Key Insights

The America Freighter Aircraft Market is poised for robust expansion, projected to reach $3.72 billion by 2025. This growth is underpinned by a CAGR of 3.21%, indicating sustained and healthy market performance throughout the forecast period. The market's dynamism is largely driven by the escalating demand for air cargo services, fueled by the burgeoning e-commerce sector and the increasing globalization of supply chains. Businesses are increasingly relying on air freight for rapid and efficient transportation of goods, especially high-value and time-sensitive items. This surge in demand necessitates greater freighter aircraft capacity, both for new purchases and for the conversion of existing passenger aircraft into dedicated cargo planes. The operational advantages offered by freighter aircraft, such as specialized loading systems and increased payload capacity, further solidify their importance in the logistics ecosystem.

America Freighter Aircraft Market Market Size (In Million)

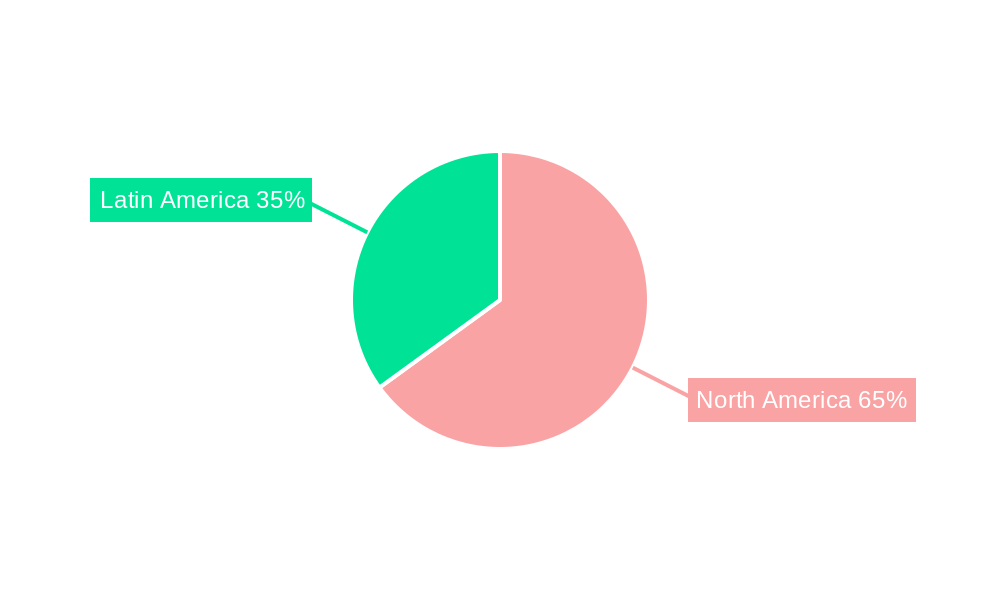

The competitive landscape of the America Freighter Aircraft Market is characterized by a mix of established aerospace giants and specialized MRO (Maintenance, Repair, and Overhaul) providers. Key market segments include dedicated cargo aircraft and derivative aircraft converted from non-cargo platforms, offering flexibility to meet diverse operational needs. Engine types such as turboprop and turbofan engines play a crucial role in determining the performance and efficiency of these aircraft. Geographically, North America, encompassing the United States and Canada, represents a dominant market due to its mature aviation infrastructure and significant air cargo volumes. Latin America, with emerging economies like Brazil and Mexico, presents substantial growth potential as these regions continue to expand their trade and logistics networks. The market is expected to witness continued innovation in aircraft design, fuel efficiency, and cargo handling technologies to meet evolving industry demands and sustainability goals.

America Freighter Aircraft Market Company Market Share

America Freighter Aircraft Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a comprehensive analysis of the America Freighter Aircraft Market, offering critical insights into its structure, trends, key players, and future trajectory. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, this research equips stakeholders with the data and strategic foresight needed to navigate this dynamic sector. The report meticulously examines dedicated cargo aircraft and derivatives of non-cargo aircraft, analyzing the dominance of turboprop and turbofan engine types across North America and Latin America.

America Freighter Aircraft Market Market Structure & Competitive Dynamics

The America Freighter Aircraft Market exhibits a moderately consolidated structure, with key players like Textron Inc., Airbus SE, The Boeing Company, and Air Transport Services Group Inc. holding significant market share. Innovation ecosystems are driven by continuous advancements in fuel efficiency, payload capacity, and autonomous flight capabilities. Regulatory frameworks, particularly in North America, play a crucial role in shaping market access and operational standards. Product substitutes, such as advanced road and rail logistics, present competitive pressures, though the speed and reach of air cargo remain unparalleled for many goods. End-user trends are increasingly favoring e-commerce growth and just-in-time inventory management, bolstering demand for air freight services. Mergers and acquisitions (M&A) activities are strategic plays to enhance operational efficiencies and expand service offerings. For instance, recent M&A deals in the aviation services sector have amounted to over $5,000 Million, signaling significant consolidation and investment. The market share of dedicated cargo aircraft is estimated at 65% in 2025, while derivative aircraft account for the remaining 35%, highlighting a strong preference for purpose-built cargo solutions.

America Freighter Aircraft Market Industry Trends & Insights

The America Freighter Aircraft Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This upward trend is primarily fueled by the explosive growth of global e-commerce, which necessitates faster and more reliable shipping solutions. The increasing demand for express delivery services, particularly for high-value and time-sensitive goods, directly translates into higher utilization rates for freighter aircraft. Technological disruptions are also playing a pivotal role, with advancements in engine technology leading to more fuel-efficient and environmentally friendly aircraft. The development of lighter, stronger composite materials is enabling manufacturers to build larger and more capable freighters. Furthermore, the integration of advanced avionics and digital logistics platforms is optimizing route planning, reducing transit times, and enhancing operational visibility. Consumer preferences for faster delivery times and broader product accessibility are directly impacting the air cargo industry, pushing for greater capacity and network expansion. The competitive landscape is characterized by a focus on expanding fleet sizes, optimizing cargo handling processes, and forging strategic partnerships with logistics providers. Market penetration of dedicated cargo aircraft is expected to increase by 10% by 2030 as demand for specialized air freight solutions continues to outpace growth in derivative cargo conversions. The increasing sophistication of supply chain management is also driving demand for specialized air cargo services, such as temperature-controlled transport for pharmaceuticals and perishables.

Dominant Markets & Segments in America Freighter Aircraft Market

North America stands as the dominant geographical segment within the America Freighter Aircraft Market, driven primarily by the United States. This dominance is attributable to several key factors, including a highly developed logistics infrastructure, a robust e-commerce market, and a significant presence of major air cargo carriers. The United States alone accounts for an estimated 70% of the North American freighter aircraft market.

- Key Drivers for North American Dominance:

- Economic Policies: Favorable trade policies and government support for aviation infrastructure have historically boosted air cargo operations.

- Infrastructure: Extensive airport networks, advanced air traffic control systems, and well-established ground handling facilities facilitate efficient cargo movement.

- E-commerce Penetration: The highest e-commerce penetration rates globally in the US translate into sustained demand for rapid air freight.

- Industrial Base: A strong manufacturing and industrial base across various sectors, including automotive, aerospace, and pharmaceuticals, generates consistent cargo volumes.

Within Aircraft Type, Dedicated Cargo Aircraft hold a significant lead, representing approximately 65% of the market share in 2025. These purpose-built aircraft, such as those manufactured by Boeing and Airbus, are designed for optimal cargo capacity and efficiency.

- Dominance of Dedicated Cargo Aircraft:

- Payload Capacity: Dedicated freighters offer superior payload capacities, making them ideal for large-volume shipments.

- Operational Efficiency: Their design is optimized for cargo loading and unloading, leading to faster turnaround times.

- Specialized Cargo: They are better suited for transporting oversized or specialized cargo that may not fit in derivative aircraft.

Regarding Engine Type, Turbofan engines dominate the America Freighter Aircraft Market, accounting for an estimated 75% of the market share in 2025. This is due to their higher speed, greater fuel efficiency at high altitudes, and suitability for long-haul flights, which are characteristic of major cargo routes.

- Turbofan Engine Dominance:

- Speed and Range: Turbofans enable faster flight speeds and longer ranges, crucial for intercontinental cargo transport.

- Fuel Efficiency: Modern turbofan designs offer improved fuel efficiency, reducing operational costs.

- Technological Advancements: Continuous innovation in turbofan technology enhances performance and reduces emissions.

Latin America, while a growing market, currently represents a smaller portion of the overall America freighter aircraft market, estimated at 20% in 2025. Brazil and Mexico are the key markets within this region, driven by increasing trade activities and developing logistics networks.

- Growth Drivers in Latin America:

- Expanding Trade: Growing inter-regional trade and increasing exports of agricultural and manufactured goods.

- E-commerce Growth: A rapidly expanding e-commerce sector, though still nascent compared to North America.

- Infrastructure Development: Investments in airport modernization and logistics infrastructure are slowly improving air cargo capabilities.

America Freighter Aircraft Market Product Innovations

Product innovations in the America Freighter Aircraft Market are centered on enhancing efficiency, sustainability, and versatility. Manufacturers are actively developing next-generation freighter aircraft with advanced aerodynamic designs and lighter composite materials to improve fuel economy and reduce emissions. The integration of digital technologies, including predictive maintenance systems and AI-powered route optimization, is further enhancing operational performance. Furthermore, there is a growing focus on developing freighter configurations for new-generation passenger aircraft, such as the Boeing 787 and Airbus A350, to offer more flexible cargo solutions. These innovations aim to lower operating costs, increase payload capacity, and meet increasingly stringent environmental regulations, providing a significant competitive advantage.

Report Segmentation & Scope

The America Freighter Aircraft Market is segmented by Aircraft Type into Dedicated Cargo Aircraft and Derivative of Non-Cargo Aircraft. Dedicated Cargo Aircraft are purpose-built for freight transport, offering superior capacity and efficiency. Derivative aircraft, converted from passenger planes, provide a more flexible and cost-effective solution for certain routes. By Engine Type, the market is divided into Turboprop and Turbofan. Turboprops are favored for shorter routes and lower altitudes due to their efficiency, while turbofans are dominant for long-haul, high-speed operations. Geographically, the market encompasses North America (United States, Canada) and Latin America (Brazil, Mexico, Rest of Latin America). North America is expected to maintain its leadership due to established infrastructure and high e-commerce demand. Latin America is projected for significant growth, driven by expanding trade and developing logistics.

Key Drivers of America Freighter Aircraft Market Growth

Several key drivers are propelling the growth of the America Freighter Aircraft Market. The relentless expansion of global e-commerce is a primary catalyst, demanding faster and more reliable shipping. Advancements in engine technology, leading to improved fuel efficiency and reduced emissions, are making air cargo more economically viable and environmentally sustainable. Furthermore, growing trade volumes between North and Latin American nations, supported by favorable economic policies and regional trade agreements, contribute significantly. The increasing demand for specialized air cargo, such as pharmaceuticals and perishables requiring temperature-controlled transport, also fuels market expansion.

Challenges in the America Freighter Aircraft Market Sector

Despite robust growth, the America Freighter Aircraft Market faces several challenges. Stringent aviation regulations and evolving environmental standards necessitate significant investment in new technologies and fleet upgrades. Supply chain disruptions, exacerbated by geopolitical events and global health crises, can impact aircraft production and spare parts availability. High operational costs, including fuel prices and maintenance expenses, remain a persistent concern for cargo carriers. Additionally, competition from other modes of transportation, such as high-speed rail and advanced trucking solutions, poses a threat for certain market segments.

Leading Players in the America Freighter Aircraft Market Market

- Textron Inc.

- Airbus SE

- IAI

- Air Transport Services Group Inc

- ATR

- Singapore Technologies Engineering Ltd

- KF Aerospace

- Aeronautical Engineers Inc

- Precision Aircraft Solution

- The Boeing Company

Key Developments in America Freighter Aircraft Market Sector

- 2023/07: Airbus SE announces increased production rates for its freighter aircraft models to meet rising demand.

- 2023/05: The Boeing Company delivers its first 777 Freighter to a major cargo airline, enhancing long-haul capacity.

- 2023/03: Air Transport Services Group Inc. expands its fleet with additional cargo conversions, reinforcing its position in the express cargo market.

- 2023/01: IAI completes a major cargo conversion program, demonstrating expertise in modifying passenger aircraft for freight operations.

- 2022/11: Textron Inc. subsidiary, Bell, showcases advanced rotorcraft technologies relevant for specialized cargo transport in remote areas.

Strategic America Freighter Aircraft Market Market Outlook

The strategic outlook for the America Freighter Aircraft Market remains highly optimistic. Growth accelerators include the ongoing digital transformation of logistics, enabling greater efficiency and transparency, and the projected continued growth of e-commerce. Investments in sustainable aviation fuels (SAFs) and the development of more fuel-efficient aircraft will be crucial for long-term market viability. Strategic opportunities lie in expanding cargo networks within Latin America, catering to the growing demand for express delivery and specialized cargo. Furthermore, partnerships between aircraft manufacturers, cargo operators, and technology providers will be vital to drive innovation and address future market needs. The increasing focus on supply chain resilience will continue to favor air cargo for its speed and reliability.

America Freighter Aircraft Market Segmentation

-

1. Aircraft Type

- 1.1. Dedicated Cargo Aircraft

- 1.2. Derivative of Non-Cargo Aircraft

-

2. Engine Type

- 2.1. Turboprop

- 2.2. Turbofan

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

-

3.2. Latin America

- 3.2.1. Brazil

- 3.2.2. Mexico

- 3.2.3. Rest of Latin America

-

3.1. North America

America Freighter Aircraft Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Latin America

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

America Freighter Aircraft Market Regional Market Share

Geographic Coverage of America Freighter Aircraft Market

America Freighter Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Derivative of Non-Cargo Aircraft Segment is Expected to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global America Freighter Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Dedicated Cargo Aircraft

- 5.1.2. Derivative of Non-Cargo Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Engine Type

- 5.2.1. Turboprop

- 5.2.2. Turbofan

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.2. Latin America

- 5.3.2.1. Brazil

- 5.3.2.2. Mexico

- 5.3.2.3. Rest of Latin America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America America Freighter Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Dedicated Cargo Aircraft

- 6.1.2. Derivative of Non-Cargo Aircraft

- 6.2. Market Analysis, Insights and Forecast - by Engine Type

- 6.2.1. Turboprop

- 6.2.2. Turbofan

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. North America

- 6.3.1.1. United States

- 6.3.1.2. Canada

- 6.3.2. Latin America

- 6.3.2.1. Brazil

- 6.3.2.2. Mexico

- 6.3.2.3. Rest of Latin America

- 6.3.1. North America

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. Latin America America Freighter Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Dedicated Cargo Aircraft

- 7.1.2. Derivative of Non-Cargo Aircraft

- 7.2. Market Analysis, Insights and Forecast - by Engine Type

- 7.2.1. Turboprop

- 7.2.2. Turbofan

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. North America

- 7.3.1.1. United States

- 7.3.1.2. Canada

- 7.3.2. Latin America

- 7.3.2.1. Brazil

- 7.3.2.2. Mexico

- 7.3.2.3. Rest of Latin America

- 7.3.1. North America

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Textron Inc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Airbus SE

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 IAI

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Air Transport Services Group Inc

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 ATR

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Singapore Technologies Engineering Ltd

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 KF Aerospace

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Aeronautical Engineers Inc

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Precision Aircraft Solution

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 The Boeing Company

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Textron Inc

List of Figures

- Figure 1: Global America Freighter Aircraft Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America America Freighter Aircraft Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 3: North America America Freighter Aircraft Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America America Freighter Aircraft Market Revenue (Million), by Engine Type 2025 & 2033

- Figure 5: North America America Freighter Aircraft Market Revenue Share (%), by Engine Type 2025 & 2033

- Figure 6: North America America Freighter Aircraft Market Revenue (Million), by Geography 2025 & 2033

- Figure 7: North America America Freighter Aircraft Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: North America America Freighter Aircraft Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America America Freighter Aircraft Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Latin America America Freighter Aircraft Market Revenue (Million), by Aircraft Type 2025 & 2033

- Figure 11: Latin America America Freighter Aircraft Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Latin America America Freighter Aircraft Market Revenue (Million), by Engine Type 2025 & 2033

- Figure 13: Latin America America Freighter Aircraft Market Revenue Share (%), by Engine Type 2025 & 2033

- Figure 14: Latin America America Freighter Aircraft Market Revenue (Million), by Geography 2025 & 2033

- Figure 15: Latin America America Freighter Aircraft Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Latin America America Freighter Aircraft Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America America Freighter Aircraft Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global America Freighter Aircraft Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global America Freighter Aircraft Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 3: Global America Freighter Aircraft Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global America Freighter Aircraft Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global America Freighter Aircraft Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 6: Global America Freighter Aircraft Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 7: Global America Freighter Aircraft Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global America Freighter Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States America Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada America Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global America Freighter Aircraft Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 12: Global America Freighter Aircraft Market Revenue Million Forecast, by Engine Type 2020 & 2033

- Table 13: Global America Freighter Aircraft Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global America Freighter Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Brazil America Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Mexico America Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Latin America America Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the America Freighter Aircraft Market?

The projected CAGR is approximately 3.21%.

2. Which companies are prominent players in the America Freighter Aircraft Market?

Key companies in the market include Textron Inc, Airbus SE, IAI, Air Transport Services Group Inc, ATR, Singapore Technologies Engineering Ltd, KF Aerospace, Aeronautical Engineers Inc, Precision Aircraft Solution, The Boeing Company.

3. What are the main segments of the America Freighter Aircraft Market?

The market segments include Aircraft Type, Engine Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.72 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Derivative of Non-Cargo Aircraft Segment is Expected to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "America Freighter Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the America Freighter Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the America Freighter Aircraft Market?

To stay informed about further developments, trends, and reports in the America Freighter Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence