Key Insights

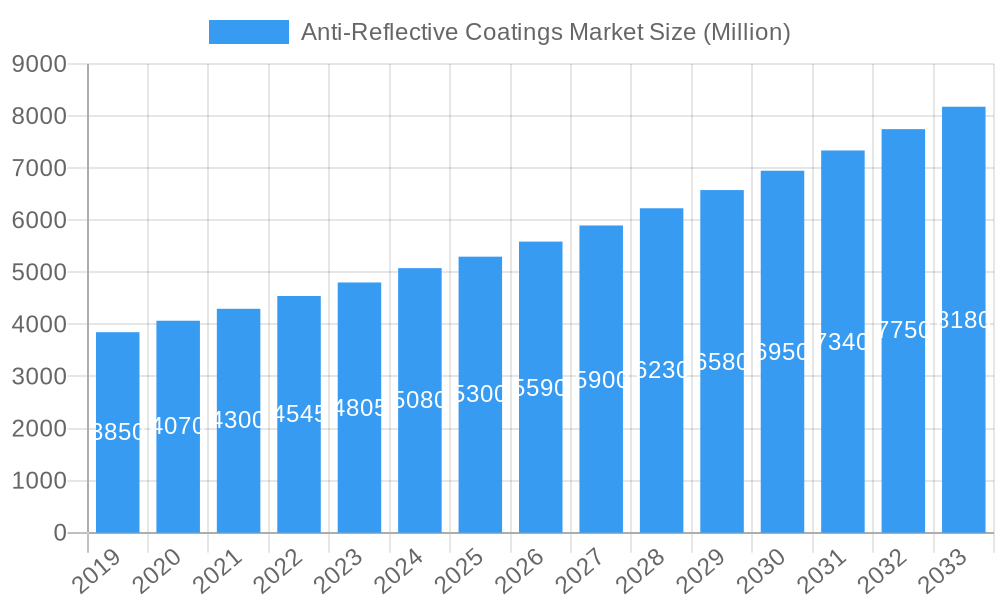

The global Anti-Reflective Coatings Market is poised for substantial expansion, projected to reach $5.30 Million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 6.22%, indicating sustained momentum throughout the forecast period. The market's trajectory is primarily fueled by the escalating demand for enhanced optical performance across a diverse range of applications, notably in semiconductors and advanced electronic devices. As the digital transformation accelerates, the need for superior visual clarity, reduced glare, and improved energy efficiency in displays, lenses, and photovoltaic cells becomes paramount. Furthermore, the burgeoning consumer electronics sector, coupled with advancements in automotive display technology and the increasing adoption of solar energy solutions, are significant drivers propelling the market forward. Emerging economies are also contributing to this growth, driven by increasing disposable incomes and a growing awareness of the benefits offered by anti-reflective coatings in everyday products.

Anti-Reflective Coatings Market Market Size (In Billion)

While the market exhibits strong growth, certain factors could influence its pace. The complexity and cost associated with some advanced deposition methods, like Electronic Beam Deposition, may present a restraint. However, ongoing innovation in Chemical Vapor Deposition and Sputtering techniques, aimed at improving efficiency and reducing costs, is expected to mitigate these challenges. The market is segmented by deposition method, with Chemical Vapor Deposition and Sputtering anticipated to hold significant shares due to their widespread applicability and cost-effectiveness. In terms of applications, Semiconductors and Electronic Devices are expected to lead the demand, followed closely by Eyewear and Solar Panels. Geographically, Asia Pacific, driven by its robust manufacturing base in electronics and increasing investments in renewable energy, is anticipated to be a dominant region, with China and India at the forefront of market expansion. North America and Europe will also remain crucial markets, characterized by high adoption rates of advanced technologies and a focus on performance-driven applications.

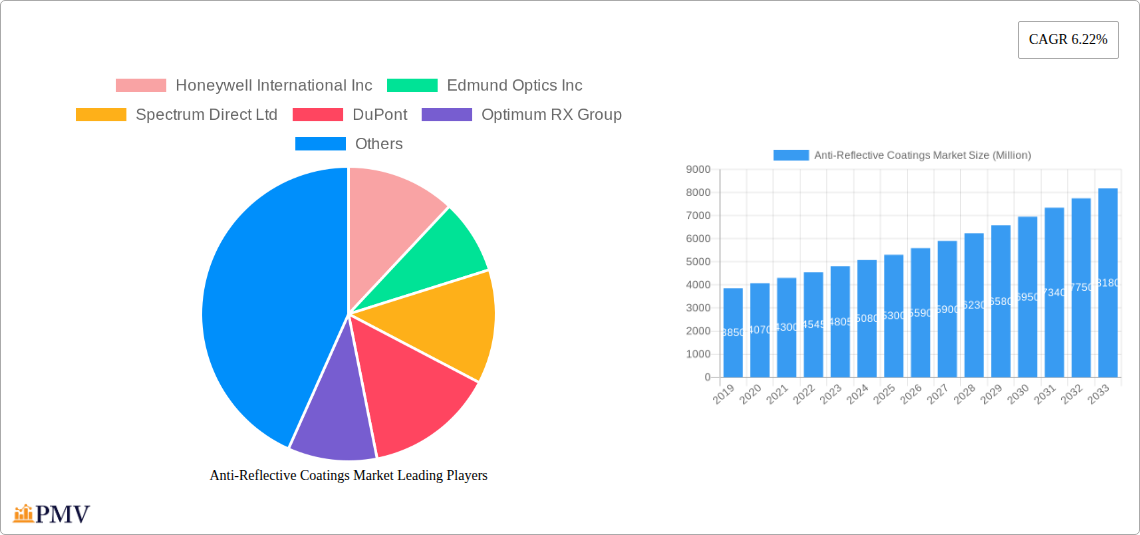

Anti-Reflective Coatings Market Company Market Share

This in-depth Anti-Reflective Coatings Market report provides a definitive analysis of the global market, examining key trends, growth drivers, challenges, and competitive landscapes. Leveraging advanced analytical methodologies, this study offers granular insights into market segmentation by deposition method and application, supported by historical data and precise forecasts. The report is designed for industry stakeholders seeking to understand market dynamics, identify growth opportunities, and formulate effective strategies in the rapidly evolving anti-reflective coatings sector. We cover essential aspects including market structure, industry trends, regional dominance, product innovations, and strategic outlook, making it an indispensable resource for decision-makers, investors, and researchers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, encompassing historical data from 2019-2024.

Anti-Reflective Coatings Market Structure & Competitive Dynamics

The Anti-Reflective Coatings Market exhibits a moderately concentrated structure, with a significant presence of both established multinational corporations and emerging specialized players. Innovation ecosystems are robust, driven by continuous R&D in material science and deposition techniques. Regulatory frameworks, particularly concerning environmental impact and material safety, influence market entry and product development. Product substitutes, while present in niche applications, struggle to match the performance and broad applicability of advanced anti-reflective coatings. End-user trends are increasingly focused on enhanced optical clarity, durability, and cost-effectiveness across diverse sectors like electronics and automotive. Mergers and acquisitions (M&A) activities are strategic, aimed at consolidating market share, acquiring new technologies, and expanding geographic reach. For instance, recent M&A deals, with aggregate values in the tens to hundreds of millions of dollars, underscore the consolidation drive. Key market players hold varying market shares, with leading companies often controlling 10-25% of specific application segments.

- Market Concentration: Moderate to High in specialized segments, Moderate overall.

- Innovation Ecosystems: Driven by academic-industrial partnerships and in-house R&D.

- Regulatory Impact: Growing emphasis on eco-friendly deposition methods and material compliance.

- Product Substitutes: Limited in high-performance applications, but present in lower-tier markets.

- End-User Trends: Demand for reduced glare, improved visual comfort, and enhanced device performance.

- M&A Activities: Strategic acquisitions focused on technology, market access, and product portfolios.

- Market Share Metrics: Key players estimated to hold between 5-20% in core segments.

- M&A Deal Values: Ranging from tens of millions to over a hundred million US dollars.

Anti-Reflective Coatings Market Industry Trends & Insights

The Anti-Reflective Coatings Market is poised for significant expansion, driven by escalating demand for enhanced visual performance and efficiency across a multitude of applications. The global market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025-2033). Technological disruptions, particularly advancements in nanotechnology and novel deposition techniques such as atomic layer deposition (ALD) and advanced sputtering methods, are revolutionizing coating properties, offering superior scratch resistance, broadband anti-reflection, and improved durability. Consumer preferences are increasingly gravitating towards devices and products that offer superior visual clarity and reduced eye strain. This trend is particularly evident in the consumer electronics, eyewear, and automotive sectors, where anti-reflective coatings are no longer considered a premium feature but a standard expectation.

The competitive landscape is characterized by intense innovation and strategic partnerships. Companies are investing heavily in research and development to create coatings with higher transmittance, lower reflectance, and enhanced hydrophobic or oleophobic properties. The penetration of anti-reflective coatings in emerging markets is also on the rise, fueled by increasing disposable incomes and a growing awareness of the benefits of these advanced optical solutions. The automotive industry's rapid adoption of sophisticated display technologies, including augmented reality heads-up displays and large infotainment screens, is a significant growth catalyst. Similarly, the burgeoning semiconductor industry, requiring highly precise optical components for lithography and inspection, presents substantial opportunities. The eyewear sector continues to be a robust segment, with ongoing innovation in lens coatings to improve visual comfort and reduce glare from digital screens.

Furthermore, the renewable energy sector, particularly solar panel manufacturers, are increasingly incorporating anti-reflective coatings to maximize light absorption, thereby boosting energy conversion efficiency. This has led to a surge in demand for cost-effective and highly durable coatings capable of withstanding harsh environmental conditions. The market is witnessing a shift towards more sustainable and environmentally friendly deposition processes, with manufacturers exploring methods that reduce energy consumption and waste. The integration of anti-reflective coatings in smart devices, wearables, and advanced medical equipment further diversifies the market's reach and underscores its critical role in modern technological advancements. The continuous evolution of deposition technologies, combined with burgeoning end-user demands for improved optical performance, paints a promising picture for the future of the anti-reflective coatings market.

Dominant Markets & Segments in Anti-Reflective Coatings Market

The global Anti-Reflective Coatings Market is dominated by several key regions and application segments, driven by robust industrial growth, technological advancements, and evolving consumer demands. Asia-Pacific, particularly China, Japan, and South Korea, emerges as the leading region, primarily due to its strong manufacturing base in electronics, semiconductors, and automotive components. The region's significant investments in research and development and the presence of major global manufacturers contribute to its dominance.

Within the Deposition Method segmentation, Sputtering is a leading technique, holding an estimated market share of over 35%. This method's versatility, ability to produce dense and uniform films, and scalability make it ideal for high-volume production across various applications. Electronic Beam Deposition follows closely, particularly for precision optics and specialized applications requiring high purity films, accounting for approximately 25% of the market. Chemical Vapor Deposition (CVD), while established, is gaining traction with advancements in plasma-enhanced CVD (PECVD) for improved efficiency and lower deposition temperatures, capturing around 20% of the market. Other Deposition Methods, including sol-gel and multi-layer coating techniques, collectively account for the remaining 20%, driven by niche applications and ongoing R&D.

In terms of Application, Electronic Devices represent the largest and fastest-growing segment, commanding an estimated market share of over 30%. This surge is fueled by the proliferation of smartphones, tablets, laptops, wearables, and advanced displays. Semiconductors follow closely, accounting for approximately 25% of the market. The critical need for precise optical components in semiconductor manufacturing equipment, such as lithography systems and metrology tools, drives this demand. Eyewear is a mature yet consistently growing segment, holding around 20% of the market, propelled by increasing consumer awareness of eye health and the demand for premium lens coatings that reduce glare from digital screens and improve visual comfort. Solar Panels, a rapidly expanding sector, contribute approximately 15% to the market, as manufacturers seek to enhance photovoltaic efficiency by maximizing light transmission. Automotive Displays, including infotainment systems and heads-up displays (HUDs), represent about 10% of the market, with a high growth potential due to the increasing complexity and prevalence of in-car digital interfaces. Other Applications, including scientific instruments, cameras, and architectural glass, collectively form the remaining segment.

- Dominant Region: Asia-Pacific (China, Japan, South Korea) - driven by electronics, automotive, and semiconductor manufacturing.

- Leading Deposition Method: Sputtering (approx. 35% market share) - versatile and scalable for high-volume production.

- Key Drivers for Sputtering Dominance: Uniformity, adhesion, and wide range of materials.

- Second Leading Deposition Method: Electronic Beam Deposition (approx. 25% market share) - for high-purity and precision optics.

- Advancing Deposition Method: Chemical Vapor Deposition (approx. 20% market share) - with innovations in PECVD.

- Dominant Application: Electronic Devices (approx. 30% market share) - fueled by consumer electronics and displays.

- Key Drivers for Electronic Devices Dominance: Smartphones, tablets, wearables, and advanced screen technologies.

- Second Leading Application: Semiconductors (approx. 25% market share) - critical for manufacturing and metrology equipment.

- Growing Application: Eyewear (approx. 20% market share) - demand for visual comfort and digital glare reduction.

- Emerging Application: Solar Panels (approx. 15% market share) - for enhanced energy conversion efficiency.

- Increasing Application: Automotive Displays (approx. 10% market share) - adoption of advanced in-car digital interfaces.

Anti-Reflective Coatings Market Product Innovations

Product innovations in the Anti-Reflective Coatings Market are primarily focused on enhancing optical performance and durability. Advancements include nanostructured coatings that offer broadband anti-reflection with minimal spectral shifts, improving clarity across a wider range of wavelengths. Development of self-cleaning and anti-smudge coatings, incorporating hydrophobic and oleophobic properties, are gaining traction, particularly for consumer electronics and eyewear applications. Furthermore, companies are innovating in multi-functional coatings that combine anti-reflective properties with scratch resistance, UV protection, and even anti-microbial capabilities. These innovations provide a significant competitive advantage by meeting diverse end-user demands for enhanced functionality and user experience.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Anti-Reflective Coatings Market. The Deposition Method segmentation includes Chemical Vapor Deposition (CVD), Electronic Beam Deposition, Sputtering, and Other Deposition Methods. Sputtering is projected to maintain its dominance due to its versatility and cost-effectiveness in high-volume production. The Application segmentation covers Semiconductors, Electronic Devices, Eyewear, Solar Panels, Automotive Displays, and Other Applications. Electronic Devices and Semiconductors are expected to exhibit the highest growth rates, driven by relentless technological advancements and expanding market penetration. The scope of this report encompasses market size, market share, CAGR, and competitive dynamics for each segment globally and across key regions.

- Deposition Method Segments:

- Chemical Vapor Deposition (CVD)

- Electronic Beam Deposition

- Sputtering

- Other Deposition Methods

- Application Segments:

- Semiconductors

- Electronic Devices

- Eyewear

- Solar Panels

- Automotive Displays

- Other Applications

Key Drivers of Anti-Reflective Coatings Market Growth

The Anti-Reflective Coatings Market growth is propelled by several interconnected factors. The escalating demand for high-performance displays in consumer electronics, automotive, and industrial sectors necessitates coatings that reduce glare and enhance readability. Advancements in deposition technologies, such as atomic layer deposition (ALD) and advanced sputtering techniques, enable the creation of thinner, more durable, and highly efficient anti-reflective films. The growing emphasis on energy efficiency drives the adoption of anti-reflective coatings in solar panels to maximize light absorption. Furthermore, increasing awareness of eye health and visual comfort fuels demand for advanced lens coatings in the eyewear industry. Regulatory support for energy-efficient technologies and a growing R&D focus on material science are also significant accelerators.

Challenges in the Anti-Reflective Coatings Market Sector

Despite its robust growth, the Anti-Reflective Coatings Market faces certain challenges. The high initial investment required for sophisticated deposition equipment can be a barrier for smaller manufacturers. Fluctuations in the prices of raw materials, such as rare earth elements used in some coating formulations, can impact profit margins. Intense competition among a large number of players, including both established giants and agile startups, can lead to price erosion. The development of highly specialized coatings for emerging applications requires significant R&D investment, and the lifecycle of some technologies can be short. Strict environmental regulations regarding solvent usage and waste disposal in certain deposition processes also pose compliance challenges.

Leading Players in the Anti-Reflective Coatings Market Market

- Honeywell International Inc

- Edmund Optics Inc

- Spectrum Direct Ltd

- DuPont

- Optimum RX Group

- Viavi Solutions

- Majestic Optical Coatings

- HOYA VISION CARE COMPANY (HOYA Corporation)

- ESSILOR OF AMERICA LLC

- EKSMA Optics USB

- Optical Coatings Japan

- PPG Industries

- Rodenstock GmbH

- AGC Inc

- COCO LENI

- Torr Scientific Ltd

- Zygo Corporation

- Quantum Coating

- AccuCoat Inc

- Zeiss International

- Evaporated Coatings Inc

- Optics Balzers AG

Key Developments in Anti-Reflective Coatings Market Sector

- February 2022: Zygo Corporation, a company engaged in manufacturing optical metrology and optical components, announced the opening of a new office in Italy, building upon its extensive network of offices and partnerships throughout Europe for expanding its business, including anti-reflective coatings.

- February 2021: Viavi Solutions announced establishing a new manufacturing facility in Chandler, Arizona, to meet the growing demand for optical security and performance products (OSP) across the United States.

Strategic Anti-Reflective Coatings Market Market Outlook

The strategic outlook for the Anti-Reflective Coatings Market is exceptionally positive, with significant growth accelerators in sight. The increasing integration of augmented reality (AR) and virtual reality (VR) technologies in consumer and industrial applications will create substantial demand for advanced anti-reflective coatings that enhance display immersion and visual fidelity. Continued innovation in material science, leading to thinner, more robust, and cost-effective coatings, will further broaden market reach. The growing trend towards smart cities and connected devices, requiring sophisticated optical components, presents a long-term growth avenue. Strategic partnerships and collaborations between coating manufacturers and end-product developers will be crucial for tailoring solutions to evolving market needs. Investments in sustainable manufacturing processes will also become a key differentiator.

Anti-Reflective Coatings Market Segmentation

-

1. Deposition Method

- 1.1. Chemical Vapor Deposition

- 1.2. Electronic Beam Deposition

- 1.3. Sputtering

- 1.4. Other Deposition Methods

-

2. Application

- 2.1. Semiconductors

- 2.2. Electronic Devices

- 2.3. Eyewear

- 2.4. Solar Panels

- 2.5. Automotive Displays

- 2.6. Other Applications

Anti-Reflective Coatings Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. NORDIC countries

- 3.7. Turkey

- 3.8. Russia

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Qatar

- 5.3. United Arab Emirates

- 5.4. Nigeria

- 5.5. Egypt

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Anti-Reflective Coatings Market Regional Market Share

Geographic Coverage of Anti-Reflective Coatings Market

Anti-Reflective Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from Eyewear Applications; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost of Anti-reflective Coatings; Dearth of Awareness

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Eyewear Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti-Reflective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deposition Method

- 5.1.1. Chemical Vapor Deposition

- 5.1.2. Electronic Beam Deposition

- 5.1.3. Sputtering

- 5.1.4. Other Deposition Methods

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Semiconductors

- 5.2.2. Electronic Devices

- 5.2.3. Eyewear

- 5.2.4. Solar Panels

- 5.2.5. Automotive Displays

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deposition Method

- 6. Asia Pacific Anti-Reflective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deposition Method

- 6.1.1. Chemical Vapor Deposition

- 6.1.2. Electronic Beam Deposition

- 6.1.3. Sputtering

- 6.1.4. Other Deposition Methods

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Semiconductors

- 6.2.2. Electronic Devices

- 6.2.3. Eyewear

- 6.2.4. Solar Panels

- 6.2.5. Automotive Displays

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Deposition Method

- 7. North America Anti-Reflective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deposition Method

- 7.1.1. Chemical Vapor Deposition

- 7.1.2. Electronic Beam Deposition

- 7.1.3. Sputtering

- 7.1.4. Other Deposition Methods

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Semiconductors

- 7.2.2. Electronic Devices

- 7.2.3. Eyewear

- 7.2.4. Solar Panels

- 7.2.5. Automotive Displays

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Deposition Method

- 8. Europe Anti-Reflective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deposition Method

- 8.1.1. Chemical Vapor Deposition

- 8.1.2. Electronic Beam Deposition

- 8.1.3. Sputtering

- 8.1.4. Other Deposition Methods

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Semiconductors

- 8.2.2. Electronic Devices

- 8.2.3. Eyewear

- 8.2.4. Solar Panels

- 8.2.5. Automotive Displays

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Deposition Method

- 9. South America Anti-Reflective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deposition Method

- 9.1.1. Chemical Vapor Deposition

- 9.1.2. Electronic Beam Deposition

- 9.1.3. Sputtering

- 9.1.4. Other Deposition Methods

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Semiconductors

- 9.2.2. Electronic Devices

- 9.2.3. Eyewear

- 9.2.4. Solar Panels

- 9.2.5. Automotive Displays

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Deposition Method

- 10. Middle East and Africa Anti-Reflective Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deposition Method

- 10.1.1. Chemical Vapor Deposition

- 10.1.2. Electronic Beam Deposition

- 10.1.3. Sputtering

- 10.1.4. Other Deposition Methods

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Semiconductors

- 10.2.2. Electronic Devices

- 10.2.3. Eyewear

- 10.2.4. Solar Panels

- 10.2.5. Automotive Displays

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Deposition Method

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Edmund Optics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Spectrum Direct Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DuPont

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Optimum RX Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Viavi Solutions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Majestic Optical Coatings

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HOYA VISION CARE COMPANY (HOYA Corporation)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ESSILOR OF AMERICA LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EKSMA Optics USB

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Optical Coatings Japan

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PPG Industries

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rodenstock GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 AGC Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 COCO LENI

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Torr Scientific Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Zygo Corporatio

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Quantum Coating

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 AccuCoat Inc

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Zeiss International

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Evaporated Coatings Inc

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Optics Balzers AG

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Anti-Reflective Coatings Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Anti-Reflective Coatings Market Volume Breakdown (Kiloton, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Anti-Reflective Coatings Market Revenue (Million), by Deposition Method 2025 & 2033

- Figure 4: Asia Pacific Anti-Reflective Coatings Market Volume (Kiloton), by Deposition Method 2025 & 2033

- Figure 5: Asia Pacific Anti-Reflective Coatings Market Revenue Share (%), by Deposition Method 2025 & 2033

- Figure 6: Asia Pacific Anti-Reflective Coatings Market Volume Share (%), by Deposition Method 2025 & 2033

- Figure 7: Asia Pacific Anti-Reflective Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 8: Asia Pacific Anti-Reflective Coatings Market Volume (Kiloton), by Application 2025 & 2033

- Figure 9: Asia Pacific Anti-Reflective Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Anti-Reflective Coatings Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Anti-Reflective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Anti-Reflective Coatings Market Volume (Kiloton), by Country 2025 & 2033

- Figure 13: Asia Pacific Anti-Reflective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Anti-Reflective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Anti-Reflective Coatings Market Revenue (Million), by Deposition Method 2025 & 2033

- Figure 16: North America Anti-Reflective Coatings Market Volume (Kiloton), by Deposition Method 2025 & 2033

- Figure 17: North America Anti-Reflective Coatings Market Revenue Share (%), by Deposition Method 2025 & 2033

- Figure 18: North America Anti-Reflective Coatings Market Volume Share (%), by Deposition Method 2025 & 2033

- Figure 19: North America Anti-Reflective Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 20: North America Anti-Reflective Coatings Market Volume (Kiloton), by Application 2025 & 2033

- Figure 21: North America Anti-Reflective Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Anti-Reflective Coatings Market Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Anti-Reflective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Anti-Reflective Coatings Market Volume (Kiloton), by Country 2025 & 2033

- Figure 25: North America Anti-Reflective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Anti-Reflective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Anti-Reflective Coatings Market Revenue (Million), by Deposition Method 2025 & 2033

- Figure 28: Europe Anti-Reflective Coatings Market Volume (Kiloton), by Deposition Method 2025 & 2033

- Figure 29: Europe Anti-Reflective Coatings Market Revenue Share (%), by Deposition Method 2025 & 2033

- Figure 30: Europe Anti-Reflective Coatings Market Volume Share (%), by Deposition Method 2025 & 2033

- Figure 31: Europe Anti-Reflective Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Europe Anti-Reflective Coatings Market Volume (Kiloton), by Application 2025 & 2033

- Figure 33: Europe Anti-Reflective Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Anti-Reflective Coatings Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Anti-Reflective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Anti-Reflective Coatings Market Volume (Kiloton), by Country 2025 & 2033

- Figure 37: Europe Anti-Reflective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Anti-Reflective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Anti-Reflective Coatings Market Revenue (Million), by Deposition Method 2025 & 2033

- Figure 40: South America Anti-Reflective Coatings Market Volume (Kiloton), by Deposition Method 2025 & 2033

- Figure 41: South America Anti-Reflective Coatings Market Revenue Share (%), by Deposition Method 2025 & 2033

- Figure 42: South America Anti-Reflective Coatings Market Volume Share (%), by Deposition Method 2025 & 2033

- Figure 43: South America Anti-Reflective Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 44: South America Anti-Reflective Coatings Market Volume (Kiloton), by Application 2025 & 2033

- Figure 45: South America Anti-Reflective Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Anti-Reflective Coatings Market Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Anti-Reflective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Anti-Reflective Coatings Market Volume (Kiloton), by Country 2025 & 2033

- Figure 49: South America Anti-Reflective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Anti-Reflective Coatings Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Anti-Reflective Coatings Market Revenue (Million), by Deposition Method 2025 & 2033

- Figure 52: Middle East and Africa Anti-Reflective Coatings Market Volume (Kiloton), by Deposition Method 2025 & 2033

- Figure 53: Middle East and Africa Anti-Reflective Coatings Market Revenue Share (%), by Deposition Method 2025 & 2033

- Figure 54: Middle East and Africa Anti-Reflective Coatings Market Volume Share (%), by Deposition Method 2025 & 2033

- Figure 55: Middle East and Africa Anti-Reflective Coatings Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Anti-Reflective Coatings Market Volume (Kiloton), by Application 2025 & 2033

- Figure 57: Middle East and Africa Anti-Reflective Coatings Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Anti-Reflective Coatings Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Anti-Reflective Coatings Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Anti-Reflective Coatings Market Volume (Kiloton), by Country 2025 & 2033

- Figure 61: Middle East and Africa Anti-Reflective Coatings Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Anti-Reflective Coatings Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Deposition Method 2020 & 2033

- Table 2: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Deposition Method 2020 & 2033

- Table 3: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Application 2020 & 2033

- Table 5: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Deposition Method 2020 & 2033

- Table 8: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Deposition Method 2020 & 2033

- Table 9: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Application 2020 & 2033

- Table 11: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 13: China Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 15: India Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 17: Japan Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 19: South Korea Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 21: Malaysia Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Malaysia Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 23: Thailand Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Thailand Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: Vietnam Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Deposition Method 2020 & 2033

- Table 32: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Deposition Method 2020 & 2033

- Table 33: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Application 2020 & 2033

- Table 35: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 37: United States Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United States Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Canada Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Canada Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Mexico Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Mexico Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Deposition Method 2020 & 2033

- Table 44: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Deposition Method 2020 & 2033

- Table 45: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Application 2020 & 2033

- Table 47: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 49: Germany Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Germany Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 53: France Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: France Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 55: Italy Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Italy Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 57: Spain Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Spain Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 59: NORDIC countries Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: NORDIC countries Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 61: Turkey Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 63: Russia Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Russia Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 65: Rest of Europe Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Europe Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 67: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Deposition Method 2020 & 2033

- Table 68: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Deposition Method 2020 & 2033

- Table 69: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 70: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Application 2020 & 2033

- Table 71: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 73: Brazil Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 75: Argentina Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 77: Colombia Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Colombia Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 79: Rest of South America Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of South America Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 81: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Deposition Method 2020 & 2033

- Table 82: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Deposition Method 2020 & 2033

- Table 83: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Application 2020 & 2033

- Table 84: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Application 2020 & 2033

- Table 85: Global Anti-Reflective Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 86: Global Anti-Reflective Coatings Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 87: Saudi Arabia Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Saudi Arabia Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 89: Qatar Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Qatar Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 91: United Arab Emirates Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: United Arab Emirates Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 93: Nigeria Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: Nigeria Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 95: Egypt Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Egypt Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 97: South Africa Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Africa Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 99: Rest of Middle East and Africa Anti-Reflective Coatings Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: Rest of Middle East and Africa Anti-Reflective Coatings Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti-Reflective Coatings Market?

The projected CAGR is approximately 6.22%.

2. Which companies are prominent players in the Anti-Reflective Coatings Market?

Key companies in the market include Honeywell International Inc, Edmund Optics Inc, Spectrum Direct Ltd, DuPont, Optimum RX Group, Viavi Solutions, Majestic Optical Coatings, HOYA VISION CARE COMPANY (HOYA Corporation), ESSILOR OF AMERICA LLC, EKSMA Optics USB, Optical Coatings Japan, PPG Industries, Rodenstock GmbH, AGC Inc, COCO LENI, Torr Scientific Ltd, Zygo Corporatio, Quantum Coating, AccuCoat Inc, Zeiss International, Evaporated Coatings Inc, Optics Balzers AG.

3. What are the main segments of the Anti-Reflective Coatings Market?

The market segments include Deposition Method, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Eyewear Applications; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Eyewear Application.

7. Are there any restraints impacting market growth?

High Cost of Anti-reflective Coatings; Dearth of Awareness.

8. Can you provide examples of recent developments in the market?

February 2022: Zygo Corporation, a company engaged in manufacturing optical metrology and optical component, announced the opening of a new office in Italy, building upon its extensive network of offices and partnerships throughout Europe for expanding its business, including anti-reflective coatings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti-Reflective Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti-Reflective Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti-Reflective Coatings Market?

To stay informed about further developments, trends, and reports in the Anti-Reflective Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence