Key Insights

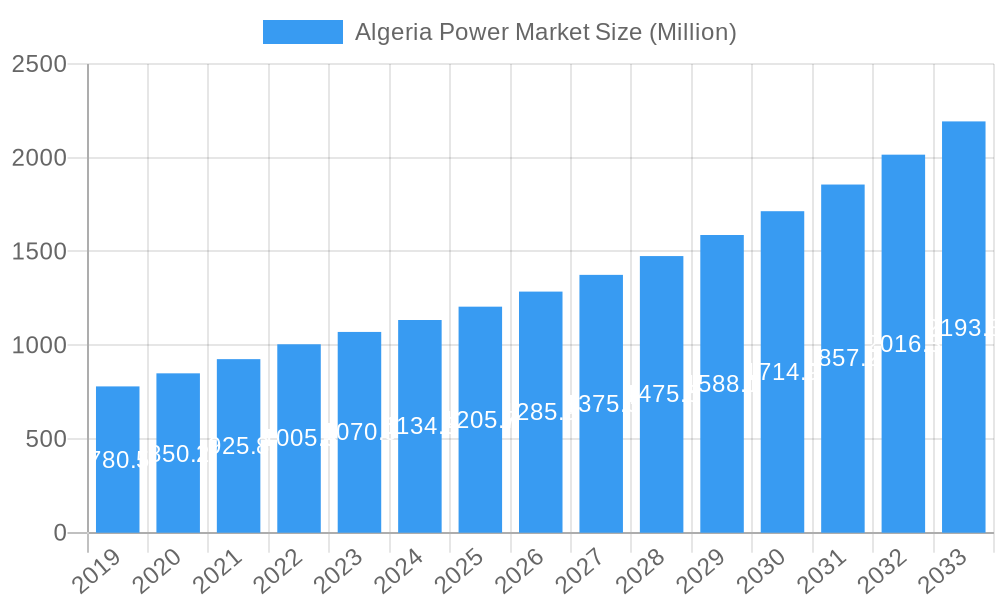

The Algerian power market is poised for significant expansion, driven by increasing energy demand and a strategic push towards renewable energy integration. With a projected market size of $1134.5 million in 2024, the sector is set to experience robust growth at a CAGR of 10.7% through 2033. This growth is primarily fueled by government initiatives aimed at diversifying the energy mix away from hydrocarbons, boosting domestic electricity generation capacity, and improving grid infrastructure to meet the needs of a growing population and industrial sector. The development of new power plants, including those powered by solar and wind energy, is a key strategic direction, attracting both domestic and international investment. This transition is not only crucial for meeting future energy needs but also for aligning with global sustainability goals and reducing the carbon footprint of Algeria's energy sector.

Algeria Power Market Market Size (In Million)

Several factors are shaping the trajectory of the Algerian power market. Key drivers include the burgeoning demand from residential, commercial, and industrial sectors, coupled with the government's commitment to enhancing energy security and independence. Emerging trends indicate a strong focus on the deployment of renewable energy sources, particularly solar photovoltaic (PV) technology, which benefits from Algeria's abundant sunshine. Investments in smart grid technologies and energy storage solutions are also gaining momentum, aiming to improve grid stability and efficiency. However, the market faces challenges such as the need for significant capital investment in infrastructure upgrades, regulatory hurdles, and the complexities associated with integrating intermittent renewable energy sources into the existing grid. Despite these restraints, the market's underlying growth potential, supported by favorable policies and increasing investor interest, paints a positive outlook for the Algerian power sector.

Algeria Power Market Company Market Share

This comprehensive report provides an exhaustive analysis of the Algeria Power Market, offering critical insights into market dynamics, trends, and future outlook. Covering the historical period from 2019 to 2024, a base and estimated year of 2025, and a robust forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the Algerian energy landscape. We delve into production, consumption, import/export markets, and price trends, supported by detailed segmentations and strategic recommendations.

Algeria Power Market Market Structure & Competitive Dynamics

The Algeria Power Market is characterized by a dynamic and evolving competitive landscape, with a moderate market concentration. Key players are actively engaged in expanding their footprints and enhancing their service offerings. Regulatory frameworks, primarily driven by the Ministry of Energy and Mines, play a pivotal role in shaping market entry, operational guidelines, and investment incentives, particularly for renewable energy projects. The increasing emphasis on energy diversification and the transition towards cleaner energy sources are fostering innovation ecosystems, encouraging the adoption of advanced technologies. While traditional fossil fuel-based power generation remains dominant, product substitutes, predominantly solar photovoltaic (PV) and wind energy, are gaining traction, driven by declining technology costs and government targets. End-user trends are leaning towards increased demand for reliable and affordable electricity, with industrial and residential sectors being major consumers. Merger and acquisition (M&A) activities, while not extensively prevalent, are observed as companies seek to consolidate their market positions and acquire specialized capabilities. For instance, strategic partnerships and smaller-scale asset acquisitions contribute to market consolidation. The overall market share distribution reflects the influence of established state-owned entities and emerging private sector participants.

Algeria Power Market Industry Trends & Insights

The Algeria Power Market is poised for significant growth, driven by a confluence of factors including robust economic development, an expanding population, and a strategic imperative to enhance energy security and diversification. The Compound Annual Growth Rate (CAGR) is projected to be substantial over the forecast period. A primary growth driver is the Algerian government's ambitious renewable energy targets, aimed at significantly increasing the share of solar and wind power in the national energy mix. This policy push, coupled with favorable solar irradiance levels across large swathes of the country, is attracting considerable investment in Algeria solar power market and Algeria wind energy market. Technological disruptions are at the forefront of market evolution, with advancements in solar panel efficiency, energy storage solutions, and smart grid technologies enabling more integrated and resilient power systems. The integration of these technologies is crucial for managing the intermittent nature of renewable energy sources and ensuring grid stability. Consumer preferences are shifting towards more sustainable and cost-effective energy solutions, although affordability remains a key consideration. The Algeria electricity market is witnessing increased demand from growing industrial sectors, including manufacturing, oil and gas, and mining, all of which require a stable and ample power supply. Competitive dynamics are intensifying as both domestic and international players vie for market share. The Algeria power generation market is a focal point for competition, with companies investing in new capacity and modernizing existing infrastructure. The Algeria power transmission and distribution market is also seeing strategic investments aimed at improving grid efficiency and reducing transmission losses, which are critical for overall market performance. Market penetration of renewable energy is expected to rise steadily, supported by government incentives and increasing private sector participation. The Algeria renewable energy market is thus becoming a significant segment, influencing the overall trajectory of the power sector.

Dominant Markets & Segments in Algeria Power Market

The Algeria Power Market exhibits distinct dominant trends across its various segments, driven by economic policies, infrastructure development, and resource availability.

Production Analysis:

- Dominant Source: Thermal power plants, primarily utilizing natural gas, continue to be the dominant source for electricity production in Algeria. This dominance is underpinned by Algeria's substantial natural gas reserves and established infrastructure for its extraction and utilization.

- Key Drivers: The government's long-term energy strategy, which aims to leverage domestic fossil fuel resources for domestic energy needs while diversifying export revenues, supports the continued reliance on thermal power. Furthermore, the need for baseload power generation to ensure grid stability favors this segment. The market size in this segment is projected to remain significant throughout the forecast period, contributing the majority of the Algeria power output.

Consumption Analysis:

- Dominant Sector: The industrial sector, encompassing oil and gas, manufacturing, and mining, represents the largest consumer of electricity in Algeria. Growing industrial activities and the energy-intensive nature of these operations drive this demand.

- Key Drivers: Economic diversification policies and industrialization initiatives are fueling increased electricity consumption in these sectors. The residential sector also represents a substantial and growing segment of consumption due to population growth and increasing access to electricity in rural areas. Understanding Algeria electricity consumption patterns is crucial for infrastructure planning and market development.

Import Market Analysis (Value & Volume):

- Dominant Products: While Algeria is a significant energy producer, the import market primarily comprises specialized equipment for power generation, transmission, and distribution, as well as certain types of fuels for specific industrial processes. For electricity itself, imports are minimal and situational.

- Key Drivers: The import of advanced power generation turbines, solar panels, wind turbine components, and smart grid technology is driven by the need to modernize the existing infrastructure and expand renewable energy capacity. The Algeria power equipment market is therefore heavily influenced by import dynamics. Import values are projected to be in the millions, driven by large-scale projects.

Export Market Analysis (Value & Volume):

- Dominant Products: Algeria's primary energy exports are crude oil and natural gas. While direct electricity exports are not a significant component, the nation's capacity to generate surplus energy supports its role as an energy provider in the broader region.

- Key Drivers: The export of energy resources is a cornerstone of Algeria's economy. The strategic location of Algeria and its potential to contribute to regional energy security could open avenues for future electricity-related exports, though this remains a nascent area. Export values are substantial, measured in billions of dollars, reflecting the global demand for its hydrocarbon resources.

Price Trend Analysis:

- Dominant Factors: Electricity prices in Algeria are largely regulated and influenced by government subsidies, production costs (especially natural gas prices), and investment in new capacity.

- Key Drivers: While end-user tariffs are kept relatively low through subsidies, industrial consumers may face different pricing structures. The increasing integration of renewables, with their declining operational costs, is expected to have a moderating influence on future price trends, particularly for newly developed power purchase agreements. Price trends for electricity generation are closely linked to the Algeria natural gas price.

Algeria Power Market Product Innovations

Innovations in the Algeria Power Market are primarily focused on enhancing the efficiency and sustainability of energy generation and distribution. The development and deployment of advanced solar photovoltaic (PV) technologies, including higher-efficiency panels and integrated energy storage solutions, are critical for increasing renewable energy penetration. Innovations in wind turbine technology, such as larger rotor diameters and enhanced aerodynamic designs, are also contributing to improved performance in Algeria's diverse wind regimes. Furthermore, the adoption of smart grid technologies, including advanced metering infrastructure (AMI) and demand-side management systems, is transforming grid operations, enabling better load balancing and reducing energy losses. These product innovations offer competitive advantages by improving reliability, reducing operational costs, and aligning with the nation's environmental goals.

Report Segmentation & Scope

This report segments the Algeria Power Market across several key areas for a comprehensive understanding. The Production Analysis examines generation capacity by source (thermal, solar, wind, hydro) and key players, with projected growth in renewable capacity. The Consumption Analysis breaks down electricity usage by sector (industrial, residential, commercial) and geographical regions, highlighting the increasing demand drivers. The Import Market Analysis quantifies the value and volume of imported power generation equipment and related technologies. The Export Market Analysis focuses on Algeria's role as an energy exporter and potential for future electricity-related exports. Finally, the Price Trend Analysis details historical and projected electricity tariffs and wholesale market prices, considering factors like fuel costs and subsidy policies. Each segment is analyzed within the study period of 2019–2033, providing detailed market sizes, growth projections, and competitive dynamics.

Key Drivers of Algeria Power Market Growth

The Algeria Power Market's growth is propelled by a robust set of drivers. Strategically, the Algerian government's ambitious renewable energy targets, aiming for a significant contribution from solar and wind power, are a primary catalyst. Economic diversification policies and increasing industrialization are boosting electricity demand from key sectors like manufacturing and mining. Furthermore, the nation's abundant natural gas reserves provide a stable and cost-effective fuel source for conventional power generation, ensuring baseload supply. Technological advancements in renewable energy technologies, leading to lower costs and improved efficiency, are making solar and wind power increasingly competitive. Lastly, ongoing investments in grid modernization and infrastructure development are essential for accommodating growing demand and integrating new energy sources.

Challenges in the Algeria Power Market Sector

Despite its growth potential, the Algeria Power Market faces several challenges. Regulatory hurdles and bureaucratic complexities can slow down project development and foreign investment, particularly in the renewable energy sector. Supply chain issues, including the availability of specialized equipment and skilled labor, can impact project timelines and costs. The intermittency of renewable energy sources like solar and wind necessitates significant investment in grid infrastructure and energy storage solutions to ensure reliable power supply. Furthermore, competitive pressures from established fossil fuel-based generation and the need to manage fluctuating global energy prices present ongoing challenges for market participants. Overcoming these barriers is crucial for sustained market expansion and achieving energy security goals.

Leading Players in the Algeria Power Market Market

- Algerian PV Company Sarl

- Eni Spa

- Shariket Kahraba Koudiet Eddraouche

- SOLIWIND Algérie Sarl

- Algerian Energy Company Spa

- General Electric Company

- Condor Electronics SPA

Key Developments in Algeria Power Market Sector

- 2023/January: Algeria announces ambitious plans to tender new solar power projects, aiming to add significant renewable capacity.

- 2022/November: Sonelgaz (Algerian Electric and Gas Company) signs several agreements for the development of new natural gas-fired power plants to meet growing demand.

- 2022/June: Eni Spa announces plans to invest in green hydrogen projects in Algeria, signaling a move towards decarbonization.

- 2021/October: General Electric Company delivers advanced turbines for a new power plant, enhancing Algeria's thermal generation capacity.

- 2020/March: SOLIWIND Algérie Sarl secures a contract for the installation of wind turbines in a key region, contributing to Algeria's wind energy portfolio.

Strategic Algeria Power Market Market Outlook

The strategic outlook for the Algeria Power Market is exceptionally promising, driven by a confluence of government commitment, resource availability, and technological advancements. The continued focus on renewable energy integration, particularly solar power, presents substantial growth accelerators. Investments in smart grid technologies and energy storage will further enhance grid stability and efficiency, paving the way for greater renewable penetration. Opportunities exist for partnerships and joint ventures that leverage international expertise with local knowledge, accelerating project execution and technology transfer. The development of hybrid power plants and the exploration of green hydrogen production represent exciting future avenues. Overall, the Algerian power sector is poised for sustained expansion and modernization, offering significant strategic opportunities for stakeholders in the coming years.

Algeria Power Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Algeria Power Market Segmentation By Geography

- 1. Algeria

Algeria Power Market Regional Market Share

Geographic Coverage of Algeria Power Market

Algeria Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Replacement of Existing Grids and the Expansion of Distribution Networks

- 3.3. Market Restrains

- 3.3.1. High Installation Costs

- 3.4. Market Trends

- 3.4.1. Non-hydropower Renewables Energy Generation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Algeria Power Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Algeria

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Algerian PV Company Sarl

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eni Spa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shariket Kahraba Koudiet Eddraouche

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SOLIWIND Algérie Sarl

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Algerian Energy Company Spa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Electric Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Condor Electronics SPA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Algerian PV Company Sarl

List of Figures

- Figure 1: Algeria Power Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Algeria Power Market Share (%) by Company 2025

List of Tables

- Table 1: Algeria Power Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Algeria Power Market Volume Gigawatt Forecast, by Production Analysis 2020 & 2033

- Table 3: Algeria Power Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Algeria Power Market Volume Gigawatt Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Algeria Power Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Algeria Power Market Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Algeria Power Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Algeria Power Market Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Algeria Power Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Algeria Power Market Volume Gigawatt Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Algeria Power Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: Algeria Power Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 13: Algeria Power Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 14: Algeria Power Market Volume Gigawatt Forecast, by Production Analysis 2020 & 2033

- Table 15: Algeria Power Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Algeria Power Market Volume Gigawatt Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Algeria Power Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Algeria Power Market Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Algeria Power Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Algeria Power Market Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Algeria Power Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Algeria Power Market Volume Gigawatt Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Algeria Power Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Algeria Power Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algeria Power Market?

The projected CAGR is approximately 10.7%.

2. Which companies are prominent players in the Algeria Power Market?

Key companies in the market include Algerian PV Company Sarl, Eni Spa, Shariket Kahraba Koudiet Eddraouche, SOLIWIND Algérie Sarl, Algerian Energy Company Spa, General Electric Company, Condor Electronics SPA.

3. What are the main segments of the Algeria Power Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Replacement of Existing Grids and the Expansion of Distribution Networks.

6. What are the notable trends driving market growth?

Non-hydropower Renewables Energy Generation to Dominate the Market.

7. Are there any restraints impacting market growth?

High Installation Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algeria Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algeria Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algeria Power Market?

To stay informed about further developments, trends, and reports in the Algeria Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence