Key Insights

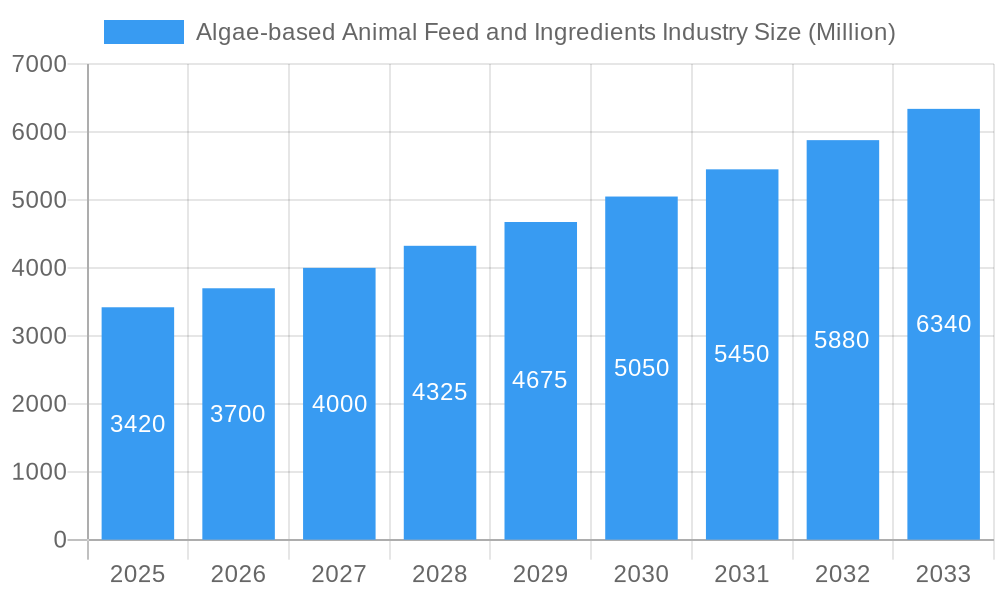

The Algae-based Animal Feed and Ingredients Market is poised for significant expansion, driven by a growing global demand for sustainable and nutrient-rich animal nutrition solutions. With a market size of USD 3,420 million in 2025, this sector is projected to witness a robust CAGR of 8.11% over the forecast period of 2025-2033. This growth trajectory is fueled by increasing awareness among livestock producers and pet owners regarding the health benefits of algae-derived ingredients. Omega-3 fatty acids and PUFAs derived from algae are highly sought after for their role in improving animal health, immune function, and the nutritional profile of animal products. Furthermore, the increasing adoption of algae-based ingredients in pharmaceuticals and cosmetics, attributed to their antioxidant and anti-inflammatory properties, is also contributing to market expansion. The drive towards reducing the environmental footprint of animal agriculture by exploring alternative feed sources further strengthens the market's potential.

Algae-based Animal Feed and Ingredients Industry Market Size (In Billion)

Several key trends are shaping the algae-based animal feed and ingredients landscape. The emphasis on functional ingredients that enhance animal performance and product quality is a primary driver. Carrageenan and alginate, derived from seaweed, are gaining traction as natural thickeners, stabilizers, and gelling agents in the food industry, with spillover effects into animal feed applications. The market is also witnessing innovation in cultivation techniques and processing technologies, leading to improved efficiency and cost-effectiveness in algae production. Key players such as Dupont, Archer Daniels Midland Company, BASF SE, and Koninklijke DSM N.V. are actively investing in research and development, forging strategic partnerships, and expanding their product portfolios to capture market share. While the market is generally optimistic, certain restraints, such as the relatively high cost of some algae-derived ingredients compared to conventional alternatives and the need for greater consumer and industry education on the benefits of algae-based products, need to be addressed for sustained growth.

Algae-based Animal Feed and Ingredients Industry Company Market Share

Algae-based Animal Feed and Ingredients Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a meticulous examination of the global algae-based animal feed and ingredients market, offering critical insights into its structure, trends, and future trajectory. Spanning from 2019 to 2033, with a base year of 2025, this analysis covers historical performance, current market dynamics, and robust forecasts. It delves into the burgeoning demand for sustainable and nutrient-rich animal feed alternatives, highlighting the significant role of algae in enhancing animal health, productivity, and reducing the environmental footprint of the livestock industry. This report is an indispensable resource for stakeholders seeking to understand market concentration, innovation, regulatory landscapes, competitive strategies, and emerging opportunities within this rapidly evolving sector.

Algae-based Animal Feed and Ingredients Industry Market Structure & Competitive Dynamics

The algae-based animal feed and ingredients market exhibits a dynamic and evolving structure, characterized by a mix of established global players and innovative startups. Market concentration is moderately fragmented, with key companies like Dupont, Archer Daniels Midland Company, BASF SE, and Cargill Inc. holding significant stakes, particularly in the production of bulk algae-derived ingredients and animal feed additives. However, specialized segments, such as high-value omega-3 fatty acid production and niche ingredient applications, see increased competition from specialized entities like Algavia and Fuji Chemical Industries Co Ltd. The innovation ecosystem is robust, driven by ongoing research and development in algae cultivation, extraction technologies, and novel application development. Regulatory frameworks are becoming more defined, with a growing emphasis on feed safety, sustainability certifications, and efficacy studies for algae-based products. Product substitutes, primarily from traditional feed sources like soy and fishmeal, are present but face increasing scrutiny due to sustainability and nutritional concerns. End-user trends are strongly leaning towards natural, traceable, and high-performance feed ingredients, driving demand for algae. Merger and acquisition (M&A) activities are anticipated to increase as larger corporations seek to integrate advanced algae technologies and secure supply chains. M&A deal values are projected to escalate, particularly for companies with proprietary cultivation methods and significant market penetration.

Algae-based Animal Feed and Ingredients Industry Industry Trends & Insights

The algae-based animal feed and ingredients industry is experiencing a period of significant expansion and transformation, driven by a confluence of potent market growth drivers. A paramount trend is the escalating global demand for sustainable and environmentally friendly animal protein production. As concerns about the environmental impact of conventional feed sources like soy (deforestation) and fishmeal (overfishing) intensify, algae emerges as a highly sustainable alternative with a significantly lower ecological footprint, requiring less land and water. This aligns perfectly with growing consumer preferences for ethically produced food products, creating a pull effect for algae-based ingredients in animal diets.

Technological disruptions are revolutionizing algae cultivation and processing. Advances in bioreactor technology, photobioreactors, and open pond systems are improving yield, efficiency, and scalability. Furthermore, sophisticated extraction techniques are enabling the isolation of high-value compounds like omega-3 fatty acids (EPA and DHA), phycocyanin, and polysaccharides with enhanced bioavailability and efficacy. These technological leaps are not only lowering production costs but also expanding the range of applications for algae-derived products.

Consumer preferences are increasingly prioritizing animal health and welfare. Algae's rich nutritional profile, including essential amino acids, vitamins, minerals, antioxidants, and omega-3 fatty acids, makes it an ideal ingredient for boosting immune systems, improving gut health, and enhancing the overall well-being of livestock, poultry, and aquaculture. This translates to improved feed conversion ratios, reduced reliance on antibiotics, and higher quality end-products for human consumption. The market penetration of algae-based ingredients is steadily rising across various animal species.

Competitive dynamics are characterized by a strategic focus on R&D, vertical integration, and partnerships. Companies are investing heavily in developing proprietary strains of algae, optimizing cultivation processes, and securing long-term supply agreements. The development of specialized algae formulations tailored to the specific nutritional needs of different animal species and life stages is a key differentiator. Strategic collaborations between algae producers, feed manufacturers, and research institutions are crucial for accelerating product development and market adoption. The projected Compound Annual Growth Rate (CAGR) for the algae-based animal feed and ingredients market is expected to be robust, estimated at over 15% during the forecast period, underscoring its immense growth potential.

Dominant Markets & Segments in Algae-based Animal Feed and Ingredients Industry

The algae-based animal feed and ingredients industry is witnessing significant growth across various geographical regions and product segments, with a pronounced dominance in certain areas.

Ingredient Type Dominance:

- Dried Algae: This segment holds a substantial market share due to its versatility and widespread use as a nutritional supplement in animal feed. Its cost-effectiveness and ease of integration into existing feed formulations make it a preferred choice for many manufacturers.

- Key Drivers: High protein content, presence of essential amino acids, cost-effectiveness for large-scale animal farming, and established supply chains.

- Omega-3 Fatty Acids and PUFA (Polyunsaturated Fatty Acids): This segment is experiencing rapid expansion, driven by the recognized health benefits for animals, including improved immune function, reduced inflammation, and enhanced reproductive performance, particularly in aquaculture and poultry.

- Key Drivers: Growing awareness of the health benefits of omega-3s for animal welfare, demand for antibiotic-free animal products, and technological advancements in extraction and purification.

- Carageenan and Alginate: While these have traditional applications in food and pharmaceuticals, their role in animal feed is growing. Carageenan can act as a binder and emulsifier, while alginates can contribute to gut health and potentially have prebiotic effects.

- Key Drivers: Functional properties in feed processing, potential health benefits in animal digestion, and exploration of novel applications.

- Others: This category encompasses a wide array of algae-derived bioactive compounds, pigments (like astaxanthin), and functional ingredients with specific applications, which are gaining traction as research uncovers their unique benefits.

Application Dominance:

- Animal Nutrition: This is by far the largest and fastest-growing application segment. Algae-based ingredients are increasingly incorporated into feed formulations for poultry, swine, cattle, and aquaculture. The demand for sustainable, nutrient-dense, and health-promoting feed is the primary catalyst.

- Key Drivers: Increasing global demand for animal protein, rising awareness of animal health and welfare, regulatory pressures to reduce antibiotic use, and the need for sustainable feed alternatives.

- Food & Pharmaceuticals: While not directly animal feed, these sectors influence the overall algae market by driving innovation in extraction and purification, which can then be leveraged for animal feed applications.

- Cosmetics & Others: These segments contribute to the broader algae market, driving research into bioactive compounds that could potentially find future applications in animal health.

Regional Dominance:

The Asia-Pacific region is projected to be a dominant market, driven by its large livestock population, rapidly growing demand for animal protein, and increasing adoption of advanced feed technologies. Countries like China and India are significant contributors to this growth. North America and Europe also represent substantial markets, driven by advanced R&D, stringent regulations favoring sustainable practices, and a well-established aquaculture industry. The focus on high-value ingredients and specialized applications is particularly strong in these developed regions. Economic policies supporting sustainable agriculture and aquaculture, coupled with robust infrastructure for production and distribution, are crucial determinants of regional market strength.

Algae-based Animal Feed and Ingredients Industry Product Innovations

Product innovations in the algae-based animal feed and ingredients market are centered on enhancing nutritional value, improving efficacy, and developing specialized applications. Companies are focusing on proprietary strains of microalgae and macroalgae rich in omega-3 fatty acids (EPA/DHA), carotenoids, and essential amino acids, specifically for aquaculture, poultry, and swine diets. Innovations include encapsulated algae ingredients for targeted nutrient delivery and improved stability, as well as blends optimized for specific animal life stages and health needs. Technological advancements in extraction and purification are yielding highly bioavailable and potent extracts for functional feed additives, such as immune boosters and gut health promoters. The competitive advantage lies in developing cost-effective, scalable production methods and demonstrating clear performance benefits and health outcomes in animals.

Report Segmentation & Scope

This report meticulously segments the global algae-based animal feed and ingredients market to provide granular insights into its various facets.

The market is segmented by Ingredient Type into:

- Dried Algae: This segment includes whole dried algae biomass used as a direct feed ingredient. Growth projections indicate continued expansion due to its cost-effectiveness and nutritional density.

- Omega-3 Fatty Acids and PUFA: Focusing on eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA) derived from algae, this segment is poised for significant growth driven by health benefits, especially in aquaculture and poultry.

- Carageenan: Extracted from red seaweed, carrageenan serves as a functional ingredient, and its market in animal feed is expected to grow due to its binding and emulsifying properties.

- Alginate: Derived from brown seaweed, alginates are gaining traction for their potential role in animal gut health and as functional feed additives.

- Others: This encompasses a diverse range of algae-derived compounds like phycocyanin, astaxanthin, and other bioactive ingredients with emerging applications.

The market is also segmented by Application into:

- Animal Nutrition: This is the largest segment, encompassing all applications in the feed for livestock, poultry, and aquaculture. It is projected to exhibit robust growth due to increasing demand for sustainable and healthy animal feed.

- Food: While not direct animal feed, advancements in algae for human consumption indirectly impact the industry through R&D and scale.

- Pharmaceuticals: Algae's therapeutic properties are being explored, and discoveries can translate to animal health applications.

- Cosmetics: Similar to food and pharmaceuticals, innovation here drives overall algae R&D.

Key Drivers of Algae-based Animal Feed and Ingredients Industry Growth

The algae-based animal feed and ingredients industry is propelled by several key drivers. Foremost is the increasing global demand for sustainable animal protein, pushing for alternatives to conventional feed sources like soy and fishmeal. Growing consumer awareness regarding the health and environmental benefits of algae-derived products is a significant catalyst. Technological advancements in algae cultivation, such as improved bioreactor designs and efficient extraction methods, are enhancing scalability and reducing production costs. Furthermore, the rising focus on animal health and welfare, coupled with regulatory pressures to reduce antibiotic usage in livestock, creates a strong demand for nutrient-dense and immune-boosting algae ingredients. The inherent nutritional profile of algae, rich in omega-3 fatty acids, proteins, vitamins, and minerals, makes it a compelling ingredient for improving animal productivity and well-being.

Challenges in the Algae-based Animal Feed and Ingredients Industry Sector

Despite its promising growth, the algae-based animal feed and ingredients industry sector faces certain challenges. Scaling up production to meet global demand sustainably and cost-effectively remains a significant hurdle. Fluctuations in raw material availability and consistency due to environmental factors can impact supply chains. The high initial investment required for advanced cultivation and processing technologies can be a barrier for smaller players. Regulatory hurdles in different regions, concerning feed safety, labeling, and novel ingredient approvals, can slow down market penetration. Consumer acceptance and education regarding the benefits and use of algae in animal feed also need continuous effort. Competitive pressures from established feed ingredients and the need for extensive R&D to prove efficacy and ROI for specific animal applications also present challenges.

Leading Players in the Algae-based Animal Feed and Ingredients Industry Market

- Dupont

- Algavia

- Archer Daniels Midland Company

- BASF SE

- Koninklijke DSM N V

- Fuji Chemical Industries Co Ltd

- Cargill Inc

- Roquette Freres

Key Developments in Algae-based Animal Feed and Ingredients Industry Sector

- 2023 October: Launch of a new range of microalgae-based feed additives for aquaculture, focusing on immune enhancement.

- 2023 July: Strategic partnership formed between a leading algae producer and a major feed manufacturer to develop specialized poultry feed formulations.

- 2022 December: Significant investment in R&D for developing sustainable omega-3 production from algae for poultry feed.

- 2022 August: Introduction of an innovative extraction technology to enhance the bioavailability of algae-derived nutrients for animal nutrition.

- 2021 November: Acquisition of a specialized algae cultivation company by a multinational agribusiness to expand its sustainable ingredient portfolio.

- 2021 May: Release of a study demonstrating improved feed conversion ratios in swine fed with algae-based supplements.

- 2020 September: Expansion of production capacity for dried algae biomass to meet growing demand in livestock feed.

Strategic Algae-based Animal Feed and Ingredients Industry Market Outlook

The strategic outlook for the algae-based animal feed and ingredients industry is exceptionally positive, characterized by robust growth accelerators and significant market potential. The increasing global demand for sustainable and healthy animal protein is a primary growth engine, driving the adoption of algae as a superior alternative to conventional feed ingredients. Advancements in biotechnology are continuously enhancing the efficiency and cost-effectiveness of algae cultivation and extraction, making these products more accessible. Furthermore, a growing emphasis on animal welfare and a desire to reduce antibiotic use in livestock farming are creating substantial opportunities for algae-based feed additives that boost immunity and gut health. Strategic focus on developing specialized algae formulations for specific animal species and life stages, coupled with a commitment to transparent sourcing and proven efficacy, will be crucial for capturing market share. Continued R&D investment and strategic collaborations will further unlock the untapped potential of algae in revolutionizing animal nutrition and contributing to a more sustainable food system.

Algae-based Animal Feed and Ingredients Industry Segmentation

-

1. Ingredient Type

- 1.1. Dried Algae

- 1.2. Omega 3 Fatty Acids and PUFA

- 1.3. Carageenan

- 1.4. Alginate

- 1.5. Others

-

2. Application

- 2.1. Food

- 2.2. Pharmaceuticals

- 2.3. Animal Nutrition

- 2.4. Cosmetics

- 2.5. Others

Algae-based Animal Feed and Ingredients Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Algae-based Animal Feed and Ingredients Industry Regional Market Share

Geographic Coverage of Algae-based Animal Feed and Ingredients Industry

Algae-based Animal Feed and Ingredients Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Convenience & Processed Food

- 3.3. Market Restrains

- 3.3.1. Increased Consumer Awareness On Side-Effects Of Chemical Additives

- 3.4. Market Trends

- 3.4.1. Health Benefits Associated With Omega-3 Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Algae-based Animal Feed and Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Dried Algae

- 5.1.2. Omega 3 Fatty Acids and PUFA

- 5.1.3. Carageenan

- 5.1.4. Alginate

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food

- 5.2.2. Pharmaceuticals

- 5.2.3. Animal Nutrition

- 5.2.4. Cosmetics

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. North America Algae-based Animal Feed and Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Dried Algae

- 6.1.2. Omega 3 Fatty Acids and PUFA

- 6.1.3. Carageenan

- 6.1.4. Alginate

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food

- 6.2.2. Pharmaceuticals

- 6.2.3. Animal Nutrition

- 6.2.4. Cosmetics

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. Europe Algae-based Animal Feed and Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Dried Algae

- 7.1.2. Omega 3 Fatty Acids and PUFA

- 7.1.3. Carageenan

- 7.1.4. Alginate

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food

- 7.2.2. Pharmaceuticals

- 7.2.3. Animal Nutrition

- 7.2.4. Cosmetics

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Asia Pacific Algae-based Animal Feed and Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Dried Algae

- 8.1.2. Omega 3 Fatty Acids and PUFA

- 8.1.3. Carageenan

- 8.1.4. Alginate

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food

- 8.2.2. Pharmaceuticals

- 8.2.3. Animal Nutrition

- 8.2.4. Cosmetics

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. South America Algae-based Animal Feed and Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Dried Algae

- 9.1.2. Omega 3 Fatty Acids and PUFA

- 9.1.3. Carageenan

- 9.1.4. Alginate

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food

- 9.2.2. Pharmaceuticals

- 9.2.3. Animal Nutrition

- 9.2.4. Cosmetics

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Middle East Algae-based Animal Feed and Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10.1.1. Dried Algae

- 10.1.2. Omega 3 Fatty Acids and PUFA

- 10.1.3. Carageenan

- 10.1.4. Alginate

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food

- 10.2.2. Pharmaceuticals

- 10.2.3. Animal Nutrition

- 10.2.4. Cosmetics

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11. South Africa Algae-based Animal Feed and Ingredients Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11.1.1. Dried Algae

- 11.1.2. Omega 3 Fatty Acids and PUFA

- 11.1.3. Carageenan

- 11.1.4. Alginate

- 11.1.5. Others

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Food

- 11.2.2. Pharmaceuticals

- 11.2.3. Animal Nutrition

- 11.2.4. Cosmetics

- 11.2.5. Others

- 11.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dupont

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Algavia*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Archer Daniels Midland Company

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BASF SE

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Koninklijke DSM N V

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Fuji Chemical Industries Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cargill Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Roquette Freres

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Dupont

List of Figures

- Figure 1: Global Algae-based Animal Feed and Ingredients Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Algae-based Animal Feed and Ingredients Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 4: North America Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Ingredient Type 2025 & 2033

- Figure 5: North America Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 6: North America Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Ingredient Type 2025 & 2033

- Figure 7: North America Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Application 2025 & 2033

- Figure 9: North America Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Country 2025 & 2033

- Figure 13: North America Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 16: Europe Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Ingredient Type 2025 & 2033

- Figure 17: Europe Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 18: Europe Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Ingredient Type 2025 & 2033

- Figure 19: Europe Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Application 2025 & 2033

- Figure 21: Europe Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 28: Asia Pacific Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Ingredient Type 2025 & 2033

- Figure 29: Asia Pacific Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 30: Asia Pacific Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Ingredient Type 2025 & 2033

- Figure 31: Asia Pacific Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Application 2025 & 2033

- Figure 33: Asia Pacific Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Country 2025 & 2033

- Figure 37: Asia Pacific Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 40: South America Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Ingredient Type 2025 & 2033

- Figure 41: South America Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 42: South America Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Ingredient Type 2025 & 2033

- Figure 43: South America Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: South America Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Application 2025 & 2033

- Figure 45: South America Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 52: Middle East Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Ingredient Type 2025 & 2033

- Figure 53: Middle East Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 54: Middle East Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Ingredient Type 2025 & 2033

- Figure 55: Middle East Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Application 2025 & 2033

- Figure 57: Middle East Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: South Africa Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Ingredient Type 2025 & 2033

- Figure 64: South Africa Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Ingredient Type 2025 & 2033

- Figure 65: South Africa Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Ingredient Type 2025 & 2033

- Figure 66: South Africa Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Ingredient Type 2025 & 2033

- Figure 67: South Africa Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Application 2025 & 2033

- Figure 68: South Africa Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Application 2025 & 2033

- Figure 69: South Africa Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Application 2025 & 2033

- Figure 70: South Africa Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Application 2025 & 2033

- Figure 71: South Africa Algae-based Animal Feed and Ingredients Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: South Africa Algae-based Animal Feed and Ingredients Industry Volume (K Tons), by Country 2025 & 2033

- Figure 73: South Africa Algae-based Animal Feed and Ingredients Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: South Africa Algae-based Animal Feed and Ingredients Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 2: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 3: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 8: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 9: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United States Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Canada Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Mexico Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 22: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 23: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 25: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Germany Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Germany Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: France Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: France Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Russia Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Russia Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Italy Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Italy Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Spain Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Spain Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 42: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 43: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 47: India Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: China Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: China Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Japan Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Japan Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Australia Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Australia Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia Pacific Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 58: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 59: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 60: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 61: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 63: Brazil Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Brazil Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: Argentina Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Argentina Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 67: Rest of South America Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of South America Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 70: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 71: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 72: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 73: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 74: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 75: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 76: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Ingredient Type 2020 & 2033

- Table 77: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 78: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 79: Global Algae-based Animal Feed and Ingredients Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 80: Global Algae-based Animal Feed and Ingredients Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 81: Saudi Arabia Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Saudi Arabia Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 83: Rest of Middle East Algae-based Animal Feed and Ingredients Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Rest of Middle East Algae-based Animal Feed and Ingredients Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algae-based Animal Feed and Ingredients Industry?

The projected CAGR is approximately 8.11%.

2. Which companies are prominent players in the Algae-based Animal Feed and Ingredients Industry?

Key companies in the market include Dupont, Algavia*List Not Exhaustive, Archer Daniels Midland Company, BASF SE, Koninklijke DSM N V, Fuji Chemical Industries Co Ltd, Cargill Inc, Roquette Freres.

3. What are the main segments of the Algae-based Animal Feed and Ingredients Industry?

The market segments include Ingredient Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3420 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Convenience & Processed Food.

6. What are the notable trends driving market growth?

Health Benefits Associated With Omega-3 Consumption.

7. Are there any restraints impacting market growth?

Increased Consumer Awareness On Side-Effects Of Chemical Additives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algae-based Animal Feed and Ingredients Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algae-based Animal Feed and Ingredients Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algae-based Animal Feed and Ingredients Industry?

To stay informed about further developments, trends, and reports in the Algae-based Animal Feed and Ingredients Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence