Key Insights

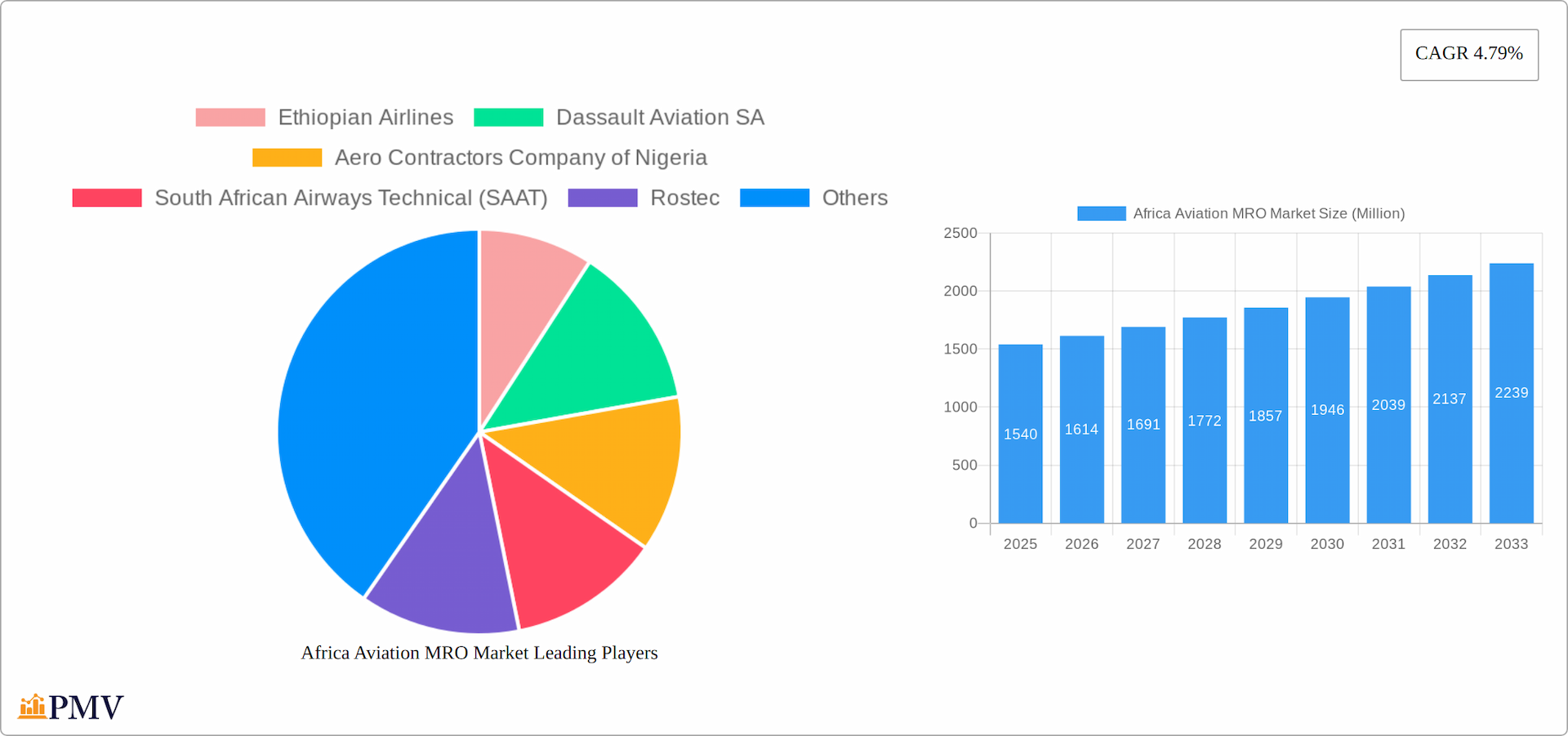

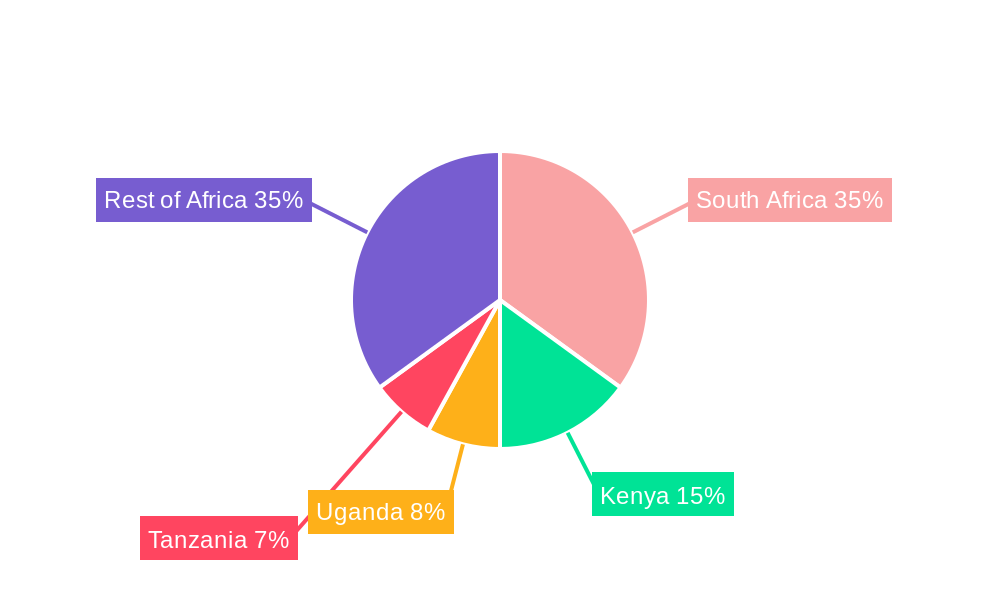

The African aviation Maintenance, Repair, and Overhaul (MRO) market, valued at $1.54 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.79% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing number of aircraft in operation across Africa, particularly within the commercial and general aviation sectors, necessitates a higher demand for MRO services. Secondly, the continent's burgeoning tourism industry and rising air travel are contributing to increased aircraft utilization and, consequently, the need for regular maintenance. Finally, government initiatives aimed at improving aviation infrastructure and safety standards are further stimulating market growth. The market is segmented by aircraft type (fixed-wing and rotorcraft), aviation type (commercial, military, and general aviation), and MRO type (engine, components, interior, airframe, and field maintenance). South Africa, with its established aviation infrastructure and skilled workforce, dominates the regional market, followed by other key players such as Kenya, Uganda, and Tanzania. However, the market's growth is tempered by challenges such as infrastructural limitations in certain regions, limited skilled labor in some areas, and the high cost of advanced MRO technologies. Nevertheless, the overall outlook for the African aviation MRO market remains positive, promising significant growth opportunities for both established players and new entrants.

Africa Aviation MRO Market Market Size (In Billion)

The competitive landscape features a mix of international and regional companies, including Ethiopian Airlines, Airbus SE, Safran SA, and Lufthansa Technik AG, alongside regional players like South African Airways Technical (SAAT) and Aero Contractors Company of Nigeria. These companies are adopting various strategies to enhance their market position, such as strategic partnerships, technological upgrades, and expansion into new geographical areas. The forecast period (2025-2033) is expected to witness heightened competition, as companies strive to cater to the rising demand for diverse MRO services across various aircraft types and aviation sectors within Africa. Focus will likely remain on adapting to local conditions, expanding capacity in key regions, and embracing innovative solutions for cost optimization and improved operational efficiency. The market's long-term prospects are tied to continued economic growth, further development of aviation infrastructure, and sustained investment in training and skill development within the aviation sector across the African continent.

Africa Aviation MRO Market Company Market Share

Africa Aviation MRO Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Africa Aviation Maintenance, Repair, and Overhaul (MRO) market, offering invaluable insights for stakeholders across the aviation ecosystem. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously analyzes market trends, competitive dynamics, key players, and future growth opportunities, incorporating data from the historical period of 2019-2024. Key market segments including Fixed-Wing Aircraft, Rotorcraft, Commercial Aviation, Military Aviation, General Aviation, Engine MRO, Components & Modifications MRO, Interior MRO, Airframe MRO, and Field Maintenance are thoroughly examined. The total market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, achieving a Compound Annual Growth Rate (CAGR) of xx%.

Africa Aviation MRO Market Structure & Competitive Dynamics

The African aviation MRO market presents a complex landscape characterized by varying levels of market concentration across different segments. While some segments, such as engine MRO, exhibit higher concentration due to the specialized nature of the services, others show greater fragmentation, particularly in areas like field maintenance. The regulatory framework influences market structure, with national aviation authorities setting safety standards and licensing requirements. The presence of both large multinational corporations and smaller, specialized MRO providers creates a dynamic competitive environment.

- Market Concentration: The market concentration is relatively moderate, with a few dominant players holding significant market share, but with numerous smaller players also contributing significantly. Market share estimates for key players like Ethiopian Airlines, Dassault Aviation SA, and South African Airways Technical (SAAT) are estimated at xx%, xx%, and xx%, respectively, in 2025.

- Innovation Ecosystems: The African MRO sector is witnessing increasing innovation, driven by technological advancements in aircraft maintenance and digitalization. However, challenges remain in accessing cutting-edge technologies and skilled labor.

- Regulatory Frameworks: Varying regulations across African nations can create complexities for MRO providers operating across multiple countries. Harmonization efforts are underway to streamline processes and improve efficiency.

- Mergers & Acquisitions (M&A): The M&A activity in the African aviation MRO market is expected to increase as larger companies seek to expand their service offerings and market reach. In recent years, M&A deal values have ranged from xx Million to xx Million, with significant growth potential.

Africa Aviation MRO Market Industry Trends & Insights

The African aviation MRO market is experiencing robust growth driven by several factors. The expansion of air travel within Africa, fueled by increasing passenger numbers and the rise of low-cost carriers, is a primary driver. Furthermore, the modernization of existing fleets and the introduction of new aircraft further contribute to the market's expansion. Technological advancements, including the adoption of digital technologies for maintenance and repair, are enhancing efficiency and improving aircraft uptime. However, the market faces challenges, such as infrastructure limitations in certain regions and skill gaps in the workforce. The market penetration of advanced MRO services is gradually increasing, with a CAGR of xx% projected for the forecast period.

Dominant Markets & Segments in Africa Aviation MRO Market

Leading Regions & Countries: North Africa currently dominates the African aviation MRO market, fueled by higher aircraft density and established aviation infrastructure. Egypt and Morocco are key players. However, Sub-Saharan Africa presents substantial untapped growth potential, with countries like Kenya, South Africa, and Nigeria exhibiting increasing activity. This growth is driven by expanding air travel demand and government investments in aviation infrastructure.

Dominant Segments:

- Aircraft Type: Fixed-wing aircraft comprise the largest segment, reflecting the prevalence of commercial and military aviation. However, the rotorcraft MRO segment is experiencing notable growth, driven by increasing demand for helicopter services in various sectors, including offshore operations, emergency medical services, and tourism.

- Aviation Type: Commercial aviation remains the largest segment, driven by a surge in air passenger traffic and the expansion of low-cost carriers. Military aviation presents a significant niche market, with growth closely tied to defense budgets and modernization programs. General aviation is also expanding, particularly in areas with robust tourism and business aviation activities.

- MRO Type: Engine MRO and airframe MRO continue to dominate, but there's significant growth in components and modifications MRO, driven by technological advancements and the increasing need for specialized repairs. Interior MRO, focused on cabin upgrades and refurbishment, also shows promising growth potential, catering to passenger comfort preferences and airline branding strategies. Field maintenance services are experiencing expansion, owing to a push for faster turnaround times and reduced operational disruptions.

Key Drivers:

- Economic Growth & Infrastructure Development: Sustained economic growth in several African nations is driving investments in modern aviation infrastructure, including new airports and improved maintenance facilities, creating opportunities for MRO providers.

- Government Policies & Initiatives: Government support for aviation development through policies promoting investments in MRO infrastructure, deregulation, and skills development programs plays a crucial role in expanding the market.

- Tourism & Travel Boom: The thriving tourism sector is a major driver, contributing to increased air passenger traffic and subsequently, higher demand for MRO services in popular tourist destinations.

- Airline Fleet Modernization: Airlines are increasingly investing in modernizing their fleets, leading to a greater need for specialized MRO services to maintain these advanced aircraft technologies.

Africa Aviation MRO Market Product Innovations

Recent product innovations focus on enhancing efficiency, reducing maintenance costs, and improving aircraft availability. The use of advanced diagnostics, predictive maintenance technologies, and digital solutions are transforming MRO operations. These innovations improve the quality and speed of maintenance services, increasing market competitiveness. The integration of AI and machine learning is also showing promise in optimizing maintenance schedules and resource allocation, impacting market fit and driving growth.

Report Segmentation & Scope

This report segments the Africa Aviation MRO market across several key categories:

- Aircraft Type: Fixed-wing aircraft (xx Million, xx% CAGR), Rotorcraft (xx Million, xx% CAGR)

- Aviation Type: Commercial Aviation (xx Million, xx% CAGR), Military Aviation (xx Million, xx% CAGR), General Aviation (xx Million, xx% CAGR)

- MRO Type: Engine MRO (xx Million, xx% CAGR), Components and Modifications MRO (xx Million, xx% CAGR), Interior MRO (xx Million, xx% CAGR), Airframe MRO (xx Million, xx% CAGR), Field Maintenance (xx Million, xx% CAGR)

Each segment's competitive dynamics, market size, and growth projections are meticulously analyzed.

Key Drivers of Africa Aviation MRO Market Growth

The growth of the African aviation MRO market is primarily driven by increasing air passenger traffic, government initiatives promoting aviation infrastructure development, the expansion of low-cost carriers, and the modernization of airline fleets. Technological advancements in MRO techniques and the adoption of digital technologies further fuel this growth. The rising demand for air travel coupled with increasing investments in the aviation sector across various countries contribute significantly to the market's expansion.

Challenges in the Africa Aviation MRO Market Sector

The African aviation MRO market faces various challenges, including regulatory hurdles in some countries, the scarcity of skilled labor, and infrastructural limitations in certain regions. Supply chain disruptions and the high cost of acquiring advanced technologies also pose considerable obstacles. These factors can impact the overall efficiency and growth of the market. For instance, inadequate infrastructure can lead to increased maintenance downtime, affecting operational costs and profitability.

Leading Players in the Africa Aviation MRO Market

- Ethiopian Airlines

- Dassault Aviation SA

- Aero Contractors Company of Nigeria

- South African Airways Technical (SAAT)

- Rostec

- Airbus SE

- Egyptair Maintenance & Engineering

- Safran SA

- Denel SOC Ltd

- RTX Corporation

- Pilatus Aircraft Ltd

- Lufthansa Technik AG

- Leonardo S p A

- Saab AB

- Sabena technics S A

Key Developments in Africa Aviation MRO Market Sector

- May 2023: ExecuJet MRO Services appointed as an authorized service center (ASC) for Embraer business jets across Africa. This signifies significant expansion of Embraer's service network and strengthens ExecuJet’s market position.

- January 2023: RwandAir signed a multi-year contract with Iberia Maintenance for CFM56 engine maintenance, improving fleet reliability and operational efficiency.

Strategic Africa Aviation MRO Market Outlook

The African aviation MRO market presents substantial growth opportunities, particularly with the projected increase in air passenger traffic and the continued modernization of airline fleets. Strategic investments in infrastructure, technology, and skilled workforce development will be crucial for realizing this potential. The adoption of advanced technologies, such as predictive maintenance and digital solutions, will play a pivotal role in enhancing efficiency and optimizing operational costs for MRO providers. Collaboration among stakeholders will be essential for sustainable growth.

Africa Aviation MRO Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Aviation MRO Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Aviation MRO Market Regional Market Share

Geographic Coverage of Africa Aviation MRO Market

Africa Aviation MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. Fixed-Wing Aircraft to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Aviation MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethiopian Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dassault Aviation SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aero Contractors Company of Nigeria

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 South African Airways Technical (SAAT)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rostec

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Airbus SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Egyptair Maintenance & Engineering

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safran SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Denel SOC Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RTX Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Pilatus Aircraft Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lufthansa Technik AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Leonardo S p A

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Saab AB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sabena technics S A

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Ethiopian Airlines

List of Figures

- Figure 1: Africa Aviation MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Aviation MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Aviation MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Aviation MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Africa Aviation MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Africa Aviation MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Africa Aviation MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Africa Aviation MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Africa Aviation MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Africa Aviation MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Africa Aviation MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Africa Aviation MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Africa Aviation MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Africa Aviation MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: South Africa Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Egypt Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Kenya Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Ethiopia Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Morocco Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ghana Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Algeria Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Tanzania Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ivory Coast Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Aviation MRO Market?

The projected CAGR is approximately 4.79%.

2. Which companies are prominent players in the Africa Aviation MRO Market?

Key companies in the market include Ethiopian Airlines, Dassault Aviation SA, Aero Contractors Company of Nigeria, South African Airways Technical (SAAT), Rostec, Airbus SE, Egyptair Maintenance & Engineering, Safran SA, Denel SOC Ltd, RTX Corporation, Pilatus Aircraft Ltd, Lufthansa Technik AG, Leonardo S p A, Saab AB, Sabena technics S A.

3. What are the main segments of the Africa Aviation MRO Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.54 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

Fixed-Wing Aircraft to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

May 2023: ExecuJet MRO Services, the business aviation maintenance, repair, and overhaul (MRO) organization in Africa, was appointed as the authorized service center (ASC) for Embraer business jets across the region. The partnership signifies a significant expansion of Embraer’s service network in the region and reinforces ExecuJet’s position as a trusted and reliable MRO provider.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Aviation MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Aviation MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Aviation MRO Market?

To stay informed about further developments, trends, and reports in the Africa Aviation MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence