encourage the adoption of antimicrobial textiles. For instance, the growing concern over hospital-acquired infections (HAIs) directly fuels the demand for antimicrobial medical textiles. The increasing popularity of performance apparel and athleisure wear, where odor control is a significant consumer benefit, also contributes substantially to market expansion.

Challenges in the Antimicrobial Textile Industry Sector

Despite its robust growth, the Antimicrobial Textile Industry faces several challenges. Regulatory hurdles, particularly concerning the approval and labeling of antimicrobial claims, can slow down market entry for new products. Supply chain complexities, including the sourcing of specialized raw materials and the integration of antimicrobial treatments into existing manufacturing processes, can pose logistical difficulties. Competitive pressures from both established players and new entrants, especially concerning pricing and differentiation, are also significant. Furthermore, consumer perception regarding the safety and environmental impact of certain antimicrobial agents, such as Triclosan, can create market resistance and necessitate the development of safer alternatives. The cost of implementing advanced antimicrobial technologies can also be a barrier for some smaller manufacturers, impacting market accessibility.

Leading Players in the Antimicrobial Textile Industry Market

- Birlacril

- Herculite

- Jinda Nano Tech(Xiamen) Co Ltd

- LifeThreads

- Microban International

- Milliken Pivots Textile Manufacturing

- Sanitized AG

- Sinterama S p A

- Surgicotfab Textiles Pvt Ltd

- Trevira GmbH

- UNITIKA LTD

Key Developments in Antimicrobial Textile Industry Sector

- 2023/Q4: Launch of new bio-based antimicrobial coatings for sustainable apparel.

- 2024/Q1: Strategic partnership formed to develop advanced antimicrobial solutions for medical devices.

- 2024/Q2: Regulatory approval received for a novel broad-spectrum antimicrobial treatment for home textiles.

- 2024/Q3: Expansion of production capacity for antimicrobial medical textiles to meet rising demand.

- 2024/Q4: Acquisition of a key antimicrobial technology firm by a major textile manufacturer.

Strategic Antimicrobial Textile Industry Market Outlook

The strategic outlook for the Antimicrobial Textile Industry remains highly positive, driven by sustained demand for hygiene and performance solutions. Key growth accelerators include the continued innovation in eco-friendly and bio-based antimicrobial agents, expanding applications in smart textiles and wearable technology, and increasing penetration into emerging markets. Strategic opportunities lie in developing tailored antimicrobial solutions for specific end-user needs, such as advanced wound care, durable sports apparel, and long-lasting home furnishings. Collaboration between textile manufacturers, chemical suppliers, and research institutions will be crucial for addressing future market demands and overcoming existing challenges, ensuring continued innovation and market leadership in this vital sector.

Antimicrobial Textile Industry Segmentation

-

1. Type

- 1.1. Quaternary Ammonium

- 1.2. Triclosan

- 1.3. Cyclodextrin

- 1.4. Chitosan

- 1.5. Others

-

2. Application

- 2.1. Medical Textiles

- 2.2. Apparel

- 2.3. Home Textiles

- 2.4. Industrial Textiles

- 2.5. Others

Antimicrobial Textile Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Antimicrobial Textile Industry Regional Market Share

Geographic Coverage of Antimicrobial Textile Industry

Antimicrobial Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Healthcare Industry; Increasing Application in Sportswear; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand from Healthcare Industry; Increasing Application in Sportswear; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Application in Medical Textiles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antimicrobial Textile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Quaternary Ammonium

- 5.1.2. Triclosan

- 5.1.3. Cyclodextrin

- 5.1.4. Chitosan

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Medical Textiles

- 5.2.2. Apparel

- 5.2.3. Home Textiles

- 5.2.4. Industrial Textiles

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Antimicrobial Textile Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Quaternary Ammonium

- 6.1.2. Triclosan

- 6.1.3. Cyclodextrin

- 6.1.4. Chitosan

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Medical Textiles

- 6.2.2. Apparel

- 6.2.3. Home Textiles

- 6.2.4. Industrial Textiles

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Antimicrobial Textile Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Quaternary Ammonium

- 7.1.2. Triclosan

- 7.1.3. Cyclodextrin

- 7.1.4. Chitosan

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Medical Textiles

- 7.2.2. Apparel

- 7.2.3. Home Textiles

- 7.2.4. Industrial Textiles

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Antimicrobial Textile Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Quaternary Ammonium

- 8.1.2. Triclosan

- 8.1.3. Cyclodextrin

- 8.1.4. Chitosan

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Medical Textiles

- 8.2.2. Apparel

- 8.2.3. Home Textiles

- 8.2.4. Industrial Textiles

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Antimicrobial Textile Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Quaternary Ammonium

- 9.1.2. Triclosan

- 9.1.3. Cyclodextrin

- 9.1.4. Chitosan

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Medical Textiles

- 9.2.2. Apparel

- 9.2.3. Home Textiles

- 9.2.4. Industrial Textiles

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Antimicrobial Textile Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Quaternary Ammonium

- 10.1.2. Triclosan

- 10.1.3. Cyclodextrin

- 10.1.4. Chitosan

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Medical Textiles

- 10.2.2. Apparel

- 10.2.3. Home Textiles

- 10.2.4. Industrial Textiles

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Birlacril

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Herculite

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Jinda Nano Tech(Xiamen) Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LifeThreads

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Microban International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Milliken Pivots Textile Manufacturing

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sanitized AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sinterama S p A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Surgicotfab Textiles Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Trevira GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 UNITIKA LTD *List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Birlacril

List of Figures

- Figure 1: Global Antimicrobial Textile Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Antimicrobial Textile Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Antimicrobial Textile Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Antimicrobial Textile Industry Volume (Billion), by Type 2025 & 2033

- Figure 5: Asia Pacific Antimicrobial Textile Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Antimicrobial Textile Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Antimicrobial Textile Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: Asia Pacific Antimicrobial Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 9: Asia Pacific Antimicrobial Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Antimicrobial Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Antimicrobial Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Antimicrobial Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Antimicrobial Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Antimicrobial Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Antimicrobial Textile Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Antimicrobial Textile Industry Volume (Billion), by Type 2025 & 2033

- Figure 17: North America Antimicrobial Textile Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Antimicrobial Textile Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Antimicrobial Textile Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: North America Antimicrobial Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 21: North America Antimicrobial Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Antimicrobial Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Antimicrobial Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Antimicrobial Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 25: North America Antimicrobial Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Antimicrobial Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Antimicrobial Textile Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Antimicrobial Textile Industry Volume (Billion), by Type 2025 & 2033

- Figure 29: Europe Antimicrobial Textile Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Antimicrobial Textile Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Antimicrobial Textile Industry Revenue (Million), by Application 2025 & 2033

- Figure 32: Europe Antimicrobial Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 33: Europe Antimicrobial Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Antimicrobial Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Antimicrobial Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Antimicrobial Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Antimicrobial Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Antimicrobial Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Antimicrobial Textile Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Antimicrobial Textile Industry Volume (Billion), by Type 2025 & 2033

- Figure 41: South America Antimicrobial Textile Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Antimicrobial Textile Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Antimicrobial Textile Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: South America Antimicrobial Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 45: South America Antimicrobial Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Antimicrobial Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Antimicrobial Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Antimicrobial Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: South America Antimicrobial Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Antimicrobial Textile Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Antimicrobial Textile Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Antimicrobial Textile Industry Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East and Africa Antimicrobial Textile Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Antimicrobial Textile Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Antimicrobial Textile Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Antimicrobial Textile Industry Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East and Africa Antimicrobial Textile Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Antimicrobial Textile Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Antimicrobial Textile Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Antimicrobial Textile Industry Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Antimicrobial Textile Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Antimicrobial Textile Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Antimicrobial Textile Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Antimicrobial Textile Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Antimicrobial Textile Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Antimicrobial Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Antimicrobial Textile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Antimicrobial Textile Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Antimicrobial Textile Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Antimicrobial Textile Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global Antimicrobial Textile Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Antimicrobial Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Antimicrobial Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Antimicrobial Textile Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: India Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Japan Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: South Korea Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global Antimicrobial Textile Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Antimicrobial Textile Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 25: Global Antimicrobial Textile Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Antimicrobial Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 27: Global Antimicrobial Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Antimicrobial Textile Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 29: United States Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Canada Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Mexico Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Global Antimicrobial Textile Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Antimicrobial Textile Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 37: Global Antimicrobial Textile Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Antimicrobial Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 39: Global Antimicrobial Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Antimicrobial Textile Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Germany Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: France Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: France Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Italy Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Italy Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Global Antimicrobial Textile Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Antimicrobial Textile Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 53: Global Antimicrobial Textile Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 54: Global Antimicrobial Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 55: Global Antimicrobial Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Antimicrobial Textile Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 57: Brazil Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Argentina Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global Antimicrobial Textile Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Antimicrobial Textile Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 65: Global Antimicrobial Textile Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global Antimicrobial Textile Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 67: Global Antimicrobial Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Antimicrobial Textile Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: South Africa Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Antimicrobial Textile Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Antimicrobial Textile Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antimicrobial Textile Industry?

The projected CAGR is approximately 3.75%.

2. Which companies are prominent players in the Antimicrobial Textile Industry?

Key companies in the market include Birlacril, Herculite, Jinda Nano Tech(Xiamen) Co Ltd, LifeThreads, Microban International, Milliken Pivots Textile Manufacturing, Sanitized AG, Sinterama S p A, Surgicotfab Textiles Pvt Ltd, Trevira GmbH, UNITIKA LTD *List Not Exhaustive.

3. What are the main segments of the Antimicrobial Textile Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Healthcare Industry; Increasing Application in Sportswear; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Application in Medical Textiles.

7. Are there any restraints impacting market growth?

Growing Demand from Healthcare Industry; Increasing Application in Sportswear; Other Drivers.

8. Can you provide examples of recent developments in the market?

Recent developments pertaining to the market studied will be covered in the complete report.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antimicrobial Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antimicrobial Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antimicrobial Textile Industry?

To stay informed about further developments, trends, and reports in the Antimicrobial Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence