Key Insights

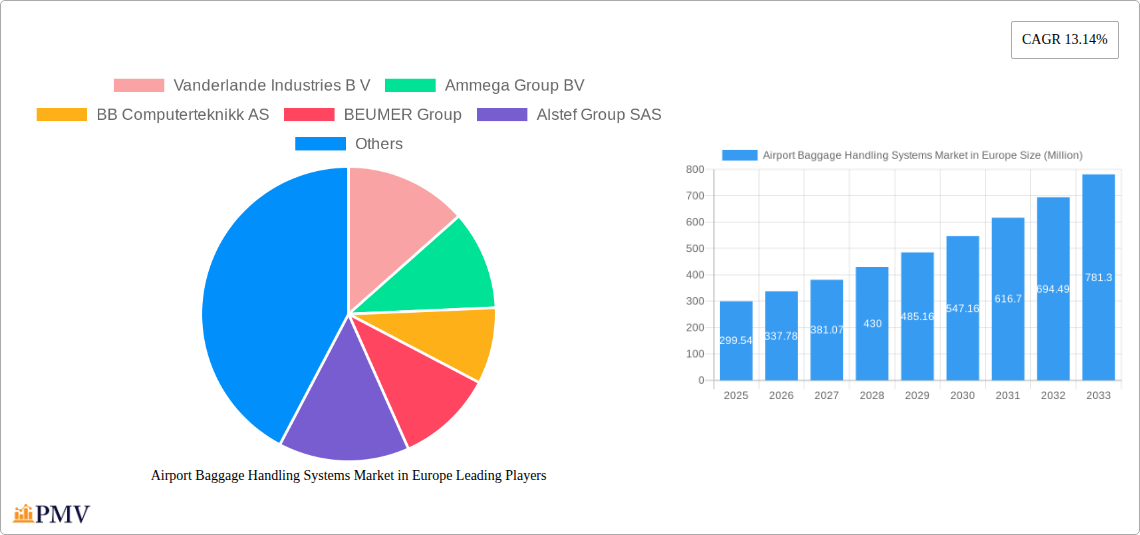

The European Airport Baggage Handling Systems (BHS) Market is poised for substantial expansion, projecting a market size of USD 299.54 million and an impressive CAGR of 13.14% from 2025 to 2033. This robust growth is fueled by increasing air passenger traffic across the continent, necessitating upgrades and expansions of existing baggage handling infrastructure to meet rising demands for efficiency and security. The imperative to modernize aging airport facilities and implement advanced BHS technologies, such as automated sorting systems, self-service bag drops, and sophisticated tracking solutions, to enhance passenger experience and operational streamline, is a primary market driver. Furthermore, stringent regulatory requirements for baggage screening and security are compelling airports to invest in state-of-the-art BHS that offer superior detection capabilities and compliance. Emerging trends like the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and optimized baggage flow are also shaping the market landscape, promising reduced downtime and improved resource allocation.

Airport Baggage Handling Systems Market in Europe Market Size (In Million)

The market segmentation by airport capacity reveals a dynamic distribution, with significant investment anticipated across all tiers, from airports handling up to 15 million passengers to those exceeding 40 million. This broad-based demand underscores the universal need for efficient baggage handling across the European aviation network. Key players such as Vanderlande Industries B.V., BEUMER Group, and Daifuku Co. Ltd. are at the forefront, driving innovation and capturing market share through their advanced technological offerings and comprehensive service portfolios. Restraints, such as the high initial capital expenditure for BHS implementation and the potential for operational disruptions during system upgrades, are being mitigated by a growing preference for modular and scalable solutions, along with a focus on lifecycle cost management. The strategic focus on enhancing passenger convenience and security, coupled with the ongoing digital transformation within the aviation sector, will continue to propel the growth and evolution of the European Airport Baggage Handling Systems Market.

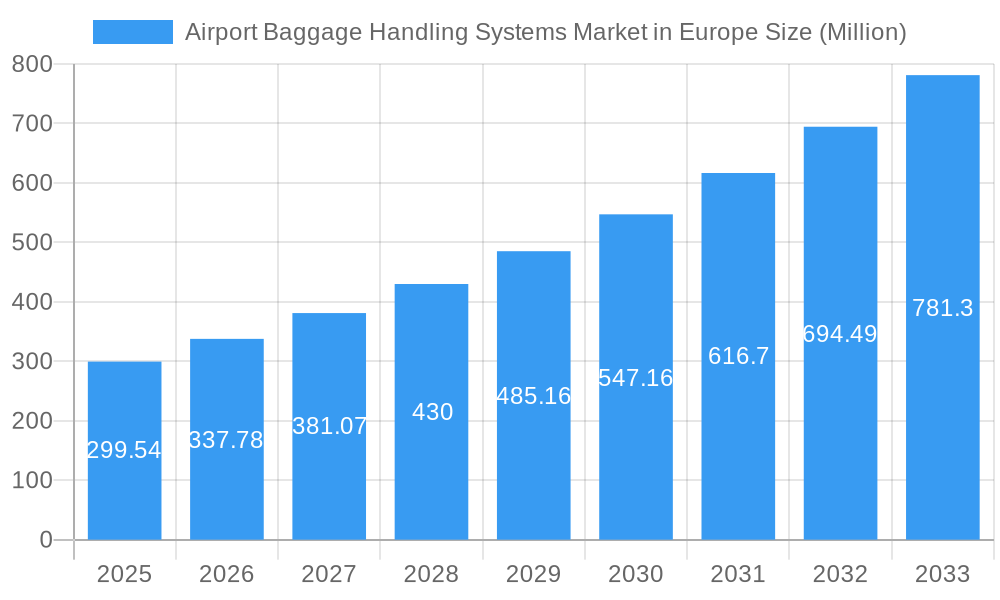

Airport Baggage Handling Systems Market in Europe Company Market Share

Report Overview: This in-depth report provides a comprehensive analysis of the European Airport Baggage Handling Systems (BHS) market, offering strategic insights and actionable intelligence for stakeholders. It covers market size, segmentation, key drivers, challenges, competitive landscape, and future outlook from the historical period of 2019–2024 through to the forecast period of 2025–2033, with a base year of 2025. The report utilizes millions for all monetary values and features a wealth of data, including market share estimations and M&A deal values.

Airport Baggage Handling Systems Market in Europe Market Structure & Competitive Dynamics

The European Airport Baggage Handling Systems market exhibits a moderately concentrated structure, dominated by a few key players, including Vanderlande Industries B.V., BEUMER Group, and Alstef Group SAS, collectively holding a significant market share. Innovation is a critical differentiator, with companies investing heavily in R&D to develop advanced BHS solutions. The regulatory framework, primarily driven by the European Union Aviation Safety Agency (EASA) and national aviation authorities, mandates stringent safety and security standards, influencing system design and implementation. Product substitutes, such as manual sorting or less automated systems, are becoming increasingly obsolete as airports prioritize efficiency and throughput. End-user trends lean towards integrated, smart BHS solutions that offer real-time tracking, predictive maintenance, and enhanced passenger experience. Mergers and acquisitions (M&A) are strategic moves to consolidate market presence, acquire new technologies, and expand service portfolios. For instance, a hypothetical M&A deal in 2023 between two significant European BHS providers was valued at over USD 500 Million, indicating substantial consolidation activities. The continuous drive for modernization and capacity expansion at major European hubs fuels these dynamics, shaping a competitive yet collaborative ecosystem focused on delivering reliable and efficient baggage handling.

Airport Baggage Handling Systems Market in Europe Industry Trends & Insights

The European Airport Baggage Handling Systems market is experiencing robust growth, driven by several compelling industry trends and insights. A primary catalyst is the surge in air passenger traffic across Europe, necessitating the expansion and modernization of airport infrastructure, including BHS. This escalating demand directly fuels market growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. Technological disruptions are at the forefront, with the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance, route optimization, and real-time baggage tracking. The integration of Internet of Things (IoT) devices within BHS solutions is enabling unprecedented levels of data collection and analysis, leading to improved operational efficiency and reduced downtime. Consumer preferences are evolving, with passengers expecting seamless and faster baggage handling processes, putting pressure on airports to implement advanced, passenger-centric BHS technologies. The focus on sustainability is also influencing the market, with a growing demand for energy-efficient BHS components and solutions that minimize environmental impact. Furthermore, stringent security regulations, such as those mandated by EASA, are driving the need for sophisticated screening and sorting technologies, creating opportunities for integrated security and BHS solutions. Competitive dynamics are characterized by fierce rivalry among established players and the emergence of innovative niche providers, all vying for market share through technological superiority, cost-effectiveness, and comprehensive service offerings. The ongoing digital transformation within the aviation sector is also a significant trend, pushing for greater automation and data-driven decision-making in BHS operations. The market penetration of fully automated and intelligent BHS is steadily increasing, especially in larger, high-traffic airports aiming to optimize their operations.

Dominant Markets & Segments in Airport Baggage Handling Systems Market in Europe

The European Airport Baggage Handling Systems market is segmented based on various factors, with Airport Capacity playing a crucial role in determining dominant markets and segments. Airports with a capacity Above 40 Million passengers per annum represent the most significant segment, driving substantial demand for advanced and high-throughput BHS. These mega-hubs, including London Heathrow, Paris Charles de Gaulle, and Amsterdam Schiphol, require sophisticated baggage handling solutions capable of managing millions of bags annually.

- Key Drivers for Dominant Segments:

- High Passenger Volume: The sheer number of passengers processed necessitates robust and efficient BHS to avoid bottlenecks and ensure smooth operations.

- Global Connectivity & Hub Status: Major international hubs act as crucial transit points, requiring highly reliable BHS to facilitate seamless transfers.

- Investment in Infrastructure Modernization: These airports are constantly investing in upgrades and new terminals to accommodate growing traffic and enhance passenger experience.

- Stringent Security Mandates: Meeting advanced security screening requirements (e.g., EASA Standard 3.1) is paramount for these large airports, driving the adoption of integrated BHS and security solutions.

- Technological Adoption Readiness: Larger airports are typically early adopters of cutting-edge BHS technologies, including AI, robotics, and IoT integration.

The 25 - 40 Million passenger capacity segment also represents a significant and growing market. Airports in this category are experiencing substantial growth and are investing in BHS upgrades to cope with increasing passenger numbers and meet evolving operational demands. Economic policies supporting air travel expansion and infrastructure development are key drivers for this segment. The 15 - 25 Million and Up to 15 Million passenger capacity segments, while smaller individually, collectively contribute to the overall market. Growth in these segments is often fueled by regional economic development, increased low-cost carrier operations, and the need for modernized, cost-effective BHS solutions. Strategic investments in airport infrastructure and the desire to improve operational efficiency are key growth accelerators for these smaller to medium-sized airports. The geographic dominance within Europe sees Western European countries, such as Germany, the UK, France, and the Netherlands, leading the market due to the presence of major international airports and significant aviation investments. Eastern European markets are also showing considerable growth potential as aviation infrastructure develops.

Airport Baggage Handling Systems Market in Europe Product Innovations

Product innovations in the European Airport Baggage Handling Systems market are centered on enhancing efficiency, security, and passenger experience. Key developments include the integration of AI for intelligent sorting and predictive maintenance, reducing downtime and operational costs. Advanced sorting technologies, such as 3D imaging and robotic arms, are improving accuracy and speed. The adoption of IoT sensors across BHS components enables real-time data monitoring, facilitating proactive issue resolution and optimizing baggage flow. Furthermore, companies are focusing on modular and scalable BHS designs to cater to the diverse needs of airports, from small regional hubs to large international gateways. The competitive advantage lies in offering integrated solutions that seamlessly combine baggage handling with security screening and passenger information systems, providing a comprehensive and optimized operational environment.

Report Segmentation & Scope

This report segments the European Airport Baggage Handling Systems market by Airport Capacity. Each segment represents a distinct market segment with unique operational requirements and growth trajectories.

- Up to 15 Million: This segment comprises smaller regional airports that require cost-effective, efficient, and reliable BHS solutions. Growth is driven by increasing regional connectivity and the need to upgrade older systems.

- 15 - 25 Million: Airports in this category are mid-sized hubs experiencing moderate growth. They demand scalable BHS that can accommodate expanding passenger numbers and integrate with emerging technologies.

- 25 - 40 Million: This segment includes major airports undergoing expansion and modernization. These airports are key adopters of advanced BHS technologies and integrated solutions to manage high volumes efficiently.

- Above 40 Million: This segment represents the largest and most dynamic part of the market, dominated by mega-hubs. These airports require cutting-edge, high-capacity BHS solutions to handle massive passenger flows and meet the most stringent security and operational standards.

Key Drivers of Airport Baggage Handling Systems Market in Europe Growth

The growth of the European Airport Baggage Handling Systems market is propelled by a confluence of factors. Increasing air passenger traffic, driven by economic growth and global connectivity, necessitates BHS expansion and upgrades. Technological advancements, particularly in automation, AI, and IoT, are enabling more efficient, secure, and passenger-friendly baggage handling. Stringent aviation security regulations, such as EASA mandates, are a significant driver, pushing for the adoption of advanced screening and sorting technologies integrated within BHS. The continuous drive for operational efficiency and cost reduction by airlines and airport operators further fuels investment in modern BHS solutions.

Challenges in the Airport Baggage Handling Systems Market in Europe Sector

Despite robust growth, the European Airport Baggage Handling Systems market faces several challenges. High initial investment costs for advanced BHS can be a barrier, especially for smaller airports with limited budgets. Complex integration with existing airport infrastructure and legacy systems requires significant planning and expertise. Supply chain disruptions and the availability of specialized components can impact project timelines and costs. Evolving regulatory landscapes and the need for continuous compliance with ever-increasing security standards add another layer of complexity. Furthermore, the skilled workforce required for the installation, maintenance, and operation of sophisticated BHS is a growing concern for the industry.

Leading Players in the Airport Baggage Handling Systems Market in Europe Market

- Vanderlande Industries B V

- Ammega Group BV

- BB Computerteknikk AS

- BEUMER Group

- Alstef Group SAS

- Siemens AG

- Lift All A

- Daifuku Co Ltd

- SITA

- PSI Logistics GmbH

Key Developments in Airport Baggage Handling Systems Market in Europe Sector

- March 2023: Alstef Group, an automated airport solutions provider in France, signed a USD 11.06 million contract to supply a new baggage handling system for Sofia Airport's Terminal 2. Under the contract, the company will supply, install, and maintain the baggage handling solution with a capacity of up to 2,400 bags per hour.

- December 2022: Alstef Group received a contract to upgrade the baggage handling system at Strasbourg Airport (SXB) in France. The project includes the adoption of Strasbourg Airport's baggage screening systems to meet the latest European Union Aviation Safety Agency (EASA) Standard 3.1 requirements.

Strategic Airport Baggage Handling Systems Market in Europe Market Outlook

The strategic outlook for the European Airport Baggage Handling Systems market remains highly positive, fueled by sustained growth in air travel and an unwavering commitment to technological advancement. Future market potential lies in the widespread adoption of smart BHS, leveraging AI, IoT, and data analytics to create highly efficient, predictive, and passenger-centric operations. Opportunities exist in retrofitting older airports, integrating sustainable BHS solutions, and developing interoperable systems that enhance collaboration across the aviation ecosystem. Strategic partnerships and continued investment in R&D will be crucial for players to capitalize on emerging trends and maintain a competitive edge in this dynamic market.

Airport Baggage Handling Systems Market in Europe Segmentation

-

1. Airport Capacity

- 1.1. Up to 15 million

- 1.2. 15 - 25 million

- 1.3. 25 - 40 million

- 1.4. Above 40 Million

Airport Baggage Handling Systems Market in Europe Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Rest of Europe

Airport Baggage Handling Systems Market in Europe Regional Market Share

Geographic Coverage of Airport Baggage Handling Systems Market in Europe

Airport Baggage Handling Systems Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Airport Baggage Handling Systems Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 5.1.1. Up to 15 million

- 5.1.2. 15 - 25 million

- 5.1.3. 25 - 40 million

- 5.1.4. Above 40 Million

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Airport Capacity

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Vanderlande Industries B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ammega Group BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BB Computerteknikk AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BEUMER Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alstef Group SAS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lift All A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daifuku Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SITA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PSI Logistics GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Vanderlande Industries B V

List of Figures

- Figure 1: Airport Baggage Handling Systems Market in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Airport Baggage Handling Systems Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 2: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Airport Capacity 2020 & 2033

- Table 4: Airport Baggage Handling Systems Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Europe Airport Baggage Handling Systems Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Baggage Handling Systems Market in Europe?

The projected CAGR is approximately 13.14%.

2. Which companies are prominent players in the Airport Baggage Handling Systems Market in Europe?

Key companies in the market include Vanderlande Industries B V, Ammega Group BV, BB Computerteknikk AS, BEUMER Group, Alstef Group SAS, Siemens AG, Lift All A, Daifuku Co Ltd, SITA, PSI Logistics GmbH.

3. What are the main segments of the Airport Baggage Handling Systems Market in Europe?

The market segments include Airport Capacity.

4. Can you provide details about the market size?

The market size is estimated to be USD 299.54 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Above 40 Million Segment is Anticipated to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Alstef Group, an automated airport solutions provider in France, signed a USD 11.06 million contract to supply a new baggage handling system for Sofia Airport's Terminal 2. Under the contract, the company will supply, install, and maintain the baggage handling solution with a capacity of up to 2,400 bags per hour.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Baggage Handling Systems Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Baggage Handling Systems Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Baggage Handling Systems Market in Europe?

To stay informed about further developments, trends, and reports in the Airport Baggage Handling Systems Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence