Key Insights

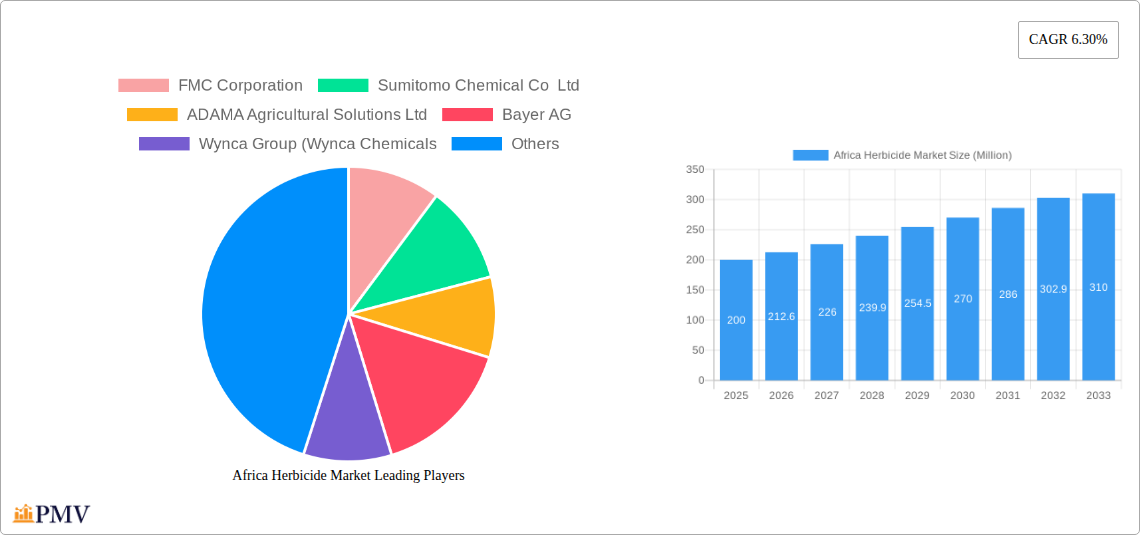

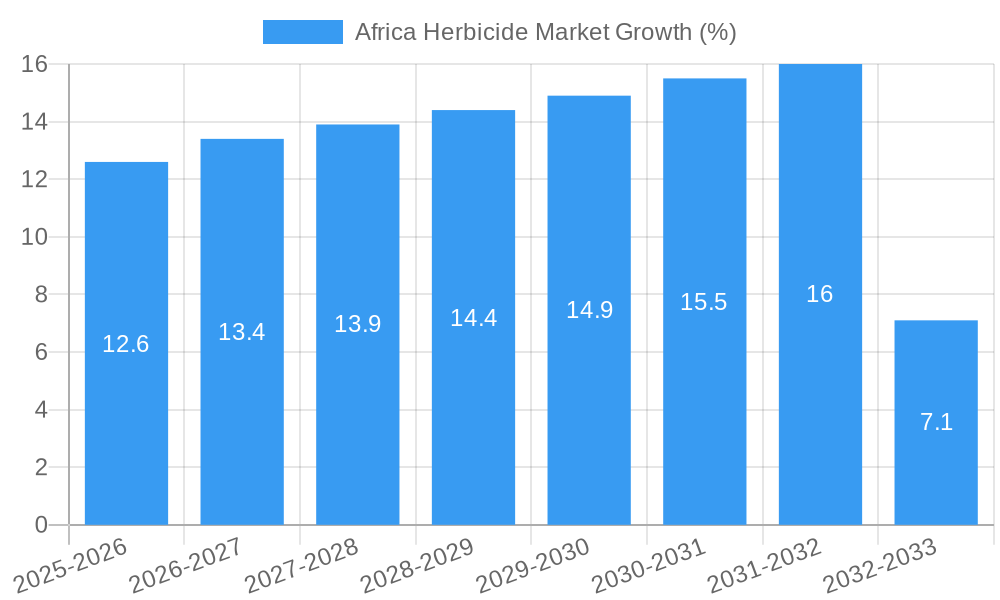

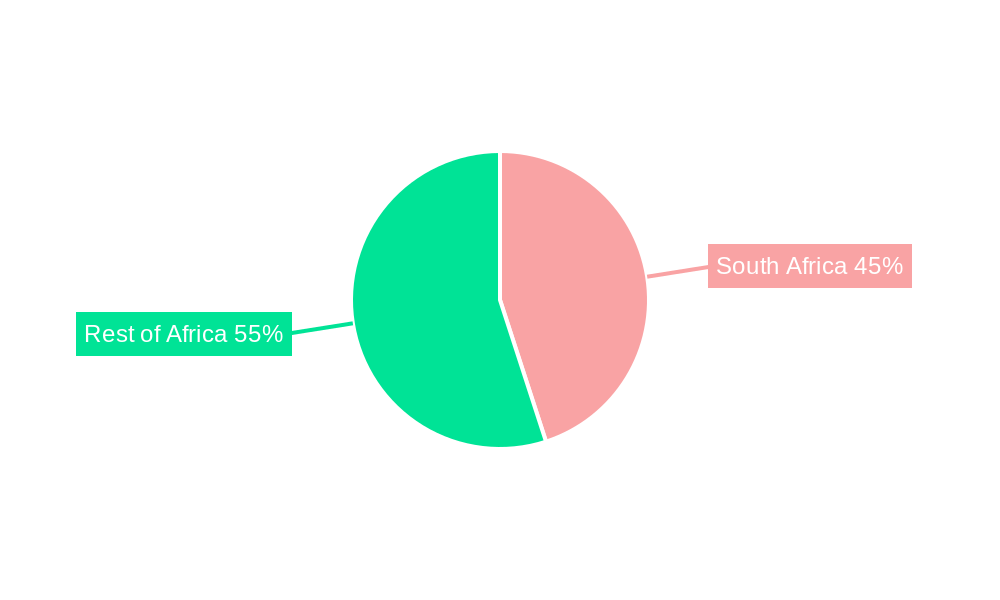

The African herbicide market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033. This expansion is fueled by several key factors. Increasing agricultural intensification across the continent necessitates effective weed control to maximize crop yields, particularly for high-value commercial crops like fruits and vegetables. The growing adoption of modern farming techniques, including chemigation and precision agriculture, is further boosting herbicide demand. Government initiatives promoting agricultural productivity and food security across countries like South Africa, Kenya, and Uganda are also contributing to market growth. However, challenges remain, including limited access to advanced herbicide technologies in certain regions, climate change impacting crop patterns and weed proliferation, and concerns regarding the environmental impact of herbicide use. The market is segmented by application mode (chemigation, foliar, fumigation, soil treatment), crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental), and geography, with South Africa representing a significant market share within the wider African region. Key players like FMC Corporation, Sumitomo Chemical, Adama, Bayer, and Syngenta are actively competing within this dynamic market.

The market's segmentation highlights opportunities for specialized herbicide products tailored to specific crop needs and environmental conditions. The growth in the commercial crops and fruits & vegetables segments is expected to outpace other segments due to their higher economic value and greater susceptibility to weed competition. While the Rest of Africa segment currently lags behind South Africa, significant potential exists for market expansion as agricultural practices modernize and farmer awareness increases. Sustainable and environmentally friendly herbicide solutions will likely gain traction, driven by increasing environmental regulations and consumer demand. The forecast period will witness the interplay of these drivers, restraints, and emerging trends, shaping the future trajectory of the African herbicide market.

Africa Herbicide Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Africa herbicide market, offering invaluable insights for stakeholders across the agricultural value chain. The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report encompasses market sizing, segmentation, competitive landscape, key trends, and growth drivers, providing a robust foundation for strategic decision-making. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Africa Herbicide Market Market Structure & Competitive Dynamics

The Africa herbicide market exhibits a moderately concentrated structure, with key players such as FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals), Syngenta Group, UPL Limited, Corteva Agriscience, Nufarm Ltd, and BASF SE holding significant market share. Market concentration is influenced by factors such as economies of scale in production, research and development capabilities, and access to distribution networks. Innovation in herbicide technology, particularly concerning bioherbicides and targeted solutions, is driving market evolution. Regulatory frameworks, varying across African nations, significantly impact market access and product registration. The presence of substitute weed control methods, such as mechanical weeding, influences market penetration. End-user trends, including the increasing adoption of precision agriculture and sustainable farming practices, are shaping product demand. The market has witnessed several M&A activities, though specific deal values are not publicly available for all transactions. For instance, the partnership between Bayer and Oerth Bio showcases strategic alliances to enhance product portfolios and achieve sustainable growth. A consolidated list of significant M&A activities with deal values would require further research.

- Market Concentration: Moderately Concentrated

- Innovation Ecosystem: Active, focused on sustainable and targeted solutions

- Regulatory Frameworks: Vary across African nations, influencing market access

- Product Substitutes: Mechanical weeding, crop rotation

- End-User Trends: Increasing adoption of precision agriculture and sustainable farming

Africa Herbicide Market Industry Trends & Insights

The Africa herbicide market is experiencing significant growth driven by factors such as rising agricultural production, increasing arable land under cultivation, and the growing adoption of modern farming techniques. The market penetration of herbicides is still relatively low in many parts of Africa, presenting significant growth opportunities. Technological disruptions, particularly in the development of more targeted and environmentally friendly herbicides, are influencing market dynamics. Consumer preferences are shifting towards safer and more sustainable solutions, prompting companies to invest in research and development of bioherbicides and other eco-friendly alternatives. The competitive landscape is characterized by both established multinational corporations and smaller, regional players. This competitive pressure fuels innovation and drives down prices, benefiting farmers. The market exhibits regional variations in growth rates, with South Africa showing higher adoption rates compared to other regions.

Dominant Markets & Segments in Africa Herbicide Market

Leading Region/Country: South Africa dominates the market due to its advanced agricultural sector and higher adoption of modern farming practices. The Rest of Africa segment presents significant untapped potential, exhibiting slower growth due to factors such as limited access to technology and financing, alongside infrastructural challenges.

Dominant Application Mode: Foliar application remains the dominant mode, driven by its ease of use and effectiveness.

Dominant Crop Type: Grains & Cereals and Pulses & Oilseeds are major consumers of herbicides due to their extensive cultivation across Africa. Commercial crops also demonstrate significant herbicide use.

Key Drivers for South Africa:

- Developed agricultural infrastructure

- Higher farmer income and access to credit

- Strong government support for agricultural development

- Adoption of modern farming techniques

Key Challenges for Rest of Africa:

- Limited access to technology and finance

- Poor infrastructure hindering distribution

- Lack of awareness about herbicide benefits and safe use

- Varied regulatory environments

Africa Herbicide Market Product Innovations

Recent innovations in the African herbicide market focus on developing more targeted and environmentally friendly products. This includes the development of bioherbicides, which offer a more sustainable alternative to synthetic herbicides. Companies are also focusing on developing herbicide formulations that are more effective at controlling specific weeds, while minimizing environmental impact. These innovations respond to the increasing demand for sustainable agricultural practices and tighter regulatory environments. The development of herbicide-resistant crops is also contributing to the evolution of the market.

Report Segmentation & Scope

This report segments the Africa herbicide market based on application mode (chemigation, foliar, fumigation, soil treatment), crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental), and country (South Africa, Rest of Africa). Growth projections, market sizes, and competitive dynamics are analyzed for each segment, providing a detailed understanding of the market's structure and evolution. Each segment's market size and growth rate vary considerably, reflecting the differing agricultural practices and economic conditions across the African continent.

Key Drivers of Africa Herbicide Market Growth

The Africa herbicide market's growth is fueled by several factors, including the increasing demand for food security, governmental initiatives promoting agricultural modernization, and expanding cultivated land. Technological advancements, such as the development of more effective and targeted herbicides, further contribute to market expansion. Favorable economic conditions and growing investments in the agricultural sector provide a supportive environment for market growth. Moreover, rising awareness among farmers about improved weed management practices and enhanced crop yields are crucial drivers.

Challenges in the Africa Herbicide Market Sector

Challenges hindering the Africa herbicide market include the high cost of herbicides, limited access to credit and financing for smallholder farmers, and inconsistent regulatory frameworks across different African countries. Supply chain disruptions, especially in sourcing raw materials and distributing products, further complicate market operations. The presence of counterfeit products also poses a significant challenge. These challenges lead to price volatility and limit market penetration, especially in less developed regions.

Leading Players in the Africa Herbicide Market Market

- FMC Corporation

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group (Wynca Chemicals)

- Syngenta Group

- UPL Limited

- Corteva Agriscience

- Nufarm Ltd

- BASF SE

Key Developments in Africa Herbicide Market Sector

- October 2021: ADAMA enhanced its R&D capabilities by investing in a new chemist's center, accelerating plant protection research and development.

- August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with advanced weed control solutions.

- January 2023: Bayer partnered with Oerth Bio to develop more eco-friendly crop protection technologies.

Strategic Africa Herbicide Market Market Outlook

The Africa herbicide market presents significant long-term growth potential, driven by increasing agricultural production, rising demand for food, and the growing adoption of modern farming techniques. Strategic opportunities exist for companies to invest in research and development of sustainable and targeted herbicides, expand distribution networks to reach underserved markets, and collaborate with local partners to build capacity and awareness. Focus on providing farmer training and support will be critical for driving market penetration and sustainable growth.

Africa Herbicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

Africa Herbicide Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Herbicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. The risk associated with the traditional weeding methods is increasing the need for herbicides in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Herbicide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. South Africa Africa Herbicide Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Herbicide Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Herbicide Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Herbicide Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Herbicide Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Herbicide Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 FMC Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Sumitomo Chemical Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ADAMA Agricultural Solutions Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Bayer AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Wynca Group (Wynca Chemicals

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Syngenta Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 UPL Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Corteva Agriscience

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nufarm Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BASF SE

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 FMC Corporation

List of Figures

- Figure 1: Africa Herbicide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Herbicide Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Herbicide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Herbicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 3: Africa Herbicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 4: Africa Herbicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 5: Africa Herbicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 6: Africa Herbicide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Africa Herbicide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Sudan Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Uganda Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tanzania Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kenya Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Africa Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Africa Herbicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 15: Africa Herbicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 16: Africa Herbicide Market Revenue Million Forecast, by Application Mode 2019 & 2032

- Table 17: Africa Herbicide Market Revenue Million Forecast, by Crop Type 2019 & 2032

- Table 18: Africa Herbicide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Nigeria Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Africa Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Egypt Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Ethiopia Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Morocco Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Ghana Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Algeria Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Tanzania Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Ivory Coast Africa Herbicide Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Herbicide Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Africa Herbicide Market?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, Corteva Agriscience, Nufarm Ltd, BASF SE.

3. What are the main segments of the Africa Herbicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

The risk associated with the traditional weeding methods is increasing the need for herbicides in the region.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Herbicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Herbicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Herbicide Market?

To stay informed about further developments, trends, and reports in the Africa Herbicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence